First-Party Intent Data is the New Gold Rush for Insurance Carriers

Never before in history has customer’s digital data been so accessible. Where we go on the internet, what we search for, what we watch—all of our digital interactions, no matter how small, leave behind digital breadcrumbs that tell a story about our intent. With that, the largest companies in the world compete with each other to obtain this data in an effort to better understand their potential customers.

But as GDPR rules change, App Tracking Transparency (ATT) is introduced, and new risks are linked to third-party data and cookies, companies are now rushing to mine data from direct sources instead of the traditional third-party datasets they’ve been using. This has made first-party data the new battleground.

You’ve likely noticed the new “Cookie Tracking“ disclosures on many of the websites you frequent. These, along with online forms, surveys, and other customer feedback and review mechanisms, have long been the best way to acquire first-party data. Recently, however, customers are turning to a new, highly predictive form of first-party intent data—behavioral intent data gathered during the online application process.

After collecting and analyzing more than a billion insurance applications in 2022, we’re more sure than ever that first-party behavioral intent data will be a given for insurance companies in 2023 that want to understand user intent and act on it.

Key Takeaways from this Article

- The difference between first, second, and third-party data

- Why first-party intent data is more important than ever before

- The veracity of digital applications

- How leading insurance carriers are leveraging real-time behavioral intent data

First-Party, Second-Party, and Third-Party Data

First-party data is user information that your company has directly collected. This data comes from a direct source that you own, and is valuable when it comes to predicting consumer behavior. Examples include website visits, purchase history, and customer service inquiries.

Second-party data refers to data shared between two organizations with the consent of the data owner. For instance, a company might share customer information with a business partner in order to sell a product or service together.

The term “third-party data” refers to information gathered and owned by a company that is not a direct competitor of the one using the information. Typically, you buy this type of data from third-party data brokers or aggregators. It might include demographic information, purchasing behavior, and online activity.

First, Second, and Third-Party Data in Insurance

A potential customer fills out an online application for life insurance with ABC Carrier. They provide ABC Carrier with their email address, phone number, demographic data, and other private information, all of which it saves and owns. This is first-party data.

To check the veracity of the provided information, ABC Carrier has relationships with different data providers, whether that’s Motor Vehicle Records, Health Records, Claims records, etc. For instance, when you share health information with your doctor and they share it with your insurance company, that’s an example of second-party data.

In the event that the applicant first went to a comparison-shopping website to see different quotes from different carriers, ABC Carrier might purchase the applicant’s information so they can follow up with them directly. This is third-party data.

It’s important to be aware of the limits of third-party data because the insurance industry is subject to rules and restrictions, such as the Health Insurance Portability and Accountability Act (HIPAA) in the US. Additionally, some insurance companies may choose to only use first- and second-party data in order to ensure the privacy and accuracy of the information they use to make underwriting decisions.

Why is First-Party Intent Data more important than ever?

First-Party Marketing Data

After Facebook’s data-sharing scandal, Apple released stricter tracking restrictions with their iOS 14 update. Google announced its plans to move similar restrictions to its Google Chrome browser. Europe is making plans for similar reform, and whether they want to or not, we can expect other tech leaders to follow.

Based on research featured in Forbes, researchers found that “69% of consumers were concerned about how personal data is collected in mobile apps, making sure your company is forthright about how it collects and uses data.” The general public agrees that data privacy transparency is the right thing to do.

So what happens next?

According to a recent Wall Street Journal article, gathering first-party data has always been a priority, but now there is a new sense of urgency. This has forced carriers to look at the tools they already have and figure out what’s good and bad about the solutions they use now.

When it comes to available data and solutions to help understand user behavior, insurance companies, like many other organizations, use marketing technology and behavioral analytics. Here are a few ways in which they might utilize them today:

- Personalized Marketing: Using first-party customer data, insurance companies can create targeted marketing campaigns that speak to the specific needs and interests of their potential customers. For example, if a customer has shown interest in a particular type of insurance coverage, the company can create a targeted marketing campaign that highlights the benefits of that coverage.

