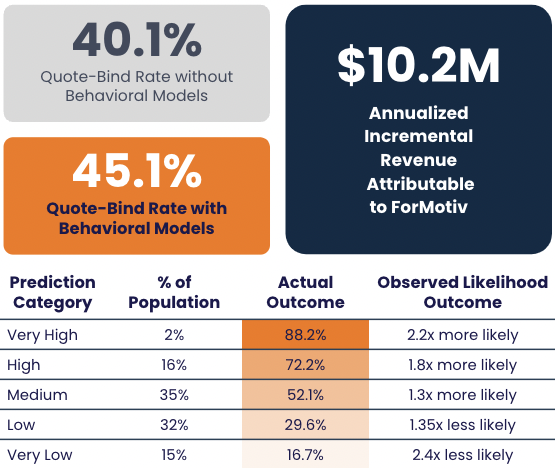

ForMotiv analyzes digital user behavior and provides real-time purchase intent scores & segmentation. Leading carriers are selling more policies with personalized, adaptive experiences that nudge genuine users’ to purchase.

“I thought we were capturing a lot of behavioral data until I met ForMotiv. With a few lines of javascript, we were collecting 10x more data in a matter of days. What’s even more impressive is how easy it’s been for us to combine their behavioral data and models with our own.” – CMO of Top 5 P&C Carrier

Conversion Optimization Solution

Improve Lead Scoring & Prioritization Models

ForMotiv tells you and your agents which users are high-intent buyers vs. window shoppers either real-time or offline to help prioritize leads and close more deals.

Combine our models with your own internal models for even better outcomes.

Optimize Remarketing & Retargeting

Not all applicants are created equal…focus your remarketing dollars on high intent and high LTV customers.

Feed Google and Facebook with targeted lookalike audiences and watch your campaign ROI soar.

Create Adaptive, Intuitive Digital Experiences

Know Precisely when to Remove Friction and Nudge Conversions

You spend enough time and money getting users to your site – don’t let them abandon.

ForMotiv helps improve insurance digital experiences by uncovering chokepoints and identifying the perfect “micro-moments” to engage, encourage, and nudge a user to convert.

Easy to Integrate. Easy to Use. Totally Safe & Secure.

Easy Integration

ForMotiv’s JS Snippet embeds inside of your Tag Manager, directly in your website, or through our API and instantly begins tracking form inputs.

Easy to Use

24/7 access to the ForMotiv portal gives your team real-time data analytics on each individual applicant. Drill down on specific applications, questions, and user actions.

Zero PII Collected

Your data is totally secure as ForMotiv collects zero Personal Identifiable Information (PII).

Own Your Data

Your data is just that, yours. ForMotiv provides you access to all of the raw data collected. No customer or outcome information is used with other customers.