Predictive Analytics in Insurance | Top 6 Use Cases for 2024

The rapid advancement of data science, machine learning, and predictive analytics in insurance is setting 2024 up to be an exciting year in the insurance space. These tools have become the backbone of modern insurance operations, reshaping everything from risk assessment to customer engagement and fraud detection. This transformation is driven by an ever-increasing volume of data and the insurance sector’s growing proficiency in harnessing it to glean actionable insights.

Predictive analytics is at the forefront of this shift. It leverages complex algorithms and machine learning models to analyze patterns, enabling insurers to make more informed decisions, mitigate risks, and enhance operational efficiency. The applications of these technologies are numerous, touching every aspect of the insurance value chain.

This article delves into the most prominent use cases of data science and predictive analytics in the insurance industry as we head into 2024. We explore how these technologies are revolutionizing risk and fraud assessment, enabling companies to predict purchase intent and personalize user experiences like never before. We’ll examine their critical role in areas such as refining insurance pricing and product offerings, streamlining claims processing, and combating insurance agent fraud and policy manipulation. Additionally, we’ll look at how big data analysis is shaping the future of insurance, providing companies with the insights needed to stay competitive in an increasingly data-driven world.

As we unpack these themes, it’s clear that the integration of predictive analytics into insurance operations is not just a trend but a strategic imperative. Companies that leverage these technologies effectively can expect not only to enhance their operational efficiencies but also to deliver more value to their customers, setting a new standard for excellence in the industry. Join us as we explore the transformative impact of predictive analytics on the insurance landscape, heralding a new era of innovation and customer-centricity.

- Predictive Analytics for Risk and Fraud

- Predicting Purchase Intent & Personalizing User Experiences

- Predictive Analytics in Insurance Pricing and Product Optimization

- Predictive Analytics in Insurance Claims

- Predictive Analytics for Insurance Agent Fraud and Policy Manipulation

- Big Data Analysis

1. Predictive Analytics for Insurance Risk & Fraud

Life Insurance Risk and Fraud Use Case | Prevent Nondisclosure and Misrepresentation with Behavioral Data

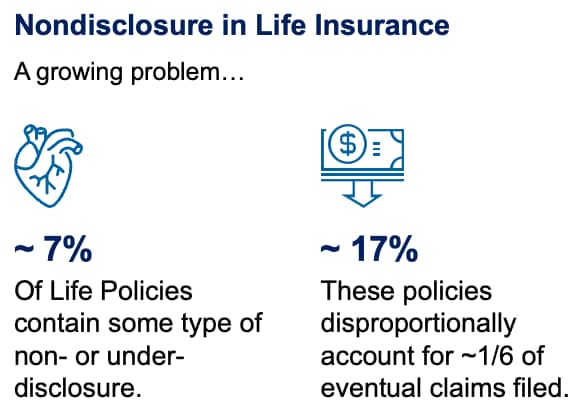

According to SwissRe, roughly 7% of life policies written are estimated to contain some type of non- or under-disclosure. By the time these policies mature into claims, nondisclosure accounts for nearly 17%, which translates to over $12 billion in costs to the insurer. Additionally, according to the FBI, the annual losses related to general insurance fraud are as high as $40 billion, costing the average American family $400-$700 in increased premiums each year.

It’s more important than ever to have a robust strategy that utilizes predictive analytics in insurance underwriting, risk, and fraud.

As Life Insurers head in the direction of accelerated underwriting and straight-through processing, the biggest challenge they face is providing the best, most seamless, and most personalized user experience possible without increasing risk. It shouldn’t come as a surprise that customers lie more on online applications.

The prevalence of increased nondisclosure is a self-perpetuating cycle of imbalance between projected mortality, premiums, and claims experience – eventually causing rising premiums for everyone. This, in turn, drives healthier customers away and increases the overall risk to the insurer, ad infinitum.

