Digital Behavioral Intelligence

“Face-to-Face” is now “Faceless”…

So, what is Behavioral Intelligence?

The explanation is simpler than you think. Not too long ago, most financial service transactions were done face-to-face.

Whether you were applying for a new credit card, a mortgage, or a life insurance policy, you would likely sit down with an agent to fill out your application.

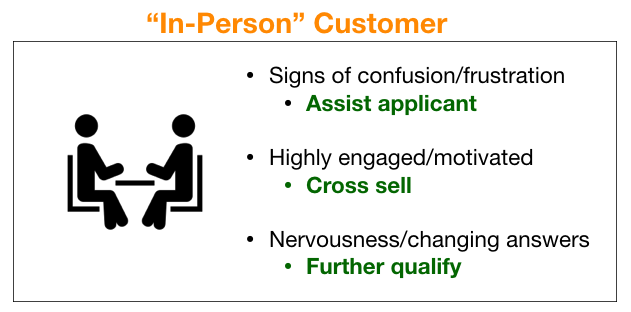

That agent, like any good salesperson, was trained to read your behavioral cues.

If you were confused or frustrated, they would offer a helping hand.

If you were excited and engaged, they may try to cross-sell you an additional product.

If you were nervous, fidgety, or doing something odd like changing your answers or looking at a piece of paper before filling out your home address or social security number, that would (hopefully) raise red flags.

The agent would then further qualify you to make sure they weren’t issuing a risky policy.

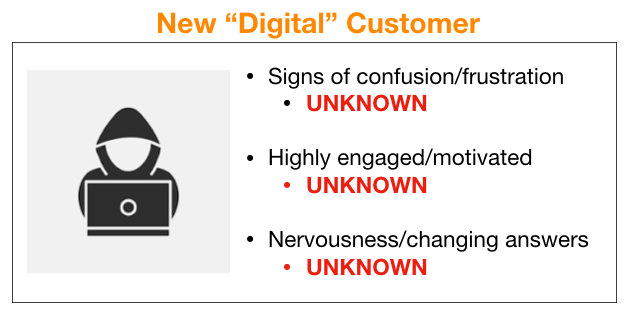

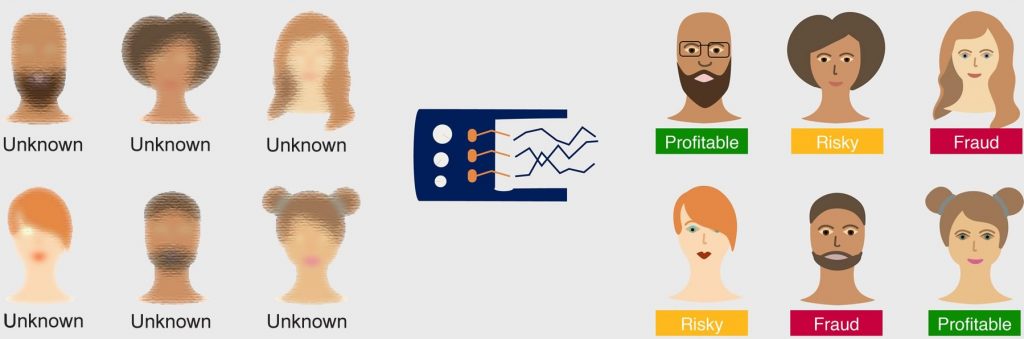

Today, with the Digital Transformation shifting virtually every financial service interaction online, businesses are completely blind to their customer’s behavioral cues.

They are making underwriting decisions and basing risk solely on the final answer that you submitted.

If we were to apply today’s standards ten years ago – it would be equivalent to you sitting down with that same agent, but before you begin filling out the application, the agent puts on a blindfold and noise-canceling headphones.

Any rational person can see the flaws with this approach.

Ignoring behavioral cues, whether intentionally or not, is reckless and is very likely hurting your business.

Observing and reacting to behavioral cues and body language is crucial in any interaction.

But don’t just take my word for it, the data backs it up.

The most well-known statistic to support this is from the famous non-verbal communication researcher Albert Mehrabian, whose studies concluded that 55% of communication is body language, 38% is the tone of voice, and 7% is the actual words spoken.

