Fluidless Underwriting in Insurance

Life Insurance Underwriting isn’t Changing, it’s Changed.

5 years ago I purchased a life insurance policy. Last week, my friend bought a life insurance policy. My experience took over 30 days. His took under 30 minutes.

Here was my experience:

- Financial advisor convinced me to buy

- Phone call with his admin to disclose some personal information

- Received an Encyclopedia sized application packet in the mail a few days later

- Multiple phone calls to answer questions (felt like I was reading an IKEA manual in another language)

- Walked to USPS to mail back the packet

- Scheduled medical exam (soonest available was 2 weeks out)

- Conducted the medical exam which consisted of a blood draw, urine sample, and a few blood pressure/lung listens reminiscent of an annual check-up in my apartment

- Policy approved a few weeks later

- Set up an online account & paid

That is an abbreviated version of how things actually transpired, but from end to end, I think it took like 5-6 weeks.

At the time, this was the way things were done so I didn’t realize I was proverbially standing in the rain, without an umbrella, trying to hail a cab on a crowded New York street. Little did I know that a few short years later, the insurance industry would have its Uber moment.

Enter Fluidless Underwriting…

Now take my friend’s experience. He recently had a baby and wanted to buy some life insurance.

- He hopped online

- Entered a little personal information

- Price shopped for a few minutes

- Bought a policy

That is an exaggerated version of how things actually transpired. From end to end, it took under 30 minutes.

At first blush, buzzwords like fluidless underwriting, consumer-completed applications, and instant/accelerated underwriting sound incredible. But with no medical exams whatsoever, it begs the question – couldn’t he have just…lied?

I had to submit blood, urine, and a medical exam for them to determine my health status and that’s in addition to the health records they likely pulled from 3rd party datasets. Luckily, I don’t smoke and had nothing to hide medically, but even if I did lie, the tests would have caught me.

But what if I did have something to hide?

It’s not a secret that people misrepresent, or more simply, lie when filling out insurance applications. Now enter a completely faceless interaction where it’s just the applicant and a computer screen where you know no matter what you do you’re receiving fluidless underwriting. Applicants can check quotes, go back, change information, use Google, check quotes again…you get the point.

As companies strive to improve user experiences, they’re often forced to remove friction, thereby increasing risk. The Risk vs. CX dichotomy is nothing new. And having processed over 300mm insurance applications we can tell you with certainty that far more people (and agents) than you’d guess manipulate their answers until they get the quote back that suits them.

Let’s take smoking, for example – 47% of people suffer from “smoker’s amnesia” which means they “forget” to disclose their smoking status. This is estimated to be a $4B per year problem and growing. And that’s just tobacco.

While data science & analytics teams have become increasingly sophisticated in using machine learning to assess risk, I have my doubts about the long-term viability if the only data companies are using is basic demographic data and 3rd party EMR records. Lest we forget, these InsurTech disrupters haven’t been around very long and life claims have a much longer tail than say, auto claims.

And maybe I’m wrong. I’m fully prepared to admit that. Maybe their marketing teams can actually sustain the aggressive user growth required to have new premiums outpace losses forever. And maybe, even in an increasingly crowded competitive landscape with only so many people buying life policies and a race to the bottom for pricing, the available datasets will be enough to forecast increased digital customer risk. People far smarter than me are working on the algorithms to determine the incremental risk of fluidless underwriting and the like and pricing it accordingly.

It’s just a lot of maybes, especially when you see how cheap these policies are.

Improving Accelerated Underwriting with Digital Behavioral Science

Uber, while still incredibly unprofitable, changed customer expectations forever. Amazon Prime did this with 2-day shipping. Netflix did this with streaming. It’s happening now in insurance.

Once customer expectations change, there’s no going back. So, like it or not, accelerated/fluidless underwriting is here to stay in one form or fashion. There isn’t a single company I’ve spoken to in the last 18-months that isn’t accelerating their digital transformation, adding a direct-to-consumer/consumer complete component, and trying to figure out how best to accelerate underwriting to improve the customer experience. With that, every one of them is looking for a better way to understand and predict both good and bad user intent.