But how do you balance the need for a seamless experience without opening up the gates and letting in a trojan horse (or many)? The ongoing battle between Risk and Customer Experience can be exhausting, but the answer lies in understanding customer behavior and predicting their intent. We’re betting that predicting intent will be the biggest data science use case in insurance in 2023.

Most life insurance carriers are attempting to reduce the number of 3rd party data checks they call per applicant, think Electronic Health Records (EHR), Prescription (Rx), and fluid tests. Not only are they expensive, but they are challenging logistically. COVID exacerbated this problem quite a bit.

So how do you determine who to accelerate and who to further qualify? Typically carriers use basic demographic data and risk models or take the TSA approach and randomly select users for further review.

But what if you knew a life insurance applicant was correcting answers on their medical history…first putting they were a smoker, filling out the drop-down questions, but then changing the answer to say they’ve never smoked? “Smoker’s amnesia,” as we’ve heard it called. Would you treat them differently?

What if they checked a quote, then went back and edited medical history or family history and checked the quote again?

What if you knew, just based on digital user behavior, that a user you were about to accelerate was 425% more likely to receive a medical downgrade if they went through additional screening?

With billions of dollars at stake, it’s no wonder predicting risk and fraud is one of the hottest data science use cases in insurance. Luckily, with advances in data science and predictive analytics for insurance, you can know that and much more. ForMotiv is using Behavioral Data Science and predictive behavioral analytics to analyze digital user behavior to understand their intent for some of the largest life and P&C carriers in the world. Leading carriers are turning to solutions such as our Nondisclosure Solution, which is built to identify when applicants or agents are manipulating their applications to receive a lower rate during the digital underwriting process. Carriers can then triage applications in real-time to ensure they are underwriting the policy correctly.

By measuring customer (or agents) “Digital Body Language” i.e., hesitation, cognitive load, frustration, confusion, keystrokes, idle time, mouse movements, copy/paste, corrections, etc., ForMotiv correlates certain behaviors to genuine user behavior or malicious outcomes like misrepresentation, nondisclosure, risk, and fraud, and empowers the carriers to take action in real-time.

The way a user fills out an application can be highly indicative of their true risk versus the risk determined by the final answers they submit. ForMotiv customers are alerted to these behaviors in real time and can dynamically change the experience to add or remove friction accordingly.

It’s analogous to the difference between preventative and reactive medicine. Wouldn’t you rather be proactive than wait until there is an expensive claim in the future?

P&C Insurance Risk and Fraud Use Case | Prevent Premium Leakage with Behavioral Data

We’re seeing the same challenges mentioned above in the P&C space as well. Premium Leakage has grown to nearly a $40 billion problem. Without completely restating the above, the Premium Leakage Solution works very similarly. The major theme for 2024 is actionable intelligence and real-time predictive analytics solutions. Figuring out how to leverage real-time insights to drive the next-best action appropriate for each user is not only possible but necessary.

Prevent Account Takeover and Fraud with Biometrics

Behavioral Data Science, not to be confused with behavioral biometrics, is great for predicting user intent, assessing new customer risk, and comparing each new user to every other user that came before them. It uses predictive behavioral analytics to measure how unknown user John Smith compares to the millions of other applicants and their outcomes and predicts what John Smith’s likely outcome is.

Behavior biometrics is all about comparing John Smith to John Smith.

Behavioral Biometrics helps companies with identity proofing, continuous authentication, account takeover fraud, and vishing scams.

Your signature, voice, thumbprint, and face are unique to you – so is the way you interact with a device. Behavioral biometrics measures how John Smith uniquely interacts with a device.

Is he typing the same way? Was he right-hand dominant and now left-hand dominant? Does he swipe up or down the same?

Using behavioral biometrics, companies can determine if a logged-in John Smith is, in fact, John Smith. Another way this can be helpful is Voice Biometrics for account verification, which is often done over the phone.

Companies like V2verify are changing the game when it comes to voice verification, needing only 2 seconds of speech to accurately identify someone.

