User Behavior Analytics Software| The Ultimate Guide to Behavior-as-a-Service

In this article, we’re going to cover a number of topics ranging from the evolution of user behavior analytics software and the rise of behavior-as-a-service to the future of Behavioral Intelligence and BaaS.

Table of Content:

- Without SaaS, there would be no BaaS…

- User Analytics 2.0: Behavior Analytics

- User Behavior Analytics Software for Marketing and User Experience

- User Behavior Analytics Software for Authentication and Security

- User Analytics 3.0: The Evolution of Behavioral Intelligence

- How was Behavioral Intelligence invented?

- Behavioral Intelligence v1.0

- Behavioral Intelligence v2.0

- The Rise of Accelerated Underwriting

- Is Disruption Inevitable?

- Fending off disruption…

- Behavior-as-a-Service or Behavioral Intelligence, which is right for you?

Without SaaS, there would be no BaaS (Behavior-as-a-Service)…

“Analytics,” in some shape or form, has been around for quite some time. Even before computers were mainstream, people like Henry Ford were using analytics to measure the speed of their assembly lines to optimize their production.

Data Analytics, at least in the way that we know it today, began picking up speed in the late 60s as computers were adopted by larger organizations as decision-making support systems.

But it wasn’t until the 2000s that things really started to get interesting (so far as our story is concerned).

At that time, an ambitious young company by the name of Salesforce was taking advantage of a new but promising technological advancement, the Cloud, that would change the software landscape forever.

Often credited with inventing the SaaS model, Salesforce began delivering its software via the web when most other companies were still delivering their software via CD-ROMs (remember those?).

Managers gained the ability to purchase software on-demand without having to leave the office.

In addition, they no longer had to maintain expensive hardware or on-premise solutions and instead could simply ‘rent’ from software providers.

And since the software vendors were responsible for handling troubleshooting, backups, administration, capacity planning, and maintenance, the time-to-market and cost savings were enormous.

“XYZ-as-a-Service” has since bled into many different categories, including analytics and that is where our journey starts…

User Analytics 2.0: User Behavior Analytics Software

SaaS accelerated the development of incredible advances and democratization of analytics.

Today, one of the first things you do when starting a business is installing Google Analytics, or something similar, on your website. This could be considered User Analytics 1.0.

Having a basic understanding of how people are finding and engaging with your website is a crucial step in growing your business.

It allows you to test ideas, see what is working and what is not, and adjust your content, visuals, layout, and everything else to continually optimize the customer experience.

For instance, let’s say someone searches “Pizza near me” on Google, finds your Italian restaurant website, clicks into it, and then leaves without placing an order.

What happened?

Perhaps the page they landed on didn’t focus enough on pizza and, therefore, the user abandoned in search of a more targeted result. Maybe they were comparing offers? Maybe they didn’t see a pizza they liked? The answer is unclear, but something clearly happened.

The desire to understand more than simply what someone did, but how they did it is what led to the evolution of user behavior analytics.

User Behavior Analytics Software for Marketing and User Experience

Understanding how long someone spent on a page only takes you so far. Understanding exactly how they behaved on that page can be much more insightful.

Most companies with sophisticated analytics reporting are using something more powerful than Google Analytics.

That’s because companies demanded more. More data, more insights, more everything. And that led to a generation of behavioral-focused marketing solutions.

These simple web analytics (User Analytics 1.0) solutions paved the way for more advanced analytics such as heat mapping, screen recording, A/B testing software, and plenty of other “behavioral” analytics solutions (User Analytics 2.0). This next-generation focused primarily on HOW users were engaging on your website/app.

Put differently, instead of answering, ”What did this user do on my website?” Which is somewhat limited to the pages they visited and the buttons they clicked, companies began answering “How did this user behave on my

website?” Which explains more about how the user physically navigated, where they moved their mouse, where they focused their attention, etc.

Using behavioral data allows companies to use data-driven insights to test different variables to optimize experiences like never before.

As this form of analytics landed on Main Street, many companies sprouted up, primarily in the marketing space, offering SaaS solutions to get organizations’ user behavior analytics efforts up and running quickly.

Hotjar, GoodEgg, FullStory, and others have done a great job of providing companies easy access to actionable insights on their user behavior through heat-mapping, screen recording, and digital experience analysis. (These are primarily software solutions with specific features to address customer needs versus an API-driven customizable behavior-as-a-service platform, which we will discuss later.)

The sheer volume of raw event data generated in the digital world arms data scientists with an incredible amount of insight into their users.

This ability to hone in on select groups of people, whether broken down geographically or demographically, to learn not just what they did but how they did it and why they did it enables accurate predictions about how they are likely to behave in the future.

User behavior analytics software was quickly adopted by marketing teams, e-commerce companies, online gaming, application development, and enabled advancements such as suggestions/recommendations, and site/app optimizations.

Combining artificial intelligence and machine learning with user behavior analytics software enables these next-generation tailored digital experiences to exist.

If I’m losing you, an easy way to think about it is the “Recommendations” you see when browsing on Amazon, or the convenient “pop-up offer” you receive when you’re in the process of leaving a website without purchasing something.

So, to summarize the logical evolution of user analytics, we originally started with, “How are people finding my website? How are they navigating around my site and what pages are they looking at?”

This led to the invention of Google Analytics and others like it.

Then came, “How are they behaving on my web pages? Are they finding the information they’re looking for? How can I better optimize and tailor their experience?”

Which led to a slew of user behavior analytics companies giving more granular insights into how users interact with their websites, what they’re interested in, what they’re looking for, and what products/offers might appeal to them.

In the context of e-commerce, “People like you also bought…” or in the context of streaming, “People like you also watched/listened to…”

While these scenarios are complex in their own right, the ROI is much easier to understand as the decision is either to Purchase or Don’t Purchase.

