Insurance Customer Experiences: Solving the Risk vs. Security Equation for Life and P&C Carriers

Insurance customer experiences are moving online. With that, nearly every Life and P&C carrier we speak with is focused on providing a better digital experience and increasing the percentage of policies they sell online. The challenge they’re facing, however, is controlling the ensuing rise in risk on their online distribution channels. The more they sell online, the higher their risk exposure. This is putting their digital growth strategies in jeopardy as they grapple with this unintended consequence.

In fact, in the past few years, we’ve seen several top carriers launch digital buying capabilities, only to pull them back off the shelf until they figure out how to adequately deal with the associated risk. In some cases, an applicant can get all the way through a quote flow, but at the very last step, they get kicked over to an agent.

For customers, this experience is roughly akin to signing up for Netflix, picking a show to stream, only to be told you need to wait for a DVD to arrive in the mail, all because they couldn’t figure out how to stop password sharing.

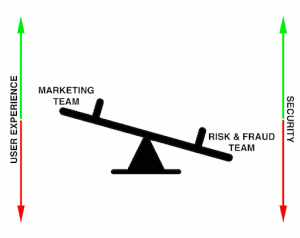

One of the issues causing this problem is that Risk teams and CX teams have misaligned goals. The solution to improving insurance customer experiences and selling more digital policies is to reduce friction, which increases risk. The solution to reducing risk is to add friction, which worsens the customer experience and reduces the number of policies sold. The inverse relationship forces carriers to choose one side of the equation at a time. In 2020-2021, they took a grow-at-all-cost approach and put risk control on the back burner. In 2022-2023, the pendulum has swung aggressively in the other direction as they slowed growth and looked to tighten up their risk measures.

As the Life and P&C industry continues to invest tens or hundreds of millions of dollars into digital experiences and distribution, figuring out how to solve both sides of the equation and underwrite digital policies profitably is paramount.

The Challenge in P&C Insurance

While the benefits of digital distribution are obvious—i.e., quicker policies for applicants, streamlined insurance customer experiences, and cost savings for both customers and carriers alike—the increase in risk/fraud was vastly underestimated. This is true for both InsurTechs and legacy carriers alike. Take the auto industry, for example. In 2022, the net combined ratio for the sector was 111.8.

This was due to a combination of factors, including higher inflation, interest rate hikes, labor shortages, supply chain issues leading to higher claims costs, and parts shortages, just to name a few.

Given that they can’t control any of the aforementioned factors, carriers have been aggressively filing for premium rate hikes to try to mitigate their losses. In addition, they’re focusing on one factor that wasn’t discussed as much in the media but has been brought up to us over and over as a major concern: premium leakage.

Premium leakage is a $36 billion problem, and it’s getting worse. In fact, application integrity (truthfulness) has dropped by over 20% in the last decade. Unfortunately, the data says that people are more likely to lie or manipulate their applications when they’re done online.

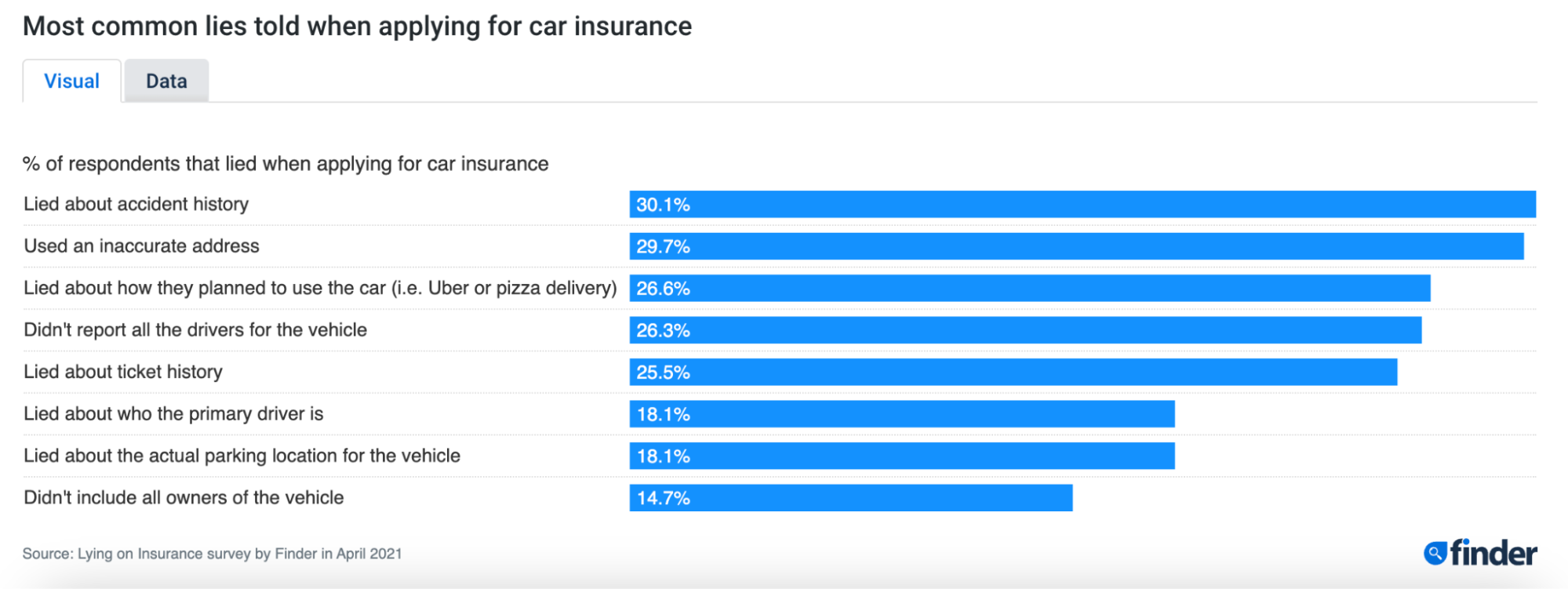

Here are some statistics from Finder to illustrate the issue:

Companies like LexisNexis and Verisk do a wonderful job of mitigating risk and providing verification solutions to discover a lot of the above, but unfortunately, there are no silver bullets when looking to solve premium leakage.