While I’m not here to argue the validity of the study, anyone with some common sense knows that body language and tone can be HUGE indicators of intent or truthfulness.

Just try asking your significant other if it’s alright if you go out drinking with your friends…a one-word “sure” reply could have half a dozen different connotations.

More commonly, how often have you found yourself analyzing a text to try to figure out the true ‘meaning’ behind it versus simply what they said?

HOW someone says something can be far more telling than what they actually say.

What is Digital Behavioral Intelligence and why is it so important?

In order to understand Digital Behavioral Intelligence, it’ll be helpful to read an excerpt I borrowed from Michael Taillard’s book “Psychology and Modern Warfare” about Military Intelligence.

Military “Intelligence” refers to any information about another group, organization, nation, or people that are useful in strategic planning or executing military operations.

Taillard says, “With the right kinds of intelligence about the actions and behaviors of others, one can not only deconstruct behaviors to derive their root causes, thereby allowing one to understand the intentions, motivations, and plans of others, but one can even predict the future actions that the person will take.”

That is a near-perfect definition of Digital Behavioral Intelligence.

Digital Behavioral Intelligence (DBI) does exactly the same thing, but online.

Digital Behavioral Intelligence works by collecting and analyzing user’s “Digital Body Language,” which is everything from how they move their mouse and did they copy/paste answers to where did they hesitate and did they correct answers.

We collect roughly 5,000-50,000 behavioral data points from 140+ different features on each individual application.

Simply, DBI helps companies figure out the root causes of their user’s actions, allowing them to understand their true motivation and intent.

We then use predictive behavioral analytics to analyze that data and predict future actions that people will take.

All of this data already lives on your forms and applications, you just haven’t had the pickaxe to mine it until now…

This is not to be confused with Emotional Intelligence, or EQ, which has been around for decades and refers to an individual’s understanding of their emotions and how those emotions influence their actions.

Emotional intelligence is internal – it happens inside people’s brains.

On the other hand, Behavioral Intelligence is external. It is observable and requires an ability to not only recognize the behaviors but understand the intent of those behaviors.

To steal an analogy from my friend David Holzmer — “If EQ provides us with a slow-motion selfie, BI plugs us into a real-time, live streaming video captured in 360 degrees.”

Behavioral Intelligence casts a much wider net in capturing the dynamic impact and influence of collective behavioral patterns.

How is Behavioral Intelligence used in forms and applications?

We break it down into three different areas:

- Optimizing User Experiences

- Reducing Risk & Fraud

- Overseeing Agent’s/Employees

Optimizing User Experiences

While most companies are looking at page views, session length and user flows in an attempt to optimize their online experiences, that is just the tip of the iceberg when it comes to the available data yet to be collected.

So while analytics software like Google Analytics is helpful in showing you that users are hitting your application forms and not pressing submit and converting, that’s a very small piece of the overall picture.

Were they price shopping? Did they get stuck or confused or frustrated and abandon the site? Did they seem nervous or suspicious?

If they were sitting across the table from you you would likely have an answer to all of these questions.

However, since they are online, pull out the blindfold and earplugs we mentioned before…

But what if you have Behavioral Intelligence embedded inside the forms?

With BI you can mine previously unimaginable insights from their digital body language and react appropriately.

Did they fill out a few fields but drop off when you asked for a phone number or some personal medical questions?

What questions did they idle on?

Did they fill out questions in the order laid out on the page or are a majority jumping around?

Did they drop off on a certain question, regardless of how it is arranged on the page(s)?

Are certain forms performing better than others?

Behavioral Intelligence gives you the same level of detail that Google Analytics would on your web pages, but on your forms/applications/internal software.

Using Artificial Intelligence and Machine Learning, ForMotiv is able to offer everything from simply the raw behavioral data to AI-driven A/B test recommendations to eliminate form friction and increase your applicant’s health.

This information is crucial when it comes to optimizing the user experience on that form or application.

Converting more high-quality leads = higher revenue, plain and simple.

But here’s the rub – you don’t want to let EVERYONE through as not everyone will be a profitable customer.

So where does that leave you?

The answer comes in the form of dynamic experiences for your customers.

At the very least, businesses should be aware and able to detect key behavioral cues.

Taking it a step further, the experience can and should change based on a user’s DBL, ‘responding’ to that individual user.