The goal in e-commerce is to encourage someone to fill up their cart, checkout, and then come back for more in the future.

Abandonment, as a metric, is fairly simple to figure out given it either happened or it didn’t. Understanding WHY someone is abandoned, however, is much more complicated.

Maybe they were price shopping, maybe they forgot their credit card, maybe they were just curious to see how the checkout flow looked, or maybe they simply changed their mind before clicking submits.

The fact is, a LOT happens on that checkout page that companies are blind to without fully realizing it. In fact, $4.6 TRILLION dollars of merchandise are left in online shopping carts each year.

For perspective, that’s more than DOUBLE the $2.2 trillion dollar COVID-19 stimulus package…

A typical scenario might look like this:

> User A adds a pair of sneakers, shorts, and a t-shirt to their cart.

> User A clicks to checkout and sees a recommendation for a sweatshirt to complete the look, they add it to their cart and proceed to checkout.

> While User A is checking out, something happens…

> User A does not complete the checkout process.

The logical next steps for the company is to retarget User A with ads and if they collected an email address, send an abandoned cart drip campaign.

But wouldn’t it be nice to know what happened between them clicking “checkout” and them leaving the website?

Turns out that gray areas could be the key to predicting user behavior after all and we will discuss that later in this article.

But before we do that, it’s important to mention the other ways user behavior analytics have been implemented.

User Behavior Analytics for Authentication and Security

Somewhere along the line, some very smart people noticed that the way we interact with our devices is actually fairly unique. The way we move our mouse, how quickly we type, are we using our cell phone predominantly left-handed or right-handed, how we walk with our cell phone in our pocket…

These markers, or what we’ve coined as “digital body language,” are so unique, in fact, that much like a fingerprint, they can be used to help with the security and identification of our devices and accounts.

Companies like BioCatch, NuData, and Secured Touch all ran with this idea and have partnered with most large financial institutions to help protect their user’s accounts.

The use cases for this type of solution are many, but a few obvious ones are device security, account logins, and account takeovers.

With nearly 80% of e-commerce transactions coming from mobile devices in 2019, businesses are putting a far greater emphasis on their mobile-shopping experiences.

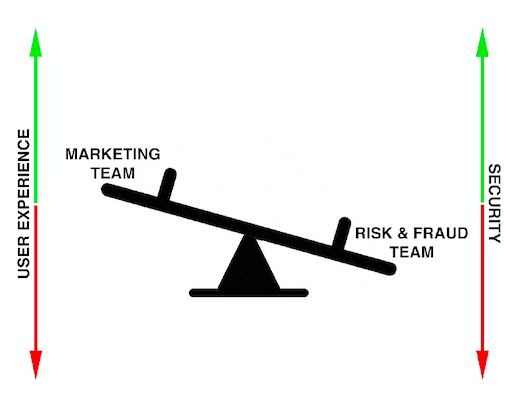

But as we’ve discussed before, optimizing user experiences often has a negative effect on risk prevention and security.

(Read: How to Walk the Security <> CX Tightrope for more on this)

TransUnion came out with a report based on approximately 10 billion transactions that they and their affiliate companies analyzed for fraud indicators in 2019.

The report says, “mobile-commerce transactions increased 32% in 2019 versus 2018. But just as consumers and merchants paid more attention to m-commerce, so too did criminals.” TransUnion measured a 118% increase in potential fraud from mobile devices last year.

The report continued, “Actual fraud—specifically account takeovers and shipping fraud—skyrocketed. TransUnion said there was a 347% increase in account-takeover fraud.” That’s when criminals gain access to accounts using credential stuffing, social engineering, phishing, or hacking tactics.

These are some of the key areas behavioral biometrics are focused on.

For instance, if someone who is predominantly right-handed is now using their left hand to navigate on their phone, did they break their hand or was their device stolen? Biometrics helps us answer these questions.

But even such a sophisticated solution comes with its own challenges…

More and more companies passively analyze user behavior in the background to correlate mouse movements, typing speeds, browsing habits, login history, and network details to ensure that accounts have not been taken over by bad actors.

If I’m Bank of America, for instance, I want to know that John Smith that just logged into his account is actually John Smith. I also want to know that John Smith is the one making purchases with his credit card, initiating withdrawals from his account, and making edits to his account information.

In order to do this companies require the collection and analysis of large amounts of personal data that often include highly personal information, or Personal Identifiable Information (PII), by combining your behavioral profile data with known demographic data.

Think of it this way – if you’re using screen capture software to analyze how your users are behaving, you’re likely capturing everything they are doing / typing. So if, for example, they’re entering credit card, bank account, or social security information you now have access to extremely sensitive information.

This poses challenges and raises concerns about privacy given the fact that a lot of this information is traded between dozens if not hundreds of parties involved in targeted advertising, not to mention makes companies much more attractive to hackers.

So how do you juggle the need for better user experiences, without sacrificing security, without encroaching on privacy?

Funny you should ask…

User Analytics 3.0: The Evolution of Behavioral Intelligence

So at this point in our analytics journey, we’ve discussed the amazing benefits of user behavior analytics software and some of the initial use cases around user experience improvements and security/authentication.

And the available solutions today are fantastic at solving these particular challenges.

It’s no secret that companies have an insatiable appetite for data and only by harnessing the power of machine learning are we able to analyze even a drop of the available data today.

As the world continues its digital transformation – companies are not only using AI and machine learning to invent new ways to analyze existing data in previously unimaginable ways, but they are actually creating new data sources that never existed before.

(Read: Top 6 Use Cases of AI & Predictive Analytics in Insurance)

The fourth industrial revolution is happening before our very eyes and if artificial intelligence is the machine, data is what powers it.

In just the past few years we’ve seen companies like Root Insurance reinvent auto insurance pricing based on how users’s physically driving with “telematics.”

