“2026 is the Year of Enterprise Intent”

Dear Customers, Partners, and Friends, As we reflect on 2025, I would like to begin with a simple thank you. The trust you place in ForMotiv, the feedback you provide, and the standards you hold us to are what drive us forward. Each year, we try to step back and look at the broader insurance […]

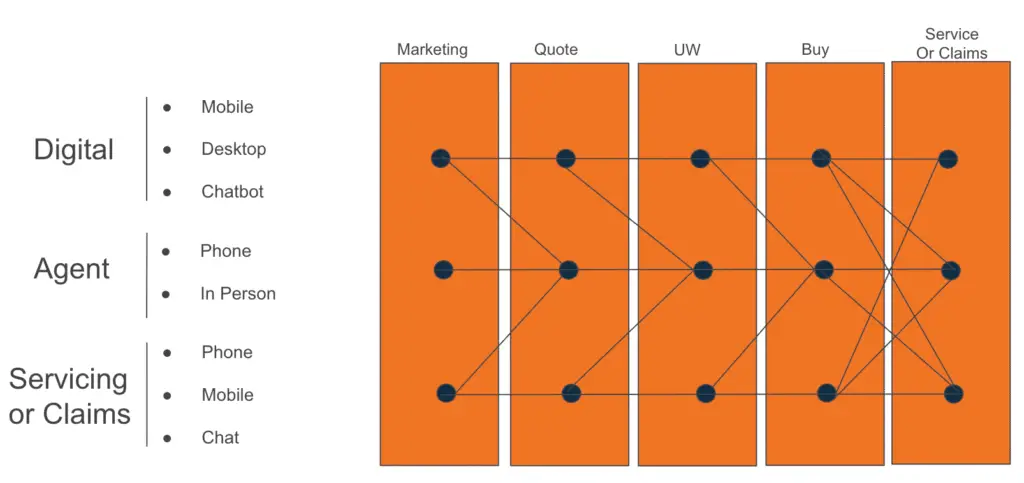

From Quote to Claim: Why Carriers Need “Enterprise Intent”

ForMotiv Introduces “Enterprise Intent Solution” One Behavioral Truth for the End-to-End Insurance Journey With nearly ten years of experience working closely with leading insurance carriers, one theme has come up over and over: their user data is highly fragmented. Digital may use session replay to improve the user experience. Applicants may submit one version of […]

A Word From Our Chief Customer Officer: Why Carriers Are Doubling Down on ForMotiv’s Agent Intelligence Data

Carriers Are Using ForMotiv’s Behavioral Intelligence to Transform Agent Performance and Risk Detection When we started ForMotiv eight years ago, nearly every conversation with our carrier partners centered around direct-to-consumer digital transformation. It made sense — at the time, carriers were laser-focused on better understanding digital behavior during online quoting flows to drive smarter underwriting, […]

ForMotiv & Clearspeed Webinar

Webinar Recap: Transforming Risk Detection with Behavioral and Voice Intelligence The insurance industry is undergoing rapid change. From shifting customer demographics to escalating fraud tactics, carriers are being challenged like never before to protect profitability while delivering seamless digital experiences. To thrive in this new landscape, insurers need more than incremental improvements. They need tools […]

Calculating The Hidden Risks Driving Auto Premium Leakage

In personal auto insurance, it’s no secret that the riskiest 10% of policyholders can account for a disproportionate share of losses, often with loss ratios exceeding 200% or even 300%. While some of this is expected in a skewed risk distribution, a significant portion stems from undisclosed risk factors that aren’t properly priced into premiums, […]

Insurance Agent Analytics for Distribution & Digital Experience Teams

ForMotiv Insurance Agent Analytics for Distribution & Digital Experience Teams In Part 1 and Part 2 of our series, we explored how Underwriting, Risk, and SIU teams use ForMotiv Agent to detect gaming, misrepresentation, and fraud. Today, we’re highlighting how our insurance agent analytics are being used by Distribution, Agent Management, and Digital Agent Experience (AX) teams […]