- Customer Segmentation: Insurance companies can segment their customer base into different groups based on factors such as demographic information, purchasing behavior, and product usage. This also allows them to create more targeted and effective marketing campaigns, as they can focus their efforts on the segments that are most likely to respond to their messages.

- Predictive Analytics: Carriers use demographic data to identify potential customers who are most likely to purchase a policy. We’re seeing more and more carriers develop lead-scoring models using customer-submitted or 3rd party data.

- Customer Journey Mapping: Carriers are using behavioral analytics to map the customer journey and understand the different touchpoints that customers have with their brand. This information can be used to improve the customer experience and create more effective marketing campaigns that address the specific needs and interests of each customer.

- Website Optimization: Carriers are using behavioral analytics to optimize their websites and improve the user experience. For example, by tracking how customers interact with the site, carriers can identify areas for improvement and make changes that result in a better experience for the customer.

- Campaign Optimization: Insurance carriers are using behavioral analytics to optimize their marketing campaigns by tracking customer response and engagement. For example, by tracking the results of different marketing campaigns, carriers can identify which campaigns are most effective and make changes that result in better engagement and increased sales.

MarTech tools like Google Analytics, Session Replay, and Heatmapping, which make these strategies possible, are great for analyzing how users have behaved in the past. They were built to review individual sessions, glean insights into how users are flowing through their website, how ad campaigns are performing, and help determine new A/B tests to be performed in the future.

What they were not built for, however, is dealing at scale on a statistical and machine-learning basis. With that, there are two critical drawbacks for insurers using these tools… One, they are not built specifically for insurance, and two, they’re simply not built to help make real-time decisions, whether for underwriting, customer experience, claims, or anything else.

Again, if you want to figure out how your ads are performing, which part of your website customers are focusing on, what product pages they’re visiting, or watch how a particular customer used your product, these tools are helpful.

First-Party Underwriting Data

Carriers have limited data when it comes to underwriting. We think about it in two buckets: customer-submitted data and third-party validation data. For example, an auto insurance applicant submits that they do not have a recent claim, and the carrier runs a CLUE report to check the validity of the information. Another example would be a life insurance applicant submitting that they do not take any medication and a carrier running an Rx report to validate.

The trouble with this method is that customers are not always truthful, and the third-party datasets available are expensive and often outdated or inaccurate. So as carriers turn their focus from growth to profitability, they are searching for new tools, solutions, and datasets that can provide a more accurate picture of customer risk.

And it’s easy to understand why. The combination of rising inflation and rising interest rates has led to rising loss ratios. This, coupled with the fact that fraud is trending higher and the veracity of customer inputs, or first-party customer-submitted data, is decreasing, means carriers need a new source of truth in order to stay profitable.