HazardHub has tapped into satellite imagery and is using advanced AI on this spatial imagery data to help insurance companies price properties more accurately. We’re seeing similar advancements in flood insurance.

And more recently, ForMotiv launched a proprietary Behavioral Intelligence technology that gives businesses a seamless way to anonymously collect “digital body language.”

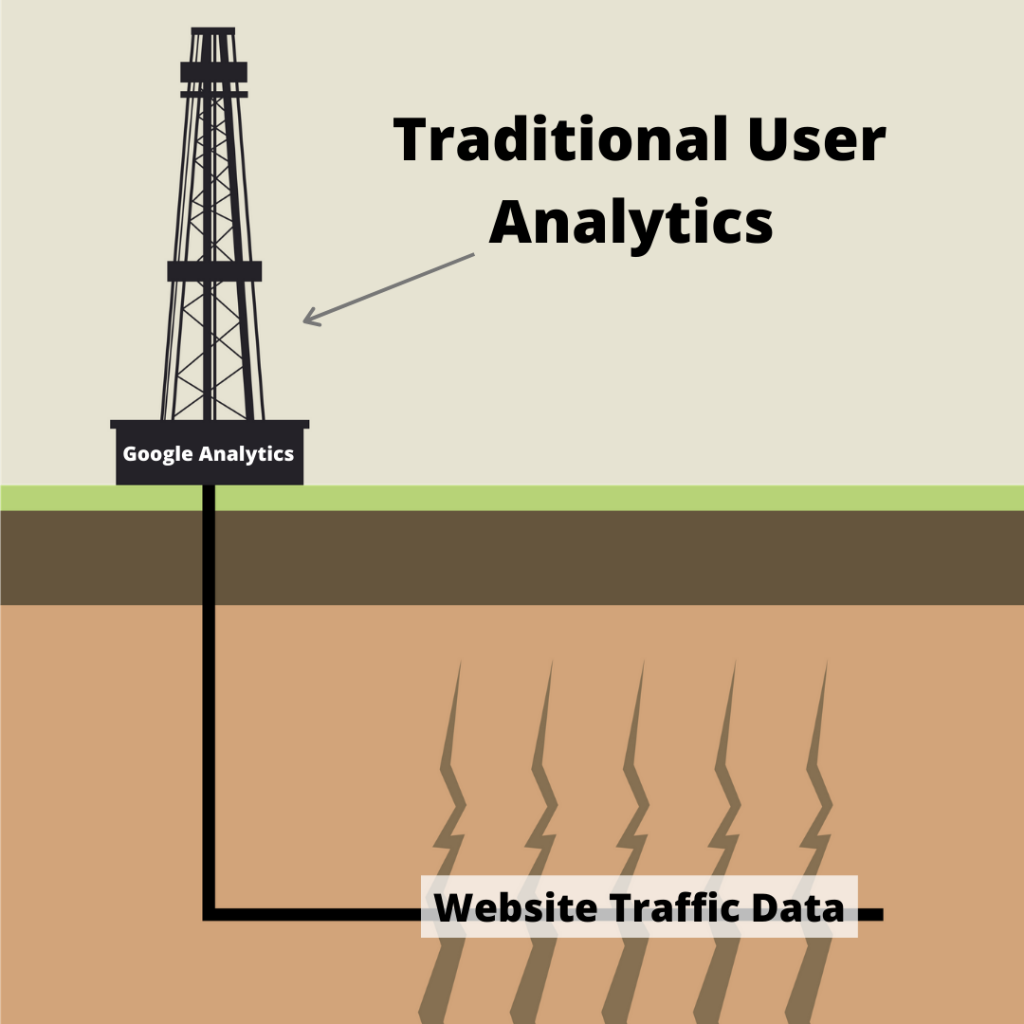

Solutions like Google Analytics were the initial oil rigs. They allowed companies to drill down and mine their websites for data. This allowed them to make critical ‘data-driven’ decisions, A/B test, and understand basic traffic and flow information.