If there is a high amount of hesitancy on a particular question, this could signal confusion or frustration.

In that case, dynamically adding in a friendly FAQ or ‘More Info’ option or popping up a ‘Live Agent’ or ‘Click to Call’ option could help pull them through.

User experience is an obvious use case, but the impact of DBI goes a lot deeper than just converting users…

Reduce Risk & Fraud

Imagine a bot is rushing through an application… Why spend all that time and money further qualifying what you (should) know is ultimately not an actual customer?

To prevent this, one of our customers has an “Upload a Drivers License” pop-up if they are filling out the application in under 50% the normal time it should take to apply. This helps ensure they are a real customer, in real-time, without needing to send the application to a call center.

Yes, understanding user behavior is crucial when it comes to increasing conversion rates, engagement, and revenue, but why stop at the tippy-top of the funnel?

What about risky applicants or fraudsters- both very hot topics in financial services today.

As I stated before, Digital Behavioral Intelligence can break down root causes, understand intentions, and predict future actions.

In the context of risk & fraud, did they hesitate on the “have you ever smoked” question, see that there were drop-downs, start filling them out and then go back and click no?

We call that “Smoker’s Amnesia” and as companies continue moving away from paramed interviews for every applicant, understanding HOW a user fills out a question can be far more telling than that they simply put “no.”

Did they hesitate and then edit their annual income, source of income, or other important information?

Did they put down estimated mileage or number of dependents, check a quote, then go back and change their answers?

Did they change the previously insured carrier or worker’s comp classification before submitting it? While this is a very limited number of examples, our data shows that they can be very indicative of increased risk or potential fraud with applicants.

Companies with Behavioral Intelligence can use this information to further qualify risky applicants, make smarter underwriting decisions and lower loss ratios, and ultimately increase profits and lower risk, overall.

Agent and Employee Oversight

Understanding your customers using DBI is important, but so is understanding your employees and distributed agents.

Maximizing the agent experience is quickly becoming a key area of focus for companies as competition is fierce and many options are available.

Attracting agents by way of slick portals, applications, and user experiences are on the rise.

The first step is getting the agents, the next step is monitoring those agents for performance, as well as risk and fraud.

While the most public and commonly known example of agent fraud is that of Wells Fargo, you can think of them as the Mark McGuire of banking fraud.

Lots of players used steroids in the early 2000s, only a few got caught, and only the biggest stars had their names dragged through the media mud.

It took a concerted effort, new regulations, and new oversight measures to get the rampant steroid issue under control.

We’ve witnessed a similar scene in financial services.

Now that banking and financial services are on notice, they’re (hopefully) taking proactive measures to make sure they avoid similar headlines.

Many companies sell through internal or external / distributed agents. While a majority of those agents are honest, not all are.

Having Behavioral Intelligence on not just customers, but the actions of employees and agents are more important today than ever before.

Collecting information on who filled out which questions, when, and from what device can make-or-break a policy under investigation.

With a full audit trail, similar to the “Revision History” feature inside Google’s Docs/Sheets, the “he-said-she-said” guesswork is eliminated.

We’ve heard examples of basic form field manipulation, i.e. agents or brokers changing answers after customers submit applications to make them look more attractive to carriers & receive a better rate, allowing the agent to close more deals. Cha-ching.

Examples of agents creating fake Gmail accounts for customers, sending themselves DocuSign’s, signing them, and then approving those policies on the spot.

Premium avoidance, fictitious policies, and coverage sliding are all very common in insurance today and carriers need to smarten up if they want to avoid penalties, fines, and public shaming.

Companies spend billions to prevent fraud every year.

Much in the way medicine is turning proactive versus reactive, preventing fraud needs to take a similar approach.

Proactively signaling and reducing risk and fraud is a far superior method of prevention.

Behavioral Intelligence

Digital Behavioral Intelligence can be useful in a number of ways – from user experience analysis to fraud prevention, there is no shortage of applicable use cases.

While a lot of seemingly obvious use cases point out negatives, it goes without saying that one can derive important metrics to discover positive outcomes, as well.

Profitable customers, increased conversion rates, or even simply knowing users are engaging inside the website or application exactly how you’d like them to can all be helpful.