AI in Insurance Underwriting | Leveraging Real-Time Data for a Competitive Edge

In recent years, the insurance industry has undergone a significant transformation, largely due to developments in artificial intelligence (AI). While Generative AI is the topic du jour, we believe that carriers will be better served to focus on solutions that are insurance-specific and purpose-built to address their current challenges. More specifically, solutions aimed at improving underwriting profitability in a trying macro environment.

How is AI in Insurance Underwriting Used Today?

Among its many applications, AI has particularly impacted the field of underwriting, enhancing risk assessment and decision-making processes. This has allowed carriers to accelerate an increasing number of Life and P&C applications, in addition to raising the face amounts of the life policies they are willing to provide instant decisions for.

It’s no secret that there is a dark side to digital underwriting in the form of increased nondisclosure, premium leakage, misrepresentation, and fraud. With that, carriers are looking for new datasets and solutions to improve their risk management.

The challenge is that there are very few unique, real-time datasets specifically designed to help insurers underwrite accurately and profitably. Yes, the use of Driving History, Claims History, Medical Records, Prescription Data, Dental Records, Credit Scores, and the like is table stakes today, but these data checks are often incomplete, incomprehensive, and costly. In addition, these types of data checks are what we describe as “veracity checks,” which attempt to determine whether or not the answers submitted by the applicant are accurate or not. Despite improvements in ease of access to these datasets, they are far from a silver bullet. The desire to identify premium leakage and nondisclosure earlier in the application and underwriting process is rising almost as quickly as the negative impact these unidentified risks are having on carriers’ bottom lines.

With that in mind, carriers are quickly adopting new solutions that take aim at the problem directly.

AI in P&C Insurance Underwriting

The primary benefit of AI in P&C insurance underwriting is risk evaluation. AI allows underwriters to harness a vast amount of data and a wider spectrum of variables to realize more accurate risk assessments.

That being said, even with advancements in AI, the P&C industry recorded a net underwriting loss for 2022 of $26.9 billion, more than six times the $3.8 billion underwriting loss in 2021. This was the highest loss in over a decade and has carriers searching for new solutions and datasets to help improve loss ratios and lower risk.

Several factors contributed to this massive loss, including inflation and rising input costs, supply chain issues and labor shortages, and natural disasters. Unfortunately, carriers cannot control inflation, nor can they control the weather, so their only recourse has been to raise prices, stop writing business in certain states, and focus on reducing risk and preventing premium leakage during the application process.

To address the last point, carriers have rapidly adopted new solutions made possible by real-time behavioral data.

Real-Time Data and Solutions Built for Premium Leakage

As we mentioned earlier, carriers are scrambling to address the rise in risk and premium leakage they’re seeing, specifically on digital applications. To elaborate on this point, here are some industry statistics:

- Application integrity (truthfulness) is down over 20% in the last decade.

- 60% of vehicles have underreported mileage.

- 10%+ of garaging addresses submitted by applicants are found to be inaccurate.

- 12% of standard policies and 15% of substandard policies are likely to have hidden drivers. 75% of discovered drivers are high-risk.

- Loss ratios are more than two times higher on policies with hidden or undisclosed drivers.

For P&C Carriers, premium leakage represented a $32 billion problem in 2022, and we expect it to grow again this year. The rise in risk and associated losses are partly attributable to carriers hyper-focusing on improving the customer experience, often removing friction so much that it had an inversely proportional impact on their risk controls. The challenge of balancing Risk vs. Experience has long plagued the insurance industry.

As an immediate stopgap, we’ve seen several leading carriers reduce, or turn off entirely, the ability for customers to purchase policies online. Realizing this is only a short-term fix, they’re quickly turning their attention to new solutions such as ForMotiv’s Premium Leakage Solution to identify risky applications from customers and agents that are showing signs of policy manipulation in real-time based on their digital behavior. This real-time underwriting solution allows them to identify risky behavior and triage the application to take the appropriate next-best action during the underwriting process.

It works by analyzing a customer’s or agent’s digital body language as they navigate through an online application and running real-time machine-learning models on this unique, first-party dataset to predict the applicant’s risk. How customers behave on high-impact premium questions such as driver disclosure, garage address, mileage, accidents, etc. during the application process can greatly impact the final quote they receive. Oftentimes, customers or agents will manipulate these questions to receive a better rate. ForMotiv identifies this and other high-risk behaviors and alerts the carrier in real-time so they can take the appropriate action.

The future of AI in P&C insurance underwriting is all about real-time data. It will allow carriers to have a much better understanding of the applicant’s intent, which will drive not only better, more personalized experiences but also help them reduce risk during the digital application process.

AI in Life Insurance Underwriting

Similar to the P&C industry, AI’s integration into life insurance underwriting is redefining how insurers assess risk, enhance accuracy, and expedite decision-making. Machine learning algorithms can analyze vast datasets with speed and precision, enabling insurers to identify patterns, correlations, and potential risks that may otherwise go unnoticed. This data-driven approach has led to a more holistic evaluation of applicants, factoring in elements beyond traditional health metrics. It’s allowing insurers to offer tailored coverage and faster processing times, thus improving the customer experience.