“The AI is the secret sauce of our Voice Biometric technology. Most Biometrics suffer from an inability to change and evolve after initially mapping a person’s vectors. With our patented processes, our AI enables the ability to evolve at the user level, real-time; something that is extremely important when using a person’s voice to ID or authenticates,” says Alan Smith VP of Sales with V2verify.

Because of this, behavior analytics software can help drastically reduce account takeover, prevent fraud, and enhance identification protocols.

2. Personalizing the Customer Experience by Predicting Purchase Intent

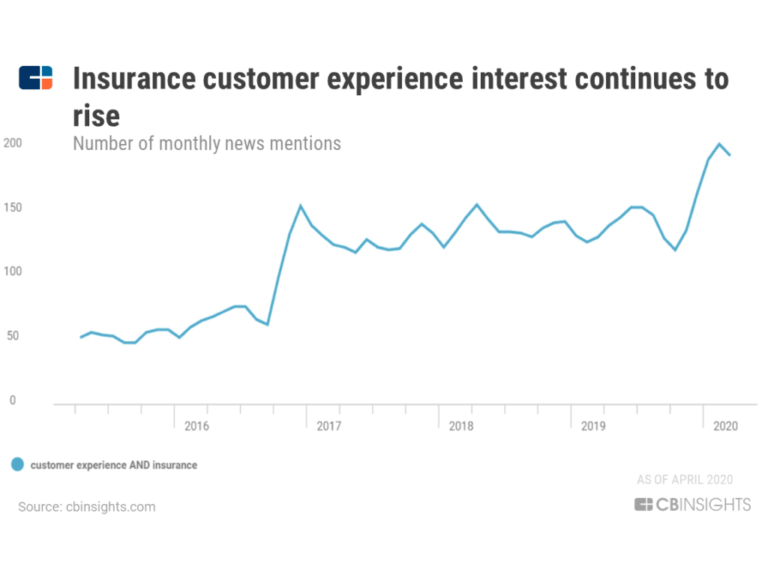

According to ITL and their prediction of InsurTech trends, the main focus is on a digital-first customer-centric approach.

A KPMG report also stresses how customer satisfaction and retention are becoming more important KPIs than operational efficiency.

As products are commoditized, loyalty becomes a thing of the past.

So what do you do now that maximizing customer satisfaction has become the name of the game?

I believe predictive analytics, and more specifically, predicting intent, holds the key to achieving optimal customer experience and, ultimately, customer loyalty.

As recently as a few years ago, customers were still mainly buying insurance policies face-to-face. In that setting, the agent could read the individual’s body language, tone, etc., react to them, and “personalize” the user experience in its purest form.

Today, a vast majority of customers are behind a computer screen, making this level of personalization impossible.

Or is it?

ForMotiv’s Placement Lift and Bind Solutions work by analyzing digital body language, interpreting what it says about that customer’s intent, and driving personalized experiences down to the individual end-user level based on things like frustration, confusion, risk, buying intent, and more.

These next-generation dynamic experiences are the future and leapfrog us into a world where improving the user experience AND improving risk identification is possible – helping solve the age old Risk vs. Experience challenge. This level of personalization is unprecedented. Looking a few years down the road, as the data science use cases in insurance continue to expand, we see these experience improvements as only the beginning.

3. Predictive Analytics in Insurance Pricing and Product Optimization

Armed with more granular data and leveraging predictive analytics in insurance modeling, actuaries can now build products better suited to dynamic business and market conditions, risk patterns, and risk concentrations.

In other words, insurance predictive modeling analyzes historical costs, claims, expenses, risks, and profits and then projects them into the future, allowing insurers to dynamically adjust quoted premiums. For instance, in property insurance, continual monitoring of variables like claim history in the neighborhood, construction costs, and weather patterns helps to predict risk and price more accurately.

By analyzing customer preferences, behavioral signals, buying patterns, and pricing sensitivity, companies can use their predictive modeling algorithms powered by machine learning to constantly optimize and showcase more relevant insurance products.

Up until now, it was difficult to customize policies at the individual level. However, companies can now use pay-as-you-go and dynamic pricing models based on customers’ predicted risk, behavioral signals, and buying preferences.