Veracity of customer-submitted data in Auto Insurance

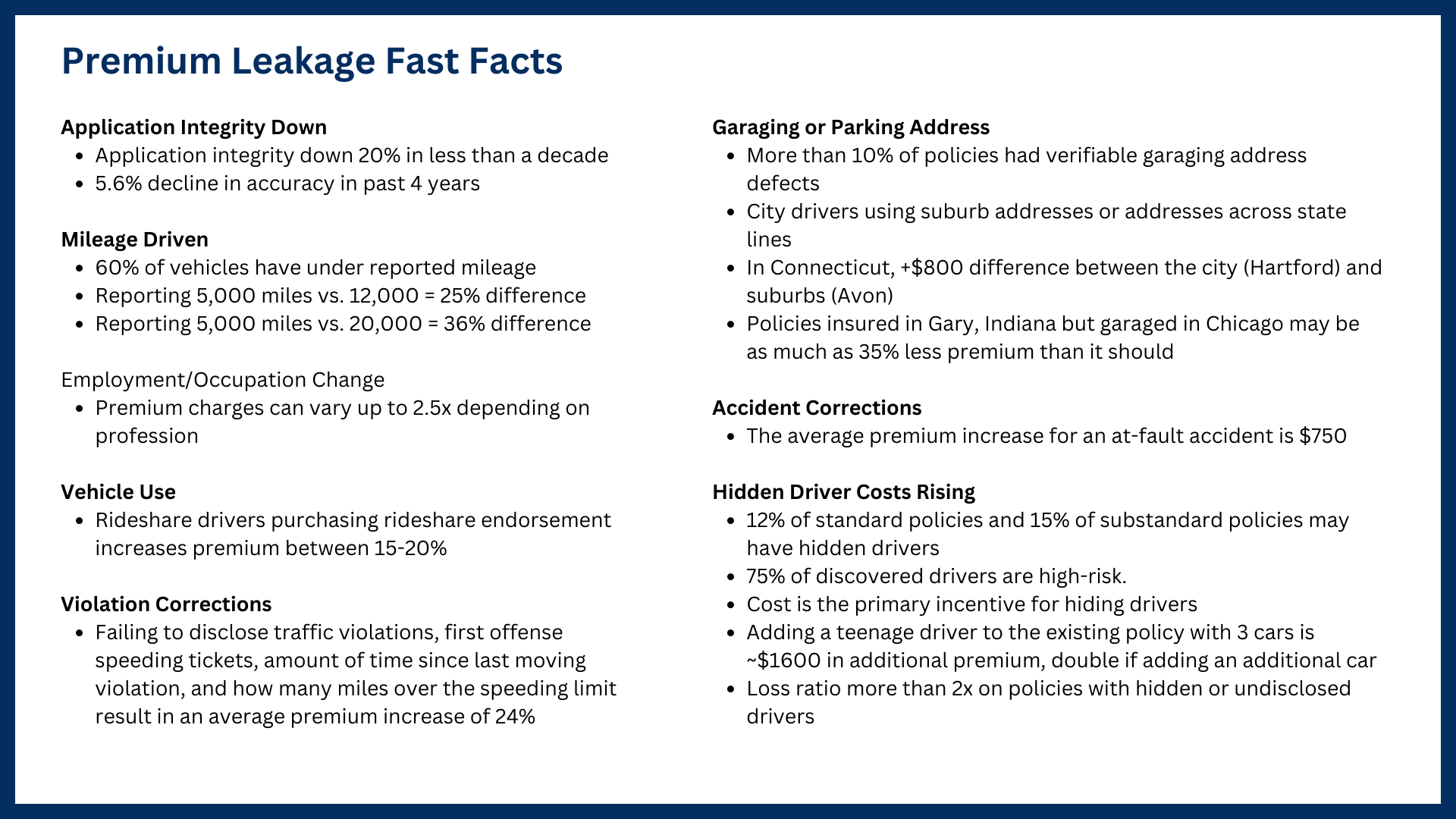

It’s no secret that applicants aren’t always truthful when they apply for auto policies. Customers often “forget” about a recent accident or rationalize that their teenage dependent doesn’t qualify to be added to the policy.