Behavioral Intelligence is more like fracking…

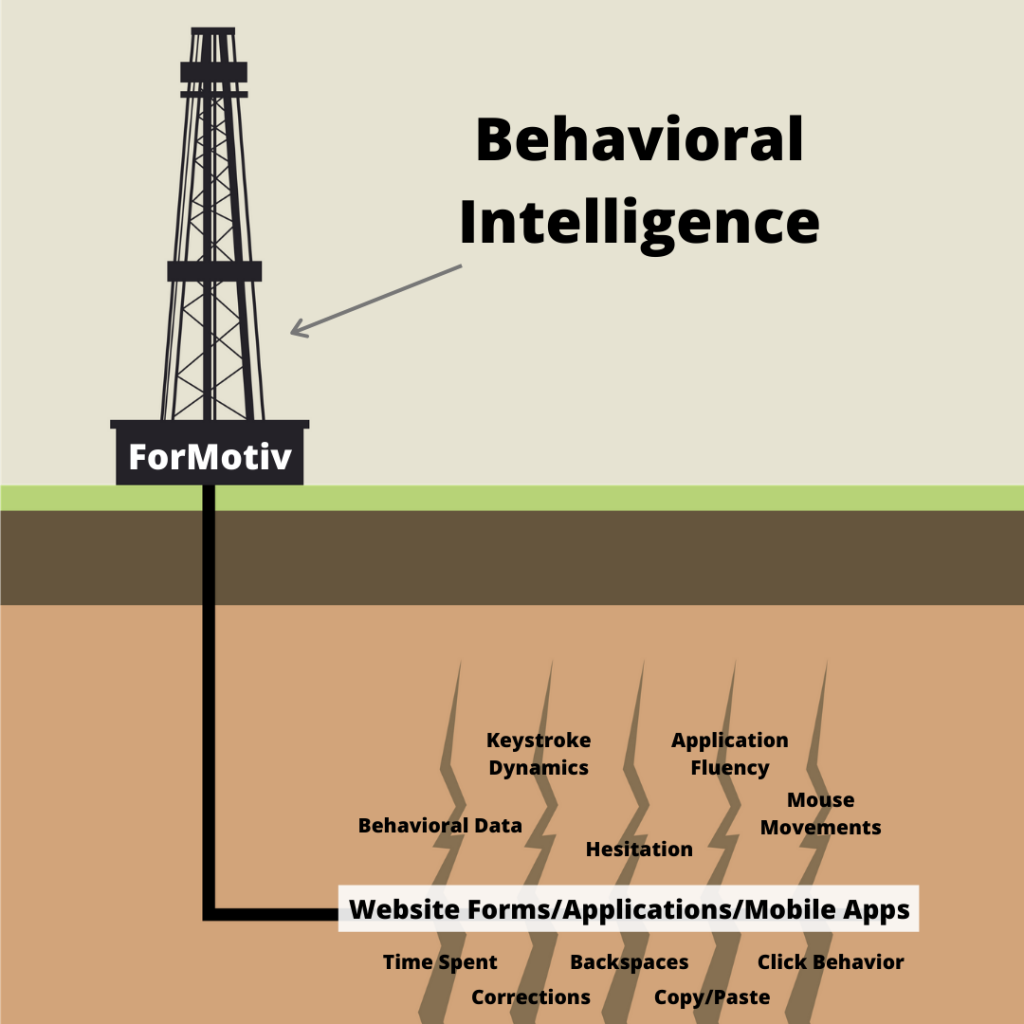

With this new technological invention we can now mine the same wells (website forms/applications/mobile apps) but produce exponentially more behavioral data.

On a standard 20-40 question application, companies will end with 20-40 data points. With Behavioral Intelligence, we are typically collecting 100x-1000x that amount.

And the most interesting thing about it is these reservoirs of behavioral data already live on your website, the tools just haven’t existed to mine it with the speed to have a real-time impact until now.

Behavioral Intelligence ushers in a new era of data access, availability, and user predictability, or “What will they do next?”

How was Behavioral Intelligence invented?

While I would love to tell you the invention of Behavioral Intelligence was an “Ah-hah!” moment, or even better, a beautiful mastermind plan, I can’t.

Like most great inventions, Behavioral Intelligence resulted from evolution not revolution.

You may remember the “gray area” in the checkout process we discussed earlier. Companies were able to see that customers started the checkout process (because they landed on the form page) and then whether or not they completed it, but what happened in between was largely unknown.

Where were they dropping off? How much time did they spend on the form? Did they spend more time on certain questions?

And these questions weren’t reserved for just check out…What about account sign up? Or online surveys? Or online applications?

Noting that the digital transformation was shifting virtually every business interaction online, Andrew, the founder of ForMotiv, realized that when it came to forms and applications (on both web and mobile), user behavior was either invasive/retroactive (i.e. screen recording) or largely ignored.

But how could businesses ignore this crucial information? That would be like running your retail business with a blindfold on…

For example, a person abandoning their cart checkout is no different than a person leaving a store without buying anything, but in person, we have access to so much more information.

Let’s pretend it is a shoe store – did they walk around, not see anything they liked and leave? Did they try on a pair and not like the way it feels? Was their size not in stock? Did they forget their credit card and say they’ll come back later?

Taking that a step further and applying it to the financial service industry, the application process for most major products (i.e. insurance, credit cards, loans, mortgages, etc.) is moving online.

This means that agents/sales reps can no longer tell if someone is confused or frustrated, engaged or excited, or even nervous, fidgety, or exuding odd behavior…therefore, they can no longer read their customer’s body language and react appropriately.

They’re completely blind to their user’s behavior.

90% of communication is non-verbal, meaning we intuitively pick it up by listening to someone’s tone and watching their body language. HOW someone says something can be far more telling than simply the words that they said.

But online, with zero human interaction, we lose all of that ‘data.’ We are stuck with what we call “final answer data”, or simply, whatever is the last answer filled in when you press submit. We’ll discuss this more in the next section.

Our ability to read and react to someone’s body language is a crucial component of communication and intent and because of that there is so much more to the story than simply “did they buy or not.”

Andrew wondered if you could gain those same insights online. And with that, he set out to answer these basic questions in a way that satisfied both the marketing and security teams.