That’s where companies like ForMotiv come in.

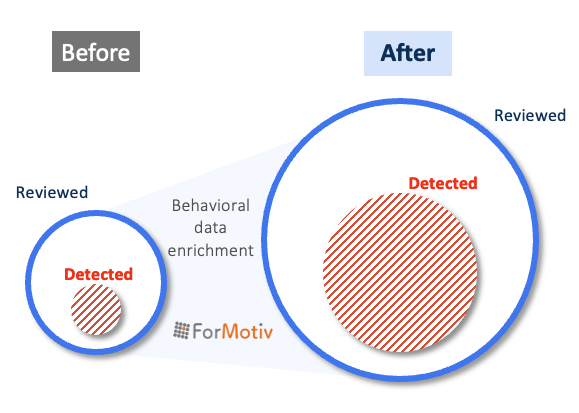

ForMotiv fills the gap between the current pre-submit marketing analytics companies and post-submit 3rd party datasets by focusing on what users do during the application.

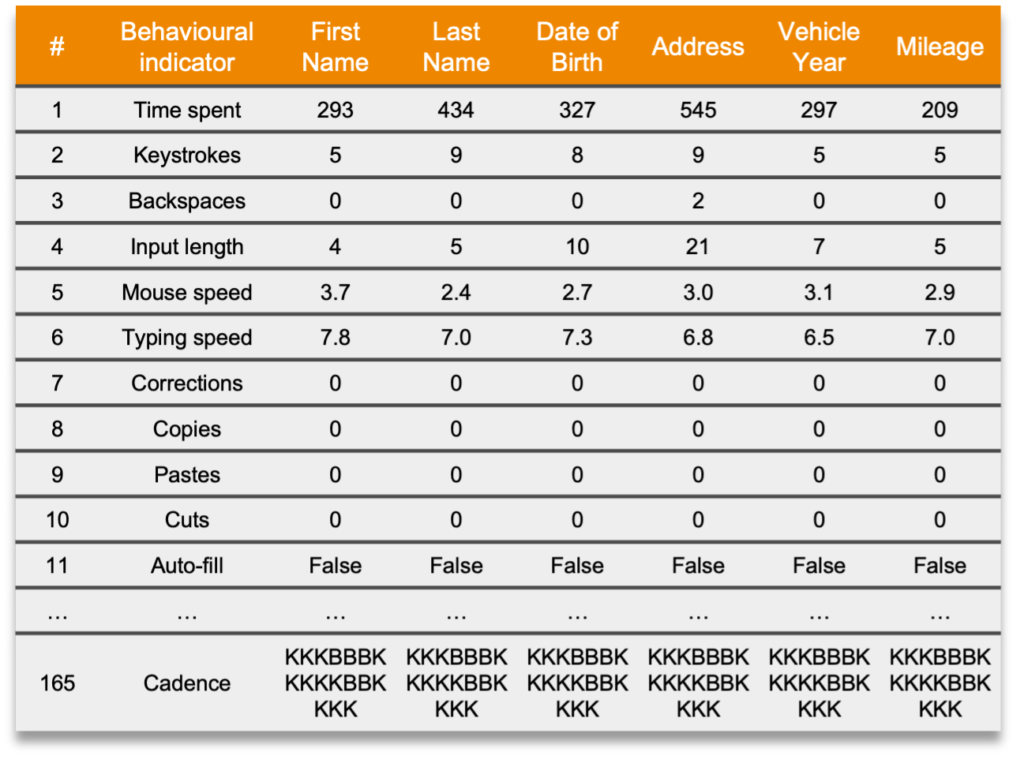

Our behavioral data science platform is purpose-built for legacy carriers and InsurTechs alike to accurately predict user intent, in real-time. ForMotiv collects unique behavioral features such as mouse movements, hesitation, copy/paste, corrections, keystrokes, time spent, and nearly 200 additional features, resulting in 10,000s of raw digital behavioral data points per application. The solution works by reading this “digital body language” and predicting, in real-time, the intent, motive, or disposition of the end-user. In addition, ForMotiv’s real-time intent engine enables carriers to identify important “micro-moments” and intuitively adapt the experience to drive more profitable conversions while triaging risky applications.