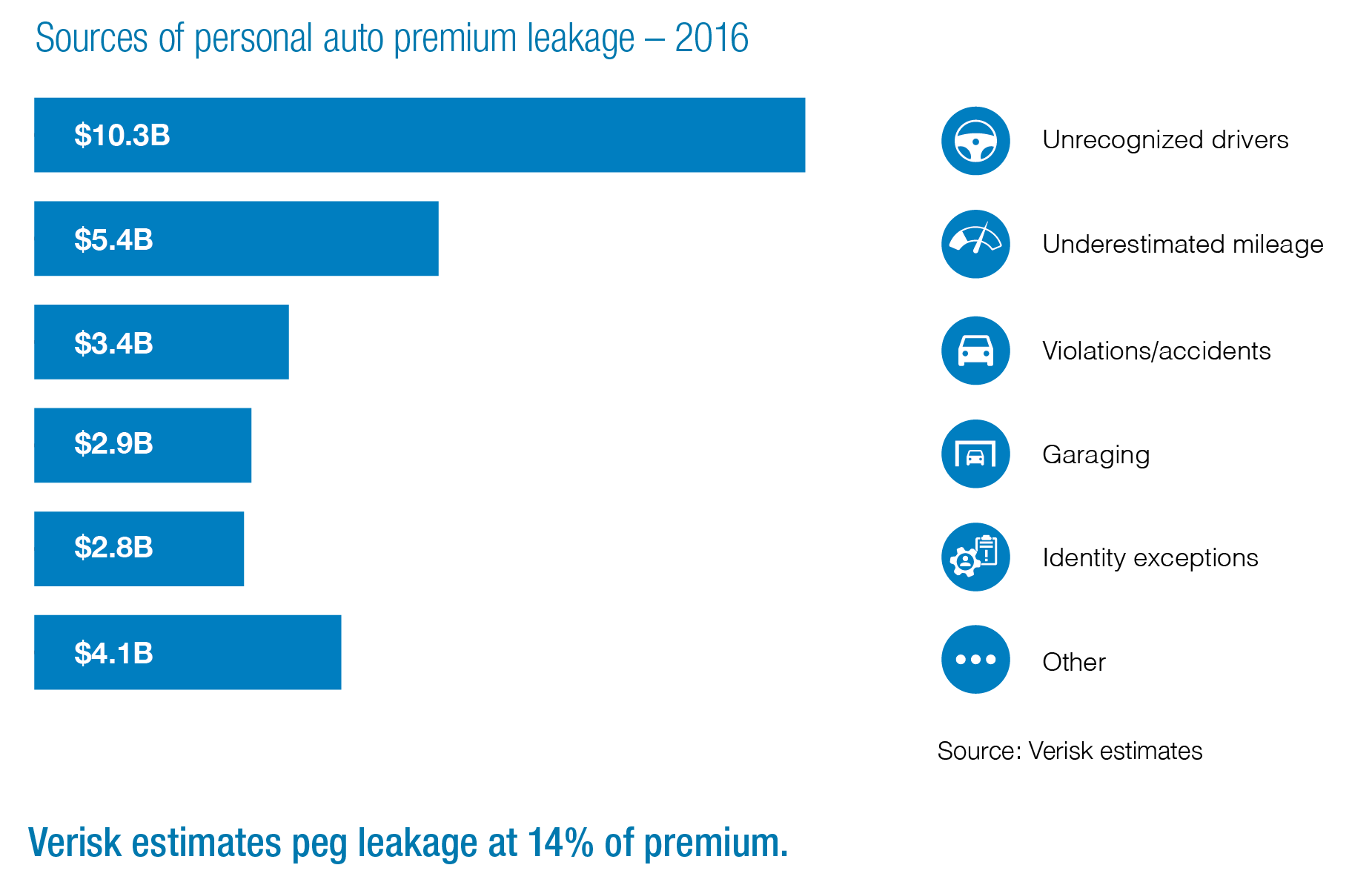

According to Verisk, application integrity for auto policies has deteriorated by over 20% in less than a decade. This includes nearly a 6% decline in the veracity of data inputs in the last four years alone. This supports another survey that said about 15% of Americans admitted to lying on their car insurance applications in 2021. And these lies add up to nearly $30 billion in premium leakage a year and growing.