Behavioral Intelligence v1.0

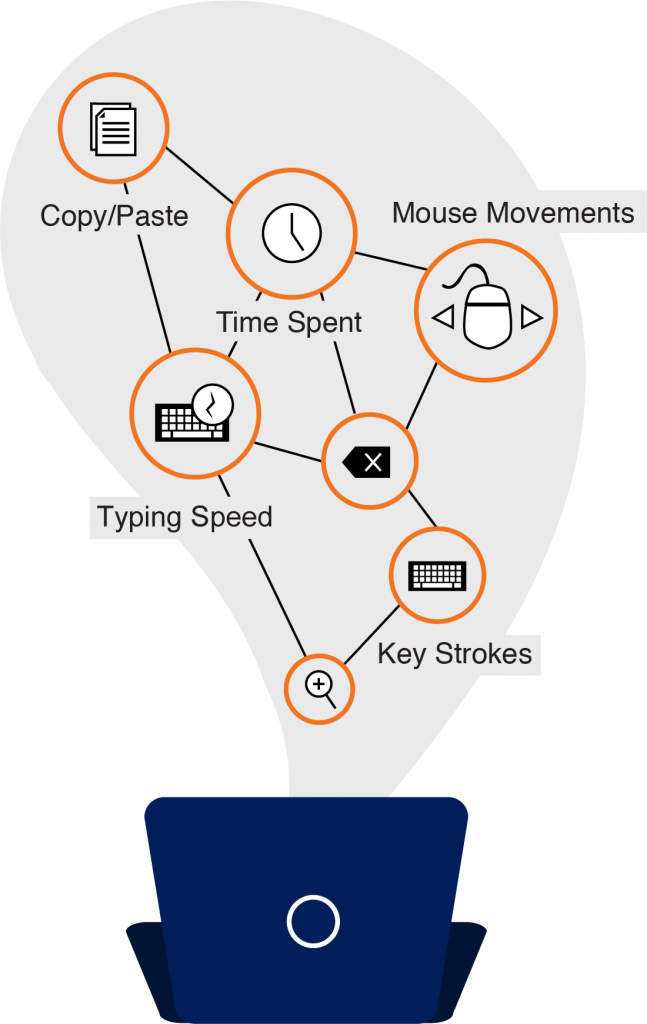

The first version of the technology was a simple way of collecting a user’s “digital body language” as they filled out any digital form or application. Keystrokes, copy/paste, mouse movements, hover time, idle time, and dozens of other behavioral features collected in real-time.

This was unique in two ways. The first being that up to that point, no other solution existed that gave companies the ability to do this. Seemingly everyone wants user behavior analytics software but collecting and accessing any sort of meaningful behavioral data was extremely difficult, and the companies that existed were all black box solutions so companies didn’t have access to the raw data itself, only the outputs.

The second was that it didn’t collect the actual information, it strictly collected the behavioral data, thereby eliminating the PII concern.

The first commercial adoption of this new technology was actually by a survey company looking to understand the behavior of the people filling out their surveys and optimize the surveys themselves to increase conversions.

The behavioral data collected proved useful in improving the user experience. Not only was this successful, but it got Andrew thinking about all of the other possibilities…

As a data scientist newly equipped with the ability to easily collect behavioral data, the next obvious question was, “is this data predictive?”

And then maybe more appropriately, predictive of what? This is where things really start getting interesting…

Behavioral Intelligence v2.0

There is a book called Psychology and Modern Warfare written by Michael Taillard in which he describes military intelligence as, “With the right kinds of intelligence about the actions and behaviors of others, one can not only deconstruct behaviors to derive their root causes, thereby allowing one to understand the intentions, motivations, and plans of others, but one can even predict the future actions that the person will take.”

Apply this to digital experiences and this is about as good a definition of Behavioral Intelligence as you’ll find.

More simply, by understanding the past behaviors of your users you can begin to predict their future behaviors. And if you can predict what someone is likely to do next you can eventually create dynamic experiences on an individual level.

It’s the analytics world’s version of “personalized medicine,” allowing companies to guide customers on an individual level to achieve the desired outcome.

So in the context of a sign up form, application, survey, whatever it is, we can use this data to predict if someone will complete the application or not. And if we determine they will abandon, we can dynamically change the experience for them to encourage them to finish.

But how is this possible?

Well, in the last decade we’ve seen tremendous advances in artificial intelligence and machine learning that has allowed us to look at old data sources and extract a previously unimaginable level of insight. Coupled with these newly available data sources and the predictive power we’re seeing is borderline frightening.

Up to this point, the solutions on the market were focusing on comparing John Smith to John Smith and optimizing for his experience.

But what if we compared John Smith to every other user who had come before him or every other person who was confused on a website?

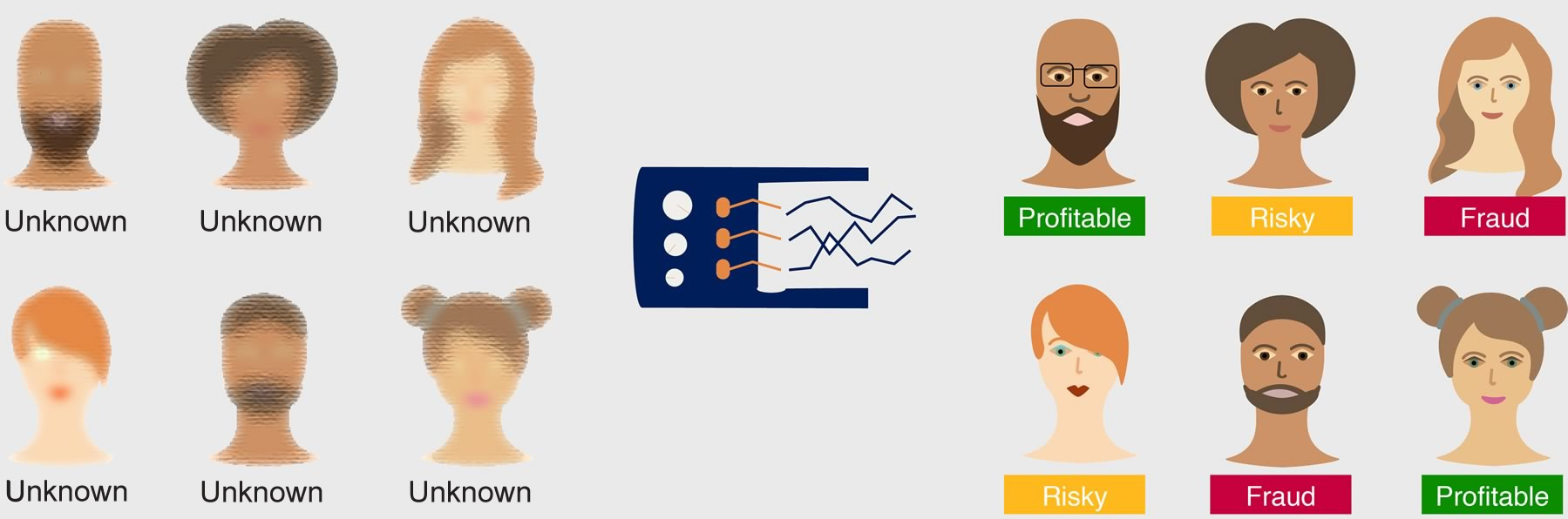

The hypothesis became, “Do users with similar outcomes exude similar behavior to someone I’ve seen before?” As in, do profitable customers look like other profitable customers? Do people who abandon prematurely behave similarly? Can you predict a delinquent payer by comparing them to other delinquent payers?