Think about the previous example of a user checking a quote, going back to edit information, and checking the quote again. With ForMotiv, carriers can set up real-time signals to alert them of this type of behavior. In addition, if a user is showing signs of confusion ForMotiv enables the carrier to dynamically react to offer contextual help or drive them to a call center. Or if a user is showing high-risk signals on the smoking or medical questions, the carrier can react by triggering a fluid test to triage the application before it is approved.

As carriers invest heavily in personalized, adaptive digital experiences, predicting user intent and knowing who to accelerate, who to further qualify, when to remove friction for a genuine customer, and when to add friction for a potentially high-risk customer misrepresenting their health questions can have a monumental impact on your loss ratio.

With life claims ranging from hundreds of thousands to millions of dollars, any incremental lift in existing risk identification capabilities, such as identifying tobacco non-disclosure, can pay huge dividends.

Improve Fluidless Underwriting Using Behavioral Intent Data

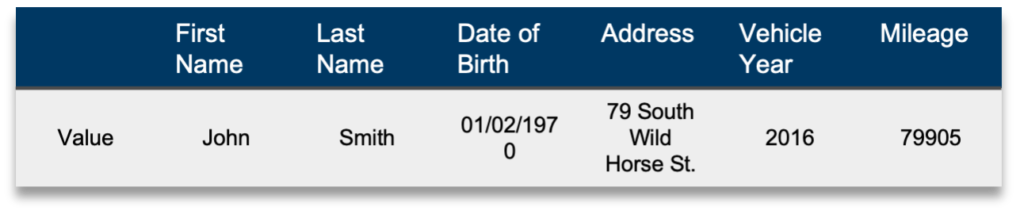

ForMotiv recently ran a test with a large life carrier who was looking to identify instances of tobacco non-disclosure undetected by their existing 3rd party datasets. The carrier has a hybrid accelerated underwriting model where they instantly underwrite some policies and send others for a medical review.

ForMotiv analyzed each user’s digital behavior and flagged applicants showing signs of high risk on the tobacco and medical questions. For every thousand applications during the pilot, ForMotiv found 2.4%-2.9% of the population were cases of tobacco non-disclosure undetectable by other 3rd party datasets, verified by fluid tests.

Even with small sample sizes, ForMotiv is able to drive significant value for their customers by expanding the scope of its triage capabilities. This carrier is now using ForMotiv’s real-time intent scoring to dynamically trigger labs on potentially high-risk applications. The carrier is already starting to test another use case of predicting medical upgrades/downgrades. And as the dataset grows, the accuracy of the models continues to improve and additional use cases will be possible.

So, is fluidless underwriting here to stay?

Like Netflix vs. Blockbuster, the winners and losers in the insurance battle will be those who have the best understanding of their users and use that intel to provide the best digital user experiences. Currently, that means removing friction but we think there’s a better way – dynamically adapting the digital experience to best fit each individual user.

We’re very curious to see what happens to fluidless underwriting in a few years when the risk are better understood. But in the meantime, we’re here to help. While a vast majority of carriers have not ditched fluid/medical tests entirely, many are heading towards a hybrid model. The challenge with this is who should be tested and who shouldn’t. They’re currently determining this mainly using demographic data such as age, gender, geography, etc. ForMotiv’s 1st party behavioral data can unlock a whole new population of applicants that should be further qualified before being underwritten.

As carriers head into 2022 and look at their accelerated underwriting processes, they need to be asking themselves if they have the right datasets to help them identify who to accelerate and who to further qualify.

To learn more about ForMotiv and how their behavioral science platform is helping leading carriers understand user behavior, predict intent, identify application friction, high-intent buyers vs. window shoppers, tobacco & medical non-disclosure, and more, email woody@formotiv.com.