Veracity of customer-submitted data in Life Insurance

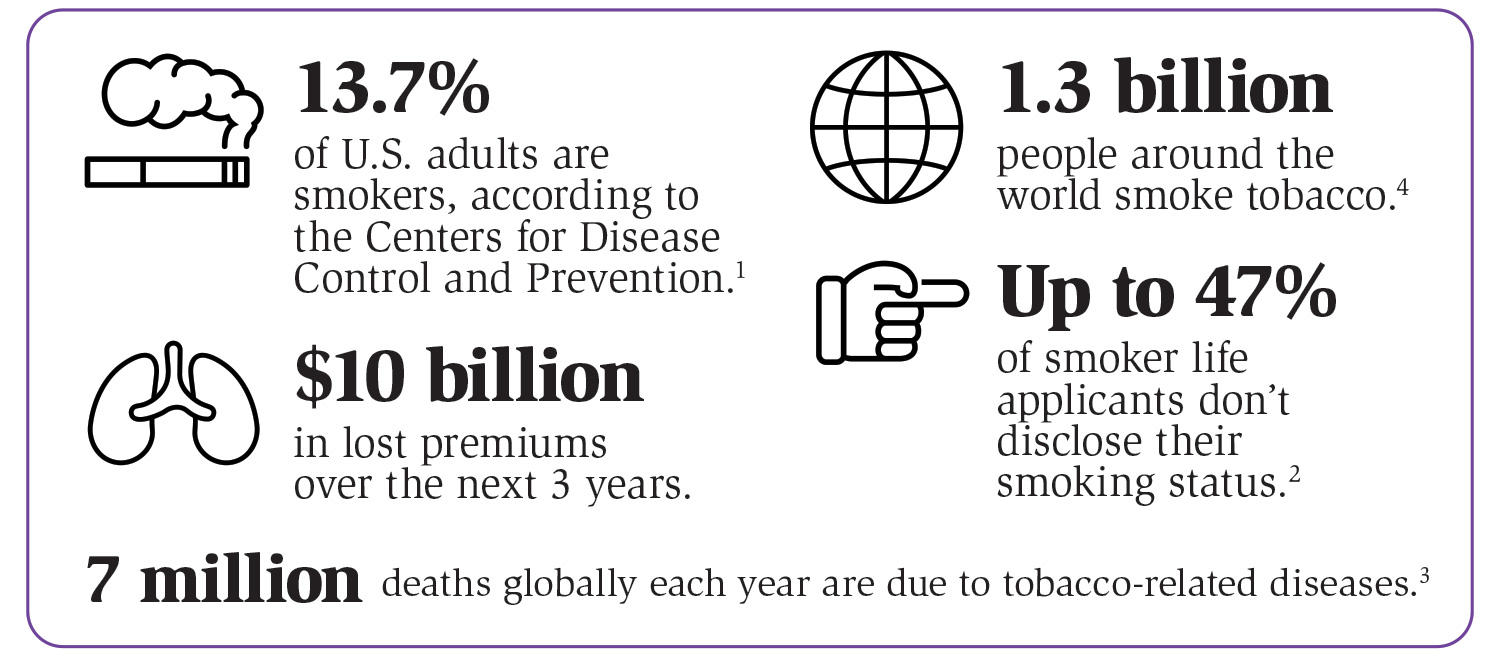

About half of the people who fill out life insurance applications online don’t tell the truth about whether or not they smoke. Insurance companies that have been around for a while and newer InsurTechs are both writing million-dollar-plus policies without medical exams today. They trust applicants to tell them the truth about their health, and they charge more for the extra risk they are taking on. But if you are a smoker and know your premium could be as much as five times higher, would you tell the truth knowing you won’t receive a medical exam either way?

But it’s not just smoking statuses they’re failing to disclose; close to 10% of all digital life applications have some form of non-disclosure in them. And while insurers frequently view non-disclosure as inevitable but marginal, the rising cost of claims is changing that perception… Non-disclosure policies now account for roughly one in six of all claims filed, and that number is increasing.

Carriers and customers both feel the effects of the negative impact on loss ratios as it forces carriers to increase rates for all policyholders to account for the increase in risk.

The Story We’re Hearing in 2023

The story we continue to hear over and over from carriers confirms that they are now focusing on profitable growth and tightening up risk controls. So, the holy grail of insurance digital experiences is figuring out how to instantly approve or accelerate underwriting for as many users as possible without increasing risk.

Traditionally, these two opposing forces have had an inversely proportional relationship. To increase digital conversions, you need to remove friction, which subsequently increases risk. Or, conversely, if you want to lower risk, you need to increase friction, which makes it harder for people to convert.

In the last month alone, we’ve seen a retrenchment at some carriers who are dramatically reducing the number of digital policies they’re issuing and, instead, are increasing the number of policies they’re manually underwriting. This two-steps-forward, two-steps-back scenario has led them to drive more traffic to agents and call center channels, increasing their customer acquisition costs and worsening the customer experience.

The challenge is that customers expect instant decisions now. Imagine if Netflix went back to mailing DVDs after launching its streaming service. Once customer expectations change, there is no going back.

Until now, the seesaw between the Risk & Fraud and Marketing & Customer Experience teams has always been a zero-sum game. What if there was a way to both increase digital conversions and reduce risk and fraud?

The answer lies in understanding and acting on user intent.

Leveraging ForMotiv’s First-Party Behavioral Intent Data in Insurance

What if you could create a perfect, seamless user experience and speed up users who deserve to be sped up while determining risky applications that show signs of misrepresentation, non-disclosure, and manipulation?