Around that time, financial services were undergoing a massive digital transformation in their own right, but what was really interesting about this space is the components surrounding risk and fraud.

As we alluded to earlier, companies were struggling to balance customer experience with security. There seemed to exist a seesaw in which marketing and fraud departments each had a seat.

So ForMotiv set out to answer, “Do risky or fraudulent applicants look like other risky or fraudulent applicants?”

And if they do, can we use this knowledge to price them more effectively and further qualify those who appear to be fraudulent before underwriting their policy?

Turns out, you can.

Over the years, ForMotiv has added nearly 150 additional behavioral features that result in thousands of behavioral data points collected on each individual application.

Behaviors like corrections, save and exits, hesitancy, application fluency, rage-clicking, and more help paint a more complete picture of a user’s behavior.

To give you an example, imagine buying life insurance 10 years ago. You would most likely have walked into a retail branch, sat down with an agent/broker, and filled out a stack of papers.

As we discussed before, during that time, the agent would likely pay attention to your body language (as any good salesperson would).

If they asked you for your zip code and you changed your answer three times, that would be odd.

If they asked you for your social security number and you pulled out a piece of paper from your wallet and copied your answer over, that would be odd.

Or if they asked you if you smoked and you started biting your nails or bouncing your knee or asked a few follow-up questions to clarify, that would likely raise some red flags.

Online, this type of behavior happens every single day and companies are completely blind to it. As we mentioned before, they are stuck “grading” risk based on “final answer data”, or whatever the applicant’s final answer was when they pressed submit.

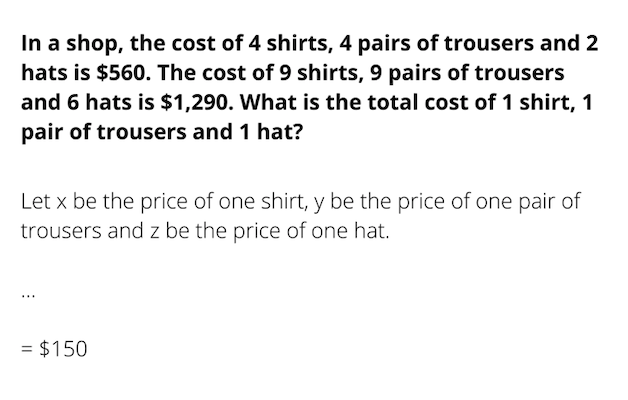

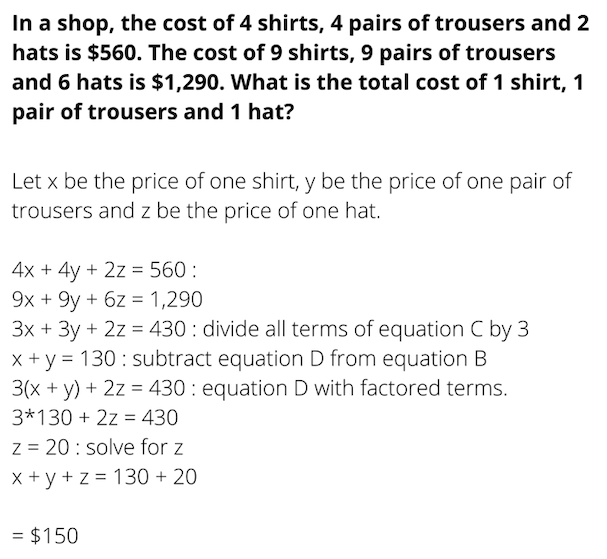

Think of that in the context of your high school math class…would you ever be able to submit an answer on a test like this?

No chance! Even if the answer is correct you will not receive full credit. That’s because your math teacher understands how much more important it is to understand HOW someone arrives at an answer versus simply the answer they put.

For all the teacher knows, the student looked over at a classmate’s paper and copied the answer!

Now compare that last answer to this one…

Now THAT student is getting full credit, but more importantly, the teacher can feel confident “grading” this student because they can see the full picture.

Unfortunately, practically every financial service company “grades” like this during their underwriting and risk pricing process.

As a result, none of the risky behaviors are being captured so applications that have no businesses being priced the way they are, or even approved for that matter, are being approved more than ever before.

It’s no surprise that outright fraud rates are nearly double online than in person.

And this is not something they can choose to ignore as it’s costing the insurance industry over $40B in losses and premium leakage despite spending billions to prevent it.

That’s where Behavioral Intelligence and user behavior analytics software comes in.

It doesn’t matter if you’re looking to optimize your user’s experience, predict risk and fraud, understand your employee workflows, or oversee your independent agents, behavioral data has many current applications and many more we, and our customers, have not thought of yet.

The Rise of Accelerated Underwriting

The key change driving the adoption of Behavioral Intelligence in the insurance space is that of accelerated underwriting.

With the rise of the internet, improved data sources, and big data, the insurance industry is moving towards the credit card model with instant decisioning.

While we’ve seen it for years in the P&C, it’s creeping into the life space.

In the past — whenever someone applied for life insurance for example, they’d sent out a paramedic to everyone’s house in order to do a fluid test. That test alone typically costs the insurer around $100+ each visit plus the cost of the commission to the agent.

With the rise of SaaS and an obsession with metrics like the cost to acquire, more and more companies are trying to move to a direct-to-consumer model and offer an instant decision where you can have a term policy in under 5 minutes…just look at Haven, Ladder, and Ethos Life.

Instant decisioning saves the insurer time and money and provides the proposed insured with seamless user experiences.

But what’s happened as a result of this better experience for the customer is a higher likelihood of the applicant lying. I mean, why wouldn’t you?

