What is Intent Data?

What is intent data? And what does it mean for the insurance industry? These are two burning questions that top insurers are asking right now. In this article, we’re diving into what is intent data, what are the different types of intent data, and how to collect and leverage intent data.

While you’re reading this, you have potential customers on your website scrolling through pages, reading blog posts, and likely filling out digital applications. Ultimately, they’re looking for an insurance solution that they hope you can provide them. They’re also likely researching your competitors and making quicker buying decisions than consumers of the past.

You’ve got about eight seconds to capture their interest before they’re on to the next company — no pressure.

With that type of buyer, a new gauntlet has been thrown down for marketers, digital experience teams, and underwriters alike.

Trying to keep up with the “buy in under 5-minutes!” and “no medical reviews!” and “enter your first name for an instant quote!” crowd sounds like a nightmare. (That last example was maybe a slight exaggeration but you get the point).

InsurTechs are playing a risky game in their effort to streamline the user experience by continually removing friction from their application process. After all, the more friction you remove, the more risk you invite.

But unfortunately for legacy carriers, once customer experiences change there is no going back. Just ask the Taxi industry or any retailer who can’t offer 2-day shipping. Carriers are currently weathering a perfect storm comprised of 3 fronts:

- The rise of accelerated underwriting via heavily funded InsurTech unicorns who don’t care about making a profit anytime soon (or ever) as long as they keep acquiring new customers

- COVID quite literally forcing them to move from face-to-face to digital experiences

- Big Tech + Governments changing data privacy regulations and making it much more difficult to target customers (anyone see Facebook’s recent earnings report 👀)

With that, the need for 1st party data, particularly 1st party intent data has moved from “nice to have” to “must-have” seemingly overnight.

For those of you with attention spans like mine, here’s the TL;DR of how 1st Party Intent Data can help carriers today:

- Intuitively personalizes every user’s digital experience

- Identifies qualified, high-intent leads early in the game

- Predicts user intent and reacts in real-time

- Reduces the cost of manual labor

- Nurture applicants with targeted ‘nudges’ during the application flow

For everyone else, read on to learn more about intent data and some specific use cases for the insurance industry!

What exactly is “Intent Data”?

You may have heard the term thrown around online, but what is intent data, exactly?

Stealing a quote from Michael Taillard’s book Psychology and Modern Warfare, “With the right kinds of intelligence about the actions and behaviors of others, one can not only deconstruct behaviors to derive their root causes, thereby allowing one to understand the intentions, motivations, and plans of others, but one can even predict the future actions that the person will take.”

In this quote, “intelligence” is synonymous with “intent data.”

Simply put, intent data is any data collected by a company that they use to help them determine what a user is likely to say, do, or purchase in the future.

Until now, companies have used data gathered from mostly second or third-party datasets. This data, consisting primarily of user-submitted answers or verification resources like DMV or Health records, is a helpful way of using historical data to try to piece together what the future picture of that user looks like.

However, pressure is mounting to accelerate quoting, underwriting, and claims. With that, companies are searching for real-time data solutions that give them instant customer insights to enable more personalized digital experiences.

This can be incredibly challenging given the investment required to build, launch, and maintain a data science solution that can facilitate the real-time demands of customers and CX teams alike.

Luckily, recent technological advancements in predictive behavioral analytics are making this possible. For instance, carriers now have a way to analyze and react to a user’s digital body language while they actively engage with a digital form or application. The concept is similar to that of in-person interactions where 90% of communication is non-verbal. In-person, we intuitively pick up on behavioral cues such as body language, tone of voice, eye contact, and more that help us read and react to whatever unique situation we find ourselves in.

Shockingly, it’s very similar online. As insurance-seekers engage with your website, digital forms, and applications, not only do they leave behind their email addresses, phone numbers, IP addresses, and other personal information, they also leave behind behavioral breadcrumbs that tell a story about their intent.

And not just any story – an incredibly predictive story. “Intent scoring” is really just the analysis of these online behavioral micro-expressions to create a user profile that predicts their future behavior, in real-time.

For reference, we’re consistently seeing behavioral data outperform demographic data, 3rd party data, and just about every other available dataset on the market when it comes to predictive value.

Now that we have the ingredients to cook up some “intent scores” the recipe is actually quite simple. Combine raw behavioral data with machine learning and predictive analytics, stir it up in a Behavioral Science Platform, and get ready for some tasty intent scores that can be consumed in real-time.

But first, what are the different types of intent data?