And many of the digital-first products are a result of millennial influence. As Richard Hartley, CEO & Co-Founder of Cytora puts it in Gina Clarke’s “How Your Insurance Quote Is Powered By A.I.” article…

“Millennial consumer behavior is forcing irreversible changes across financial services, leading to the emergence of digital-first and app-based services for banking, loans, mortgages, and investment. As the millennial cohort starts their own companies and moves into decision-making roles in business, commercial insurance is beginning to undergo the same revolution.”

Given millennials and Gen Z are quickly making up a majority of the buyers in the insurance market – what should traditional insurers do?

There are a few options, but simply put, they need to skate to where the puck is going. By integrating currently available data science and predictive analytics tools, they can avoid a full reboot of their legacy systems.

Not only that, but they’ll be able to thrive in the new age of digital transformation.

4. Predictive Analytics in Insurance Claims

Automating insurance claims processing was a huge step forward as insurers continued their digital transformations. Given that claims are part of the insurance lifecycle that has the highest percentage of attempted fraud, it is one of the first places companies are looking to integrate AI fraud detection and predictive analytics claims solutions.

While legacy insurers are integrating data science solutions into their legacy claims process, companies like Lemonade are starting with an AI/behavioral-first approach.

They tout that they can process claims faster and by using a chatbot, they’re able to provide customers with faster payouts. And Lemonade isn’t the only company using chatbots during the claims process.

These chatbots are getting more sophisticated and can review the claim, verify policy details, and pass it through an AI fraud detection algorithm before sending wire instructions to the bank to pay for the claim settlement. This can help speed up processes and reduce human error.

Other companies, like Tractable, offer machine vision software to help insurance agencies automate claims.

Insurance agents can upload images associated with a claim, such as a damaged car, and an estimate of what they think the appropriate payout is. The software then compares the image to a database of similar images and allows the agent to make smarter payout decisions.

This helps companies avoid overpaying for claims.

Some companies, like Cape Analytics, offer a service that they claim can help property insurers underwrite more accurately and more cost-effectively using satellite-based machine vision.

They can assess information about the roof, property, treeline, pool, trampolines, etc. saving the company from needing to send a human inspector to the property.

AI is also used to spot anomalies and unknown correlations that would be impossible for the human eye to detect. This leads to increased opportunities for straight-through-processing.

In addition, by crunching data collected by behavioral biometrics and behavioral analytics software companies, companies can correlate user behavior against past customer records to detect fraudulent activity and suspicious behavior patterns.

5. Uncovering Insurance Agent Fraud and “Gaming”

Companies are smart to look at reducing insurance fraud during new account openings and claims, but if their fraud prevention efforts stop there, they are missing out on a hugely important area.

While fraud continues to evolve and affect all types of insurance, the most common in terms of volume and average cost are automobile insurance, workers’ compensation, health insurance, and medical fraud.

The tricky part for insurers, however, is that large percentages of fraud are coming from inside their walls. Believe it or not, customers are not as savvy when it comes to committing fraud as their agent counterparts. One very common but hard-to-prove way insurance agents commit fraud is application manipulation.

ForMotiv recently worked with a Top 10 Life Insurance carrier to identify and solve this exact problem. The results were astounding.

The original use case was to determine how many questions customers were manipulating on their life insurance applications. For instance, were they changing their source or amount of income? Or were they trying to game their e-med questions to receive a better rate? As it turns out, after a month of behavioral data collection, we found some phenomenal insights regarding the agents.

The data showed the following… 72% of the applications had 2 or more questions corrected by an AGENT after being submitted by an applicant.

The Insurer had this to say…

“You helped us find the agents who represent themselves better than their employer and customer.”

Yes, we were able to identify a significant amount of customer manipulation as well. But what we did not expect to see was how often and aggressively agents were gaming the application. Changing a few key answers to receive a better rate helps them convert more customers. More customers = more commissions. Simple formula.