Look at the tobacco question. If you answer YES, you are going to pay a premium 2-3X that of a non-smoker. In essence, the applicant is incentivized to lie, especially when no one is going to confirm the data you’ve provided.

This “smoker’s amnesia” is horrible for carriers and can drastically impact their profitability.

With Behavioral Intelligence, after recognizing the high-risk behavior of a user, carriers can respond by scheduling a fluid test. On the other hand, if the user shows positive and genuine behavioral responses, drive them through algorithmic underwriting.

This new intelligence allows for dynamic experiences and saves carriers time, money, and helps price more efficiently.

Is Disruption Inevitable?

The current state of the industry is similar to around ten years ago when the on-demand car revolution came into existence.

We recently wrote an article discussing the fact that Lemonade is attempting to disrupt the market in the same way Uber did – digital-first, customer experience first, advanced analytics, and rapid scaling catching incumbents on their heels.

While this analogy is obviously apples to lemons (see what I did there?) as Uber and Lemonade are inherently different businesses – a lot can be learned from the transportation industries’ response, or lack thereof, to a disruptive entrant.

Imagine if in the very early days of Uber there existed a technology that Taxi, Limousine, Private Driving, and every other form of passenger transportation could have adopted that gave them an out-of-the-box mobile app, pricing transparency, GPS tracking, automated payments, and a rating system…how much different do you think things would have played out?

That’s where we are in the insurance space today.

Lemonade’s Chief Underwriting Officer, John Peters, said it himself…

“We’re getting smarter. Lemonade started at a data disadvantage, building up a data set from scratch and collecting information at every customer interaction. We knew it was only a matter of time before we were at a data advantage. If we’re not there yet, we sure are close. Interacting with our customers directly and digitally means we know them really well, even if we’ve never met them face-to-face. That knowledge is translated to a ‘risk score’ that accurately predicts future loss ratios, and can be used across the organization, from marketing to acquisition to policy management and claims. It has not yet impacted our pricing sophistication, but that day will come – just like credit history did and auto telematics may soon.”

Well since that quote was given, that day has come.

Lemonade has seen consistent decreases in their loss ratio that have put them on the path to profitability and they attribute their success directly to their user behavior analytics efforts.

John again puts it perfectly when he says…

“When you have 100x more data being collected, you can get an exponentially more precise picture of risk.”

Thanks for helping educate the market, Lemonade! We couldn’t agree more.

The key point is, whether companies are paying attention or not, the shift is happening and the landscape is changing. If the carriers of today do not accept this and adapt, they will be the Blockbusters of tomorrow.

Fending Off Disruption…

Blockbuster had the advantage over Netflix in virtually every aspect – funding, brand, scale, you name it. But the one thing they lacked that ultimately led to their demise was customer data.

A wise man once said, “Algorithms come and go, but Data is forever…”

No matter what Blockbuster did to compete, the sophistication of Netflix back-end data engine created a moat that was nearly impossible to breach. With that (and a few other things), it was only a matter of time before Netflix surpassed them and eventually put them out of business.

Like our Taxi example before, if Blockbuster had a company they could quickly partner with to replicate that same back-end data engine, there is a very good chance that history would be completely rewritten and Netflix would have never become a household name. (Note: Blockbuster rejected an offer to buy Netflix for $50 million…as of 4/15/20 Netflix is worth $188 BILLION)

Insurance companies today are presented with this same scenario, except unlike Blockbuster, they have the luxury of enlisting the help of third-party experts like ForMotiv.

So what should they do to fend off disruption? (Learn more about competing with Lemonade)

Well, we took the expression “copying is the greatest form of flattery” literally when we first started out by modeling ForMotiv after Salesforce in two key ways.

One, we wanted to give customers an out-of-the-box product that they can use on Day 1. Two, we opened up our APIs because we wanted our customers and partners to have the ability to use them for any customizations/integrations they want to layer on top on top of their applications.

If you have a sophisticated data science team, use our data as another key data source.

We are big believers in building an ecosystem around our product and making integration as easy as possible is a big part of that.

When it comes to analytics, there is no “correct” answer for how to best utilize the data available to you, the key starts with simply collecting or having access to the data itself.

Now should you venture off to build your own Behavioral Intelligence product? You certainly can, but we wouldn’t recommend it. (Read our Build vs. Buy argument for more on this)

When there is a “job” that needs to be done, companies should “hire” other companies to do the job versus trying to do it themselves.

After all, if you need milk, you will buy a carton from the store, you won’t go buy a cow.

“Spending time, money, and energy building out an entirely new product outside of your core competency simply because you use it doesn’t make much sense at all.”

And, frankly, financial service companies today do not have the luxury of time with FinTech and InsurTech startups nipping at their heels.

Obviously understanding website traffic, page views, and the flow of a user through your site is important information to know, and whether you are using Google Analytics or Adobe Analytics or some other vendor, the decision was “which vendor should we use?” not “should we use a vendor.”

You likely wouldn’t build your own analytics solution unless your business is that analytics solution.

Partnering with a company like ForMotiv can get you in the game on day 1 versus spending months, or even years, building out a solution capable of collecting Behavioral Intelligence, detecting predictive behavioral signals, and ultimately scoring against customer outcomes based on those unique behavioral attributes all in real-time.

There are many benefits of using a partner company. For starters, time to market. Hiring a solution that can get you up and running in a matter of days versus months or years is a no-brainer.

Return-on-investment… For many companies, the cost of fraud, which tends to be in the multi-millions, is one of the biggest drags on profitability. Eliminating even a very small percentage of net-new fraud can provide huge returns on invested capital.

Building/maintaining the codebase…rather than trying to invest in and manage an entirely new product/solution, outsource it.

Instead, spend your time on last-mile customizations that mold the perfect solution for your business. If you’re an insurance company focus on insurance and your loss ratio not building and maintaining a Behavioral Intelligence solution.

