Predictive Analytics in Life Insurance

Predictive analytics in Life insurance isn’t exactly a new concept. In fact, actuaries have been using forms of predictive analytics for hundreds of years. And for hundreds of years, actuaries have used estimates of life expectancy in the form of mortality tables that reflect aggregate insured population mortality1. This, coupled with additional underwriting predictive analytics techniques, is used to analyze individual risk as well.

The problem is that this process, while still widely used, is slow and expensive. Individual policies can take months and hundreds of dollars to underwrite, resulting in higher premiums for everyone.

As carriers, both legacy and InsurTech, undergo the digital transformations they’ve made strides towards streamlining the underwriting and sales process. Improvements such as shortened, user-friendly applications, accelerated insurance underwriting, and lower monthly premiums have led to more digital adoption.

But Life Insurance has a ways to go in its adoption of predictive analytics to keep pace with its insurance counterparts like Property & Casualty. Hope is not lost, however, as companies such as Breathe Life, Ladder Life, and Bestow have recently entered the market with an innovative accelerated underwriting & digital-first approach.

The challenge with any predictive analytics modeling is access to good data. Take an auto insurance claim versus a life claim, for instance. It’s estimated that 10% of drivers make a claim per year, which is significantly more than what life insurers can expect, or about one death in the first year per 1,000 policies issued. Given life insurance policies are typically very long (10-30+ years), using claims as the outcome to train your models can be challenging.

As a result, carriers are beginning to work with a growing number of next-generation datasets to assess risk and enhance predictive models more accurately. For instance, many are using behavioral intelligence to analyze how users interact with digital life insurance applications, which has proven to be effective at identifying and predicting outcomes such as medical or tobacco usage non-disclosure, propensity to file a claim, risky applications, and outright fraud. Based on a user’s digital body language, carriers can determine if a user should be moved to accelerated underwriting or if the carrier needs to triage the application and add additional requirements such as a Telemed interview or fluid test before making a final offer.

These are just a few examples of how predictive analytics is helping turn Life Insurance from a reactive to proactive industry. Here’s a few more…

How Predictive Analytics Benefit Life Insurance Companies

Willis Tower Watson ran a Life Predictive Analytics Survey2 in 2018 that broke down how carriers view predictive analytics. The respondents rated the following four factors as highly important:

- Competitive pressures in product development and pricing (78%)

- Customer relationship management (67%)

- Earnings and profitability pressures (64%)

- Technology innovation (60%)

The survey identified three areas in which predictive analytics has had the greatest impact on life insurers’ performance:

- Reduction in issue and underwriting expenses. 67% of companies report a reduction in expenses

- Significant increase in sales. 60% report an increase in sales

- Increase in profitability. 60% report an increase in profitability

The projections for the next few years far exceed these percentages. And, according to Willis Tower Watson, the #1 most important thing insurers are doing today is choosing and accessing the most valuable data. “We make no apology in repeating that the biggest, quickest wins will typically come from sourcing new (or better) experiences and/or customer data.”

The fastest-growing segment of new data adoption is clickstream data, which is up from 18% in 2018 to 45% in 2020.

Projected Growth of Predictive Analytics Use Cases by Life Insurance Underwriters

The expanded use of predictive analytics by life insurers is expected to grow from 2018 to 2020 in four specific areas:

- Pricing and rate-setting use are projected to increase from 31% to 56% in two years for group life, and from 18% to 55% for individual life.

- Underwriting use is projected to increase from 52% to 92% in two years for individual life.

- Mortality and morbidity risk use is projected to increase from 19% to 56% in two years for group life, and from 23% to 75% for individual life.

- Claim management use is projected to increase from 37% to 87% in two years for group life, and from 10% to 40% for individual life.

Now that we’re well into 2022, our guess is those percentages are even higher today. Needless to say, the applications and adoption of predictive analytics in life insurance are growing.

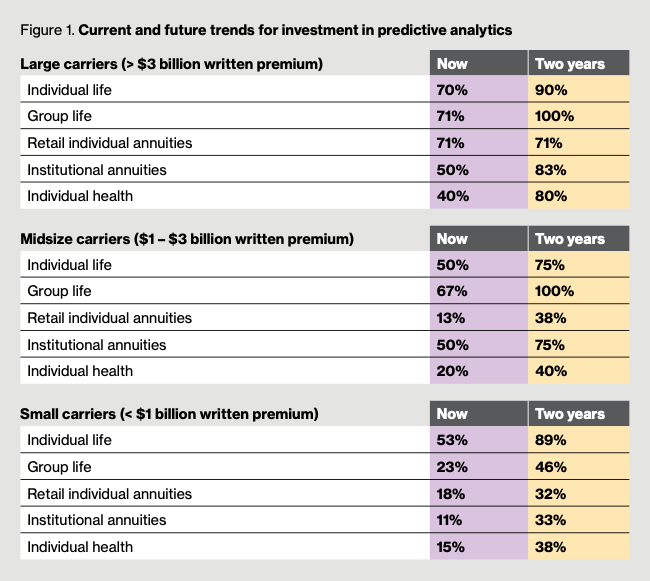

Current and Future Investment Trends (according to Willis Tower Watson)

Given the commoditized nature of insurance, competitive pressure and customer expectations are the key drivers of increased adoption. Below is the breakdown of estimated investment decisions for carriers.