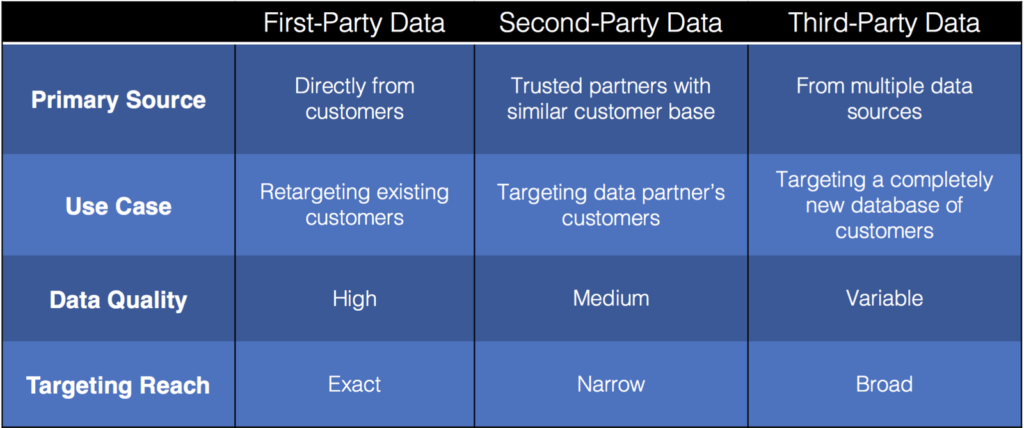

Generally speaking, there are three main types of intent data. Here’s the breakdown.

First-party intent data is user information consented to and collected by your company. Since data isn’t collected by a third party, it’s highly relevant information that only you own. For example, customer-submitted forms or user behavior data collected on your website.

Second-party intent data is information collected by a secondary company and then sold to or shared with a company outside of your industry. It is shared by two (or more) trusted parties who agree that it will be helpful to both (or all) businesses. Since it’s most often shared across industry types, it’s not always highly relevant information.

Third-party intent data, as the name suggests, is information collected by third-party data companies and then sold off to anyone. Purchasers of third-party data don’t own the information. Third-party data is under a lot of scrutiny for breaching user privacy.

If you happened to catch Facebook’s recent earnings report, they mention the new privacy laws being a $10B drag on their bottom line due to the new targeting limitations. To combat this, companies are scrambling to collect 1st party data any way they can.

That means finding ways to collect behavioral intent data – and fast.

What is the Value of Intent Data?

In the insurance world, not all applicants are created equal. For instance, high intent buyers that are 2x more likely to buy are far more valuable than window shoppers are 4x less likely to buy, right?

Right now, you’re spending the same amount of money retargeting User A, who filled out your application in 18 seconds just to receive a quote, and User B, who diligently filled out the application, hovered over the submit button, and then got cold feet and decided to price shop a little more before making a decision.

But if you only had $10 to remarket to that user via Facebook or Google, wouldn’t you rather spend $1 on User A and $9 on User B? What if you were making an outbound phone call, wouldn’t you want to know that User B is 4.8x more likely to buy and User A is 5.6x less likely to buy than the average user? What if you knew that User B was actually 7.2x more likely to pick up the phone and buy with an agent if you called them? You’d probably reorganize your call queue, right?

This level of predictive intelligence enables companies to create a seemingly endless number of intent profiles. But that’s just the beginning – the future of digital experiences will be taking it one step further and reacting to them (more on that later).

The LTV of a customer is different for every company, but as you start to think about whether intent data is right for you, here are some other questions to ask yourself:

- If I was face-to-face with a customer and recognized that they were confused – would I sit idly by and watch them or would I help them out? Is my online experience providing this same level of customer attention?

- If I knew a customer, or agent, were misrepresenting certain questions such as tobacco or previous accident history during the application, would that be helpful to know before I underwrite the policy?

- Would I want to know if a customer is going to file a claim in the first 60 days of receiving a policy? How about churn within that same timeframe?

The list of questions goes on and on…and on…and most people we speak with, whether they just launched their digital application or have had it for years, quickly understand the need for this level of insight both for real-time experiences and offline customer understanding.

Regardless of how far along you are in your digital transformation, the most important thing you can do is start building your dataset.

How to Collect Intent Data?

The groundswell for intent data seemed to start in 2021 and crescendo towards the end of the year as personalized digital experience took center stage on the 2022 priority list.

With that, the question became – how do I even collect intent data?

To answer that question, first-party intent data is typically tracked while consumers are engaging with content. Whether that’s clicking through your website, scrolling down a blog post, or filling out your digital application.