When you think of user behavior analytics in the Behavior-as-a-Service context, it allows much more flexibility than simply purchasing a black-box analytics solution.

By providing a suite of API companies like ForMotiv are able to supply both fully-baked solutions to address specific customer needs, as well as a much more abstract platform-based solution that allows businesses to build and customize to their own wants and needs.

Behavior-as-a-Service or Behavioral Intelligence, which is right for you?

Just like the product, the way ForMotiv works with its clients has evolved.

The typical rollout happens in three phases – Collect, Detect, Predict.

Most companies have not built the ability to collect digital body language and those who do are typically collecting only a handful of data points. Predictive power only happens when you have meaningful data, so more is better in this case.

With two lines of Javascript, these same companies can instantly begin collecting 150+ behavioral features resulting in nearly 5,000+ data points on each individual application. Multiply that by the hundreds, thousands, or hundreds of thousands of monthly applications our customers are receiving and that number goes up very quickly. That’s “Collect.”

“Detect” works by identifying certain behaviors the company would like to be notified about in real-time. For instance, did an applicant copy/paste their zip code, which is often correlated with fraud.

Another extremely popular but unintended benefit is the ability to not only oversee customer behavior but that of agents and employees.

Nearly 80% of our customers are using our software to prevent agent’s from “gaming” the system. For instance, did an agent receive an application submission from a customer, check a quote, hit the back button, and change their previously insured answer or mileage estimates to receive a better rate.

With commissions on the line, it’s no secret that sometimes employees are willing to bend the rules and act in their own self-interest.

These rule-based signals allow companies to respond immediately when these behaviors occur.

The third phase, “Predict”, occurs as outcomes begin to mature. Customers pass back unique identifiers of customers labeled as “risky”, “fraudulent”, “filed a claim”, “never paid”, or whatever other behavior they are looking to identify.

Eventually, as the models continue to be trained, once we reach a level of confidence with the outcome prediction our customers will integrate our scoring directly into their underwriting algorithm.

Each customer has a slightly different approach to best fit their needs.

This behavioral data can be accessed in a few different ways.

- Raw behavioral data sent via file or API

- Calculated behavioral data and signal data sent via file or API

- Console available for reviewing individual applications

We have certain clients who simply use our solution as a means of collecting calculated behavioral data which is fed to their data science teams. Others who don’t have data science teams and rely on ForMotiv’s models and calculations.

We have other clients and partners who are productizing their behavioral data with ForMotiv’s new Behavior-as-a-Service offering. We will do the collection, calculations, and transmission so you can build unique analytics offerings to provide to your customers.

Here are two examples of how ForMotiv customers are using our user behavior analytics software in the context of Behavior-as-a-Service.

Example 1:

The insurance carrier does not have the data science resources to analyze the ForMotiv data so they leverage ForMotiv’s analytics console and technology to do 90% of the crunching. Using ForMotiv alerts, when a user exhibits specific high-risk behaviors during the e-application process, the carrier is notified. All of the data probings is done by ForMotiv’s console with an end result of a simple alert consumed by our customer.

Example 2:

The fintech customer is highly sophisticated and instead of receiving just an alert, they want a combination of the calculated data to feed their existing underwriting and fraud models. Rather than data sitting in a black box with limited explanation, ForMotiv provides this behavioral insight in real-time when the user presses submit.

In example 1, the client needs minimal technology intervention to get value out of Behavioral Intelligence with rule-based alerting.

In example 2, integrating BaaS into applications, user flows, claims processes, underwriting, etc. can be very valuable, especially if they have internal data science teams to supplement the work being done by ForMotiv.

The other piece we have not touched on much is that of the user experience benefits gleaned from Behavioral Intelligence data.

For both customers and agents/employees, understanding optimal flows, chokepoints, and bottlenecks, and application/workflow friction allows for companies to improve the experience on both sides of the equation.

So whether you’re looking to utilize the behavior-as-a-service components and build on top, or simply access the raw data or predictive capabilities of Behavioral Intelligence, ForMotiv is a solid choice.

Don’t wait!

Just like autonomous cars and virtual reality, Behavioral Intelligence is an inevitable technology. It’s not a matter of if, but when, and whether companies eventually decide to use ForMotiv, someone else, or build it yourself, within a few years nearly everyone will be using it.

Whether you’re looking to use our behavior-as-a-service offering to collect raw data or you want to utilize the whole Behavioral Intelligence suite or anything in between, we’re here to help.

How a user types, their keystrokes, corrections, copy/paste, mouse movements, hesitation, fluency, mouse hovers, and hundreds of other behavioral ‘features’ come together to paint a picture of a particular user.

We’ve seen time and time again that this information pays dividends in the Marketing/CX, Risk & Fraud, Benchmarking, Compliance, Agent/Employee Oversight, Underwriting, and other departments.

Most forms/applications have 20-40 fields, which means at most you are limited to 20-40 data points.

With Behavioral Intelligence, however, ForMotiv collects and analyzes over 150+ behavioral features on each individual question, typically resulting in 100x-1000x the number of data points received per applicant.

Benefits of adopting a Behavioral Data strategy:

- Smarter Risk Scoring

- Improved Loss Ratio

- Lower Cost-per-acquisition

- Lower claims volumes

- Improved Pricing Sophistication

- Reduced fraud rates

- Exponential accumulation of data allows for even more powerful insights in the future

Why you can’t wait…

“Algorithms come and go, but Data is forever…”

Unfortunately, given the uniqueness of this proprietary data set, every day you wait is a day lost.

We’re not looking at existing data in a new way, we’re looking at new data in a new way, so we first need to collect that new data.

The Data and insights accrue exponentially, so as the data collection continues to compound, those who wait will quickly find themselves playing an impossible game of catch-up.

Bottom line? Don’t wait.

Schedule a demo with us so we can walk you through the process for getting started.