This is why predictive analytics in life insurance is paramount to detecting and preventing fraud. Using ForMotiv’s “Forensics” tool, customers can determine not just WHAT answer is being provided, but HOW and by WHOM. This level of insight was previously impossible to extract.

Today, it is being used by 4 of the Top 10 life insurance carriers. Gathering behavioral intelligence with behavior analytics software can protect carriers from claim contestability and special investigations. Not to mention, it can save companies millions of dollars.

Carries need to be aware of the fact that internal or distributed agents often act in their own best interest. And their self-service ignores the ramifications for their clients and companies.

6. Insurance Big Data Analysis

As we mentioned before, the amount of data created every second is virtually incomprehensible. For a little context- the difference between a million seconds versus a billion seconds is 11.5 days versus 31.75 years. So comparing a million IoT devices to a few billion?

It’s mind-numbing when you consider the data created by these devices.

In 2023, it is estimated that there will be 15.4 billion IoT devices. That is ~130 new devices connected to the Internet every second.

Cisco expects the total data generated to exceed 800 zettabytes, with a single zettabyte equal to about a trillion gigabytes.

Using the above time example, a trillion seconds equals about 31,710 years.

With about 90% of the data being unstructured, companies will be forced to embrace machine learning and predictive analytics more than ever to keep up with the demands of IoT.

Telematics (in-vehicle telecommunication devices), drones, wearables, smart speakers, refrigerators, washing machines, toasters…

By adding Internet access to every device imaginable, predictive analytics for insurers will be crucial for survival.

For instance, the behavioral data of applicants is computed when underwriting premium rates for vehicle insurance.

Does the driver slam on the brakes? Do they peel around corners? Do they park their car in deserted locations? Are the road conditions good where they drive?

By applying predictive analytics, insurers can assess the likelihood of the insured being involved in an accident, as well as the odds of having their car stolen by matching behavioral data with external factors like safe neighborhoods.

Ultimately, this helps tailor policies and premiums that protect the insurer as well as the insured. Health Insurance, for instance, has become a huge adopter of IoT and data science use cases.

Predictive Analytics in Health Insurance

Health insurance companies are using predictive behavioral analytics and beginning to integrate Internet of Things devices as well.

With 5% of all patients accounting for nearly 50% of all healthcare spending, it’s more important than ever to utilize available predictive analytics solutions to identify risk factors in patients before they become problematic.

Wearables such as Fitbit and or Apple Watch can provide ongoing assessments of the individual’s health risk exposure.

Adding predictive behavioral analytics and predictive analytics, in general, helps limit losses for more advanced insurance carriers. The use cases for Behavioral Data Science and artificial intelligence especially in applications and claims are seemingly endless. According to LexisNexis Risk Solutions, the top three areas where health insurance companies benefit from the use of predictive analytics are:

- Data-driven claims decisions

- Reduced operating expenses

- Improved profitability and expansion in new and existing markets.

Data-driven claims decisions are paramount in ensuring profitability and getting in front of costly patients and policies.

And according to GenRe, the top six ways predictive analytics are being used by health insurers to optimize claims processing operations are as follows…

- Allocation of resources/triage

- Reserving/settlement values

- Identification of potentially fraudulent claims

- Early warning of potentially high-value losses

- Expense management

- Trend analysis

Bonus Section: We recently wrote about the rise of Generative AI and the potential impacts, both positive and negative, it might have on insurance. You can read more about that here.

Bottom line

Artificial Intelligence, Predictive Behavioral Analytics, and Behavioral Data Science have never been more important to implement for insurers.

Using cutting-edge insurance analytics solutions is the best way for insurers to fend off competition and thrive in a competitive market.

As the digital shift continues to impact the industry as a whole, transforming user data into actionable intelligence is imperative, and integrating artificial intelligence in the insurance application process is a perfect use case.

Companies that integrate predictive analytics into their insurance analytics solutions will undoubtedly increase their market share. They will also boost customer loyalty and can significantly grow their revenue while reducing their costs.