Before ForMotiv, the only data carriers had available during the underwriting process was “what” data—what an applicant or agent put on the application or what a 3rd party dataset provided.

But a critical data gap is missing, which we’ve coined “how” data.

From Face-to-Face to Faceless

The overall benefits of a digital-first approach are many, with improved customer experiences and reduced overhead among the top benefits. The drawback is that carriers are essentially providing a static, uniform experience for every user that comes to their site.

If you think back a few years, carriers and agents did most of their selling face-to-face. In that setting, the agent would provide a “dynamic” experience tailored to each individual. If an applicant was confused, frustrated, or even displaying risky behavior, the agent could read their body language, intuitively recognize the applicant’s intent or disposition, and use that to adapt the experience to the individual.

Online, there is no way to read and react to a customer’s behavior. Carriers only know what a customer submits; they don’t know how they behaved as they filled out each question. Again, the tools we talked about earlier let carriers see what users did in the past, but they are useless when it comes to reading users’ actions in real-time and, more importantly, responding to them.

How a user behaves when answering critical underwriting questions is incredibly telling of their truthfulness and intent. “Have you used tobacco in the past twelve months?” “How many drivers will be on this policy?” “Do you have any previous claims in the past 5 years?”

For effective underwriting and figuring out which policies should be looked at more closely, it is important to know how applicants answer high-impact premium questions.

So we came up with a solution to solve this: unique first-party behavioral intent data collected during the digital application process, instantly analyzed and scored for intent, and available in real-time to drive real-time decisions and next-best actions.

Behaviors like time spent on a page, keystrokes, hesitation, cognitive load, mouse speed, typing speed, cuts, copies, pastes, and around a hundred more are captured. Individually, they mean nothing, but collectively, they paint a very predictive picture of user intent.

With the introduction of ForMotiv’s unique, behavioral first-party intent data, leading carriers can now understand applicant intent in real-time and dynamically adapt the digital experience for each user.

Here are a few examples of first-party intent data in action…

Purchase Intent & Lead Scoring to Accelerate Profitable Customers

Carriers today spend an enormous amount of money acquiring customers. The challenge is that they don’t know much, if anything, about the purchase intent of these applicants. There is a huge customer acquisition cost associated with applicants who never end up purchasing a policy. Marketers spend countless dollars retargeting them, agents spend time and energy calling them, underwriters spend enormous sums of money running third-party data checks on them, and it’s all for naught. They were never going to buy a policy in the first place.

How nice would it be if you knew that before you spent all that time and money on them? Imagine if you were an agent or marketer and you could know, in real-time, that an applicant is 3.3 times more likely to purchase a policy than your average user. Or, maybe, more importantly, 4.7 times less likely. I imagine you would treat these users differently, both in the moment and when you’re retargeting them. Think about the productivity gains, acquisition cost improvements, and prioritization optimization you could realize with this type of intelligence.

ForMotiv customers are leveraging real-time purchase intent scores to dramatically improve bind and placement rates, lower CAC, and create better user experiences.

Eliminate Bad Risks to Improve Loss Ratios

Customers and agents alike will often manipulate policies to try to receive the best possible rate. As mentioned above, roughly $30B is lost every year to premium leakage in auto insurance.

Life Insurance is similarly impacted. And given the face amounts and claims payouts are significantly larger, the costs are equally as troublesome.

Leveraging learnings from over a billion applications analyzed, ForMotiv’s Risk Solution actively determines when suspicious and/or risky behavior is happening in real-time, allowing carriers to dynamically triage those applications during the underwriting process. Adding “dynamic friction” during the application process reduces overall risk and improves loss ratios.

Bottom line, policy manipulation is a persistent, costly, and growing problem. No longer can carriers afford to sacrifice risk for growth. To adjust to this new reality, they need new data. Real-time behavioral intent data from ForMotiv is unique in its ability to solve this two-sided equation. Understanding the intent of digital applicants, in real-time, and dynamically adapting the experience to those users is their best bet to accomplish their goal of profitable growth.

Interested in learning more about ForMotiv’s first-party intent data? Schedule a demo.