The adoption of AI in life insurance underwriting brings several notable advantages:

- Enhanced Risk Assessment: AI’s analytical prowess allows insurers to assess a broader array of variables, resulting in more precise risk evaluations.

- Personalization: AI-powered underwriting enables insurers to create more personalized policies that align with an applicant’s unique circumstances.

- Efficiency: Automated processes streamline the underwriting workflow, reducing administrative burdens and shortening decision times.

- Reduced Bias: By relying on data-driven insights, AI can mitigate human biases that might influence traditional underwriting practices.

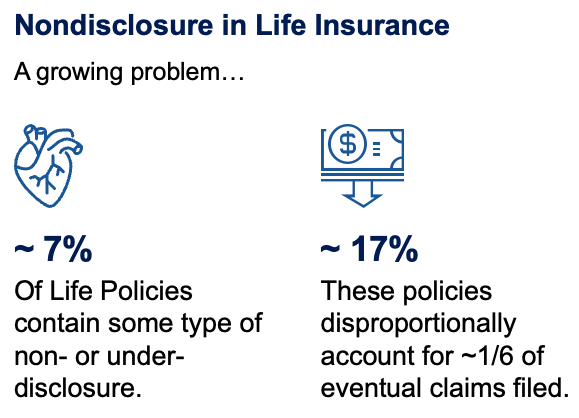

Unfortunately, Life carriers are facing similar challenges as P&C carriers in that digital application veracity is declining. It is estimated that over 7% of life insurance policies written contain some form of non- or under-disclosure. These policies account for roughly 17% of claims filed, or roughly $15 billion in claims costs per year. Here are some nondisclosure statistics to emphasize the growing importance of solving this challenge.

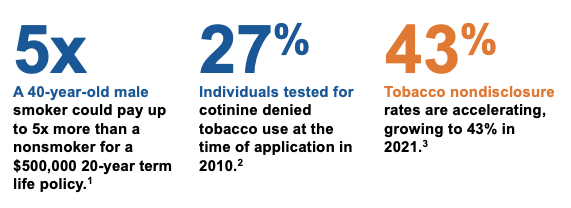

- A 40-year-old male smoker could pay up to 5x more than a non-smoker for a $500,000 20-year term life policy.

- In 2010, 27% of individuals testing positive for cotinine denied tobacco usage at the time of application. By 2021, that number had accelerated to over 43%!

- Tobacco nondisclosure alone is estimated to be a $4 billion problem and growing.

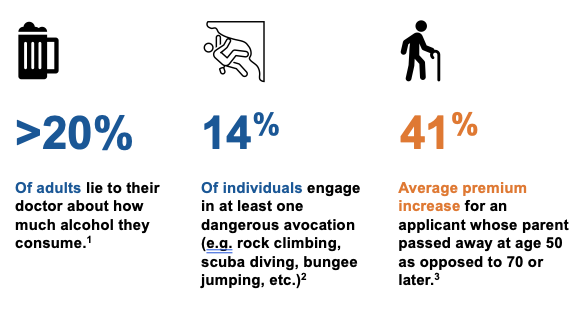

- 20% of adults lie to their doctors about how much alcohol they consume.

- 14% of individuals engage in at least one dangerous avocation.

- 18.2% of applicants fail to declare that they are obese.

- 5% of applicants understate their weight by more than 25 pounds.

- 20.7% of individuals whose BMI was greater than 30 stated normal build class during the application.

And that’s just the tip of the iceberg. Factor in family history, medical history, height, and other important underwriting questions and the incentive is there for applicants to provide whatever information they can to receive the best rate.

Real-Time Data and Solutions Built for Nondisclosure

So if you’re going to issue life policies with up to $2.5 million face amounts with fully automated underwriting, you must be confident in your ability to assess the applicant’s risk appropriately.

That said, identifying nondisclosure and misrepresentations during the application process is more important than ever. ForMotiv offers a Nondisclosure Solution that works similarly to the Premium Leakage Solution in that it identifies high-risk behaviors as applicants and agents engage with digital applications and allows carriers to drive the next-best action. With the ability to spot instances of policy manipulation in real-time, carriers can triage applications that need further investigation during the underwriting process with a significantly higher degree of accuracy than found using solely traditional methods.

Interventions could be as simple as asking additional reflexive questions, excluding an applicant from fluidless underwriting, or requiring additional data checks. Depending on the severity of the discovered risk, carriers could escalate the policy for manual review, add additional requirements like labs or medical exams, or pull out of accelerated underwriting entirely and refer it to an agent.

Combining internal risk measures, third-party data checks, and real-time behavioral data is becoming the standard for lowering risk, lowering mortality rates, and improving protective value.