Tobacco Usage Nondisclosure | Stop letting tobacco usage burn your bottom line

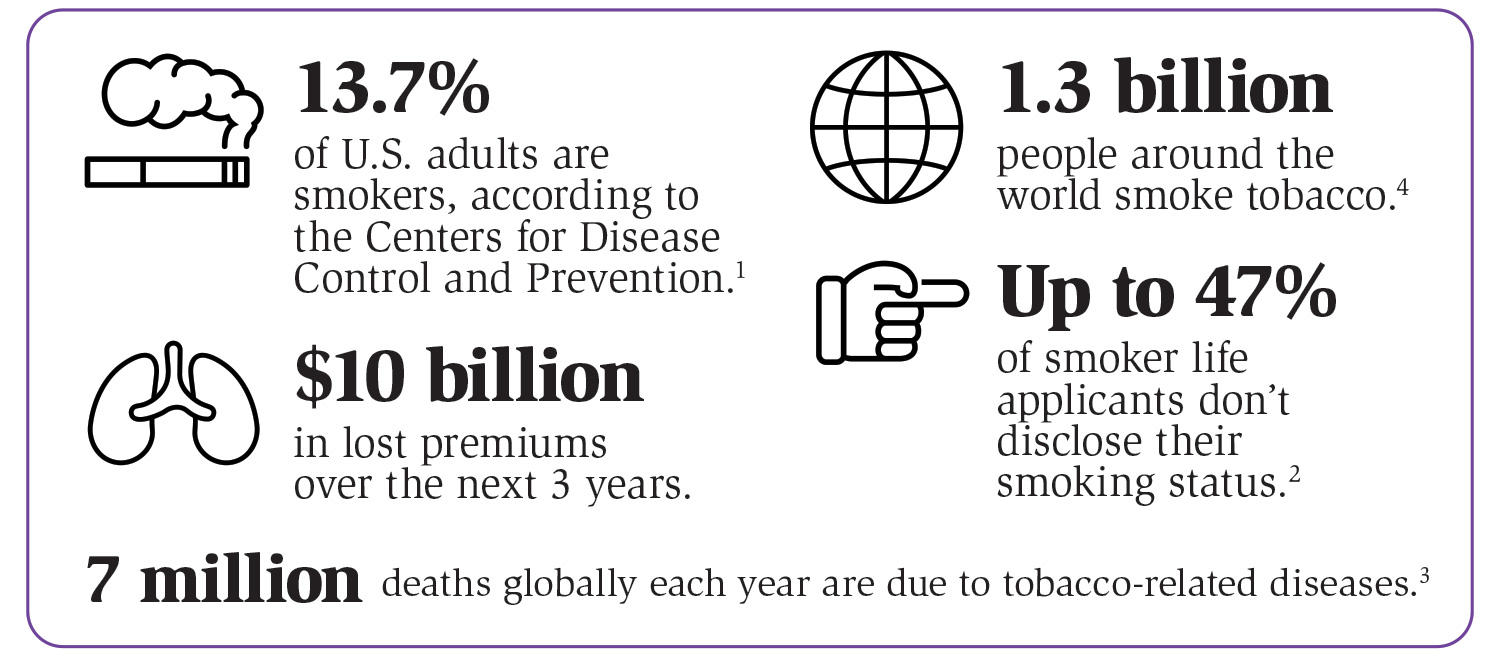

Tobacco usage nondisclosure is consistently one of the top challenges Life Insurers face.

Newly launched InsurTechs (i.e. Ladder Life and recently announced Lemonade Life) have already been setting themselves apart from legacy carriers by adopting accelerated underwriting and drastically reducing or eliminating the number of medical tests required of applicants. This has led to cost savings and increased convenience for both customers and companies alike.

Now add COVID into the mix and the age-old reality of in-person manual medical/lab tests for every customer starts to look pretty bleak and cost-prohibitive.

But you can’t simply remove medical tests, the number #1 defense against medical nondisclosure, and pray for a profitable loss ratio. This creates inherent friction between Customer Experience and Risk teams as their goals are perfectly misaligned.

Customer experience teams want to create seamless user experiences by removing as much friction as humanly possible.

This worries risk and fraud teams as friction is, again, the #1 weapon available to them when it comes to fighting fraud. And with a $3.4 Billion estimated total premium loss per year due to tobacco usage nondisclosure, I’d say their concerns are justified.

So how do you thread the needle between speed and security? Once again, data to the rescue.

*Verisk: How audio analytics can help life insurers detect undisclosed tobacco use

Using “Intent Data” for Tobacco Usage Propensity Models.

With nearly half of all 1.1B global tobacco users failing to disclose an honest assessment of their usage habits, or “Smoker’s Amnesia” as we like to call it, carriers are in a pickle.

Couple that with the shift toward automated underwriting and many insurers are scrambling to find ways to achieve this CX <> Security equilibrium.

ForMotiv offers a new proprietary data source to do just that. We invented a lightweight solution to collect and translate digital behavioral data into “Intent Data” to enhance underwriting precision while helping to expand opportunities for straight-through processing.

How a user fills out their application can be extremely indicative of their intent. Similar to how a polygraph measures physiological indicators, we measure applicants’ digital body language and use artificial intelligence to analyze the results instantaneously so carriers can add or remove friction in real-time.

Applying machine learning to our Intent Data allows us to improve nondisclosure models that selectively flag applicants who may need to be further qualified (i.e. fluid testing, cotinine lab tests, etc.) while allowing the rest of the pool to receive accelerated underwriting. Our glass-box solution offers real-time explanation-based “Signals” so carriers know exactly why certain applicants were flagged for review.

By analyzing digital body language behavior such as hesitation, mouse hovering, corrections, idle time, and other specific behaviors, our model provides a percentage likelihood of application misrepresentation which can help steer who needs further review and who doesn’t.

The benefits are obvious – whether you’re looking to reduce premium leakage, further automate your workflows, or reduce the cost of medical tests without increasing your risk exposure – Intent Data can help.