Algorithmic or Accelerated Underwriting is the Future

Algorithmic underwriting, accelerated underwriting, automated underwriting, doesn’t matter what you call it, simple fact is with the rise of the internet, improved data sources, and big data, the insurance space is moving towards the credit card model with instant decisioning.

While we’ve seen it for years in the P&C space when you open an auto policy, for example, this is entirely new to the life space.

In the past — whenever someone applied for life insurance for example, they’d sent out a paramedic to everyone’s house in order to do a fluid test.

That test alone typically costs the insurer around $100+ each visit plus the cost of the commission to the agent.

With the rise of SaaS and an obsession with metrics like cost to acquire and loss ratios, more and more companies are trying to move to a direct-to-consumer model and offer an instant decision where you can have a term policy in under 5 minutes…just look at Haven, Ladder, and Ethos Life.

How do you implement automated underwriting in life insurance?

As we mentioned, typically, a client will fill out an application that includes medical history and questions about smoking and other lifestyle habits.

Most times they will also undergo an examination that can include an electrocardiogram and analysis of blood and urine samples. They combine this information with their other data sources.

For instance, a credit score of 450 corresponds to a 20% higher risk of death. Underwriters are always looking for more data sources to build a clearer picture of their candidate to price as accurately as possible.

Traditional Underwriting:

Underwriters with experience in actuarial science take all of this information to calculate levels of risk and set a policy rate.

Life insurance sales have traditionally been face-to-face with agents but like most retail experiences, that mode is quickly falling out of favor as customers prefer online experiences, and algorithmic processes are better for online sales.

Instant decisioning saves the insurer time and money, and provides the proposed insured with a seamless user experience. If you were presented with Option A, immediately receive a policy, or Option B, wait days/weeks for a doctor’s appointment, I think it’s safe to say 100% of people would select Option A.

But what’s happened as a result of this is a better experience for the customer is a higher likelihood of the applicant lying.

I mean why wouldn’t you? When no one is watching, people are much more likely to behave inappropriately.

We recently discussed the positive correlation between recessionary periods and fraud, so as COVID-19 forces most companies to accelerate their digital transformation, fraud rates will go up.

Add in the fact that a lot of these digital transformation solutions will be reactive and rushed versus proactive and planned, there is a very high likelihood that there will be chinks in the armor.

Just take a look at the tobacco question. If you answer YES, you are going to pay a premium 2-3X that of a non-smoker.

In essence, the applicant is incentivized to lie. With the safeguard of a nurse’s home visit to take blood & urine samples no longer an option, what is to stop you from simply lying and taking the cheaper rate?

So what should you do to prevent “Smoker’s Amnesia”?

Underwriting with Behavioral Intelligence

This is where behavioral intelligence comes into play.

Underwriting with Behavioral Intelligence:

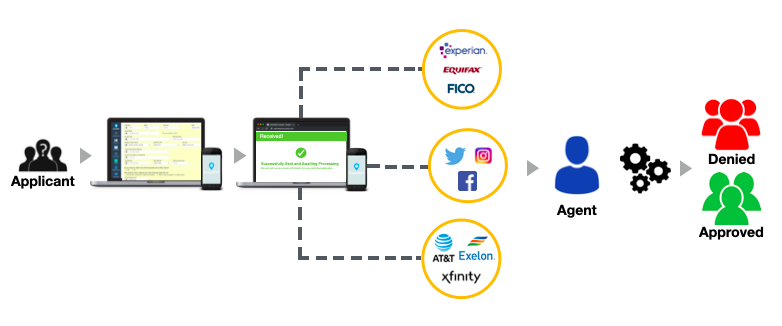

Using an insurance underwriting analytics solution like ForMotiv’s, which collects “digital body language,” or how your applicants physically fill out their forms/applications (i.e. mouse movements, hovers, copy/paste, keystrokes, corrections, hesitancy, fluency, and about 150 other features), and then uses machine learning to detect anomalous behavior and predict risk and fraud, life insurance carriers can utilize an extremely powerful and unique data set to assess their customers.

By adding this extra layer to your defense that understands if a user hesitates or gets fidgety on important questions, or suffers from a condition that some of our carriers like to call “smoker’s amnesia”, you’re able to better protect yourself and price risk more efficiently.

One of the biggest issues with automated underwriting, and just underwriting in general, is discrimination. The great thing about behavioral intelligence is that it collects zero PII so it is immune to discriminatory factors such as race.

ForMotiv’s “Digital Polygraph” allows carriers to feel confident in the answers of their customers and subsequently the policies they are approving. This pays dividends down the road as fewer false claims are filed.

ForMotiv’s “dynamic security” gives carriers the ability to dynamically adjust customers’ user experiences.

For example, if the system detects high-risk behavior by the user, carriers can pass that user over to a call center rep to review the policy before approval and determine if a medical/fluid test is necessary.

On the other hand, if the user shows genuine behavioral responses, drive them through algorithmic underwriting.

How ForMotiv can help…

Has your company thought about behavioral analytics to enhance algorithmic underwriting algorithms? We can help.

Our Behavior-as-a-Service or full-suite Behavioral Intelligence products allow you to get up and running in as little as 30 minutes.

Send us a note at info@formotiv.com and we can show you a quick demo.