Current and Future Investment Trends (according to Duck Creek)

Duck Creek3 takes it a step further and lists the Top 11 Ways Predictive Analytics in Insurance will Shape Insurance in 2022.

- Pricing and Risk Selection ✅

- Identifying Customers at Risk of Cancellation (Churn) ✅

- Identifying Risk & Fraud ✅

- Triaging Claims ✅

- Focusing on Customer Loyalty ✅

- Identifying Outlier Claims ✅

- Transforming the Claims Process ✅

- Data Management & Modeling ✅

- Identifying Potential Markets ❌

- Gain a 360-Degree View of Customers ✅

- Provide a Personalized Experience ✅

Duck Creek must be big fans of ForMotiv seeing as we helps accomplish 10 of out 11 of these… Sorry “Identifying Potential Markets” we’ll figure out a use case for you later!

What’s Next for Predictive Analytics? Dynamic User Experiences.

We write quite a bit about the benefits behavioral intelligence is having in the insurance industry. By combining predictive analytics and behavioral economics with a dash of machine learning and a pinch of proprietary behavioral data, ForMotiv has proven an ability to measure user behavior to predict intent with intent data. To learn more about how it actually works, read here.

The use cases for this grow by the day. Similar to how Netflix beat Blockbuster by understanding their customers digitally 100x better, allowing them to optimize the user experience and react to a user’s intent, ForMotiv allows insurance carriers to accomplish similar goals.

The key to thriving in a digital-first environment is providing a seamless user experience catered to the user without sacrificing risk and fraud. ForMotiv bridges the gap between Risk and Experience teams to allow exactly that. Carriers using ForMotiv get a real-time view of an individual user’s intent as they make their way through the application, allowing them to adapt the user experience to nudge the most desired outcome. We continue to see 6, 7, and even 8-figure ROI from a number of different use cases ranging from marketing and customer experience to risk & fraud.

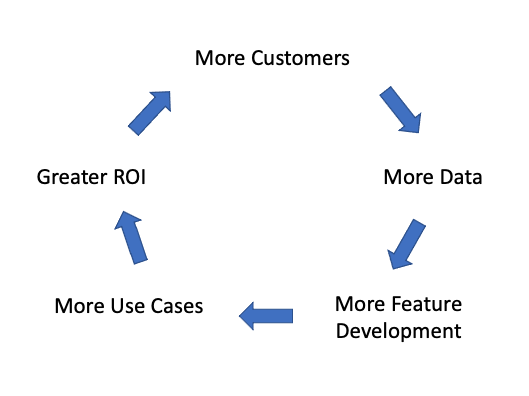

For instance, we recently helped a life carrier improve their internal predictive model to identify tobacco usage nondisclosure by 20%. Results like these speak for themselves and continue to push the flywheel we’ve started. To visualize said flywheel – here’s a very crude drawing by yours truly.

We’re now over 12mm applications processed per month and that number will continue to grow as we expand our customer list. Each application results in thousands of individual behavioral data points so the overall amount of data processed is immense. This leads to more insights drawn from the billions of data points collected and analyzed, which leads to more behavioral features developed, which leads to more use cases, which leads to bigger ROI for our current customers, which leads to more customers, which leads to more data and the flywheel continues to turn!

And as ForMotiv is utilized more and more as an enterprise-wide behavior-as-a-service solution, carriers have begun integrating behavioral data across different departments, all with a single integration. For more example use cases, read here.

Additional Resources:

- Solving the Risk vs Customer Experience Challenge

- Behavioral Analytics to Predict New Account Opening Fraud

- Predictive Analytics to Solve Tobacco Usage Nondisclosure

- Top 6 Use Cases for Predictive Analytics in Insurance (2022)

Sources:

- https://www.investopedia.com/terms/a/aggregate-mortality-table.asp

- Willis Towers Watson, “Predictive Analytics Speeds Innovation for Life Insurers”

- 11 Ways Predictive Analytics in Insurance Will Shape the Industry in 2022