Second and third-party intent data is collected from data co-op conglomerates or large corporations non-specific to an industry. Since second and third-party data records are often outdated and not always applicable to a person looking for insurance, carriers are prioritizing first-party intent data (— and we think that’s a smart move.)

When it comes to filling out digital applications, the best and most predictive dataset is behavioral data, bar none.

ForMotiv developed a way to read a user’s digital body language by analyzing thousands of behavioral micro-expressions while a user fills out an online application to produce incredibly accurate intent scores, instantly. Where they move their mouse, how they type, if they hesitate on an answer and then change it, and hundreds of other behavioral features tell a story about that user’s intent.

And guess how hard it is to start building your behavioral dataset? Would you believe me if I told you it’s a few lines of javascript you drop right into your source code or Google Tag Manager – about the same level of effort as installing Google Analytics? Let me prove it to you.

How to Leverage Buyer Intent Data

Now the real magic comes in when you use these intent scores to actually react to the user while they’re still in the application. More on this later…

It’s no secret that consumers today are making quick decisions, earlier in their buyer’s journey, often without ever talking to a sales representative. That’s why it’s more important than ever to get in front of your potential customer in the early stages of their buying process.

After all, the longer you wait between collecting customer data and using it, the greater the chance of it becoming outdated.

Example Direct-to-Consumer Use Cases

Next-generation digital experiences require a little creativity! So imagine a world where you could automatically read a customer’s behavioral cues and intent while they were engaging with your digital application. Imagine knowing if a customer is confused, frustrated, window shopping, or even attempting to submit a fraudulent application while they are doing it.

But not only that, what if your application was intuitive enough to recognize this and actually adapt the experience to encourage, nudge, or intervene on a per-user basis. Would you want to live in that world?

This isn’t Sci-Fi, ForMotiv is making this possible for dozens of insurance carriers today. Having processed +400mm insurance apps, we have a few suggestions on best practices if you’d like to hear them – on the house.

How does it work?

First, ForMotiv captures an unprecedented amount of 1st party behavioral intent data during the application process. Next, carriers can take advantage of their Behavioral Science Platform to create dynamic experiences by ingesting deterministic signals or intent scores, in real-time, at any point during the workflow.

Now no matter how intuitive your application is, applicants will inevitably drop off. With ForMotiv’s behavioral stratification product, carriers can leverage all of the gleaned intent intelligence offline. For example, try adjusting remarketing messaging based on a customer’s preference to buy online or over the phone. Or instead of a first-in-first-out model for follow-up, prioritizing the call-back queue based on buying propensity.

Imagine being able to refine your customer profiles, either real-time or offline, using this level of incredibly granular behavioral and intent stratification.

Accelerated experiences fueled by intent data enhances the customer experience by hitting the right person at the right time with the right message. And if we’ve said it once we’ve said it a thousand times, insurance is having its Netflix vs. Blockbuster moment and the winners and losers will be determined by who uses their understanding of user intent to provide the best digital experiences.

Example agent distribution use cases

Let me know if you’ve heard this before – insurance agents will soon be replaced by artificial intelligence. Yes, we’ve heard it too. But despite all of the disruption-hype, insurance agents have not gone away. Far from it. Other than InsurTech upstarts, nearly every carrier on the planet has some form of agent distribution.

For what it’s worth, we’re in the camp that believes there will always be agent distribution in one form or another. And guess what – they can benefit from intent data as well.

As an agent, wouldn’t you want to spend your time on high-intent buyers vs. calling dead numbers, applicants who will never pick up your call, or wasting your time on window shoppers?

Or as a carrier, wouldn’t you want to know if a quote submitted by an agent is genuine or if the agent is price shopping for a customer? Wouldn’t you want to know if they were pushing through bad policies, changing answers to a customer-submitted application, or outright “gaming” the system?

Beyond that, we have customers using our platform to understand agent behavior for training purposes, to optimize their workflows, even to benchmark high-performers vs. low performers by behavior.

We’ve found that nearly every D2C use case also has applicability for agent distribution as well.

Wrapping up

As we mentioned, no matter where you are on your digital transformation journey, it is never too soon to start collecting behavioral intent data. Every day you wait is a day’s worth of data that is lost for good.

There’s no need to overthink it – drop a few lines of javascript into your application and start building your behavioral database today. That way, whenever you’re ready to take advantage of the platform, your dataset has had time to build up and you can realize the value immediately.

Want to see how it works? Schedule a call and we’ll walk you through a demo and some relevant use cases. You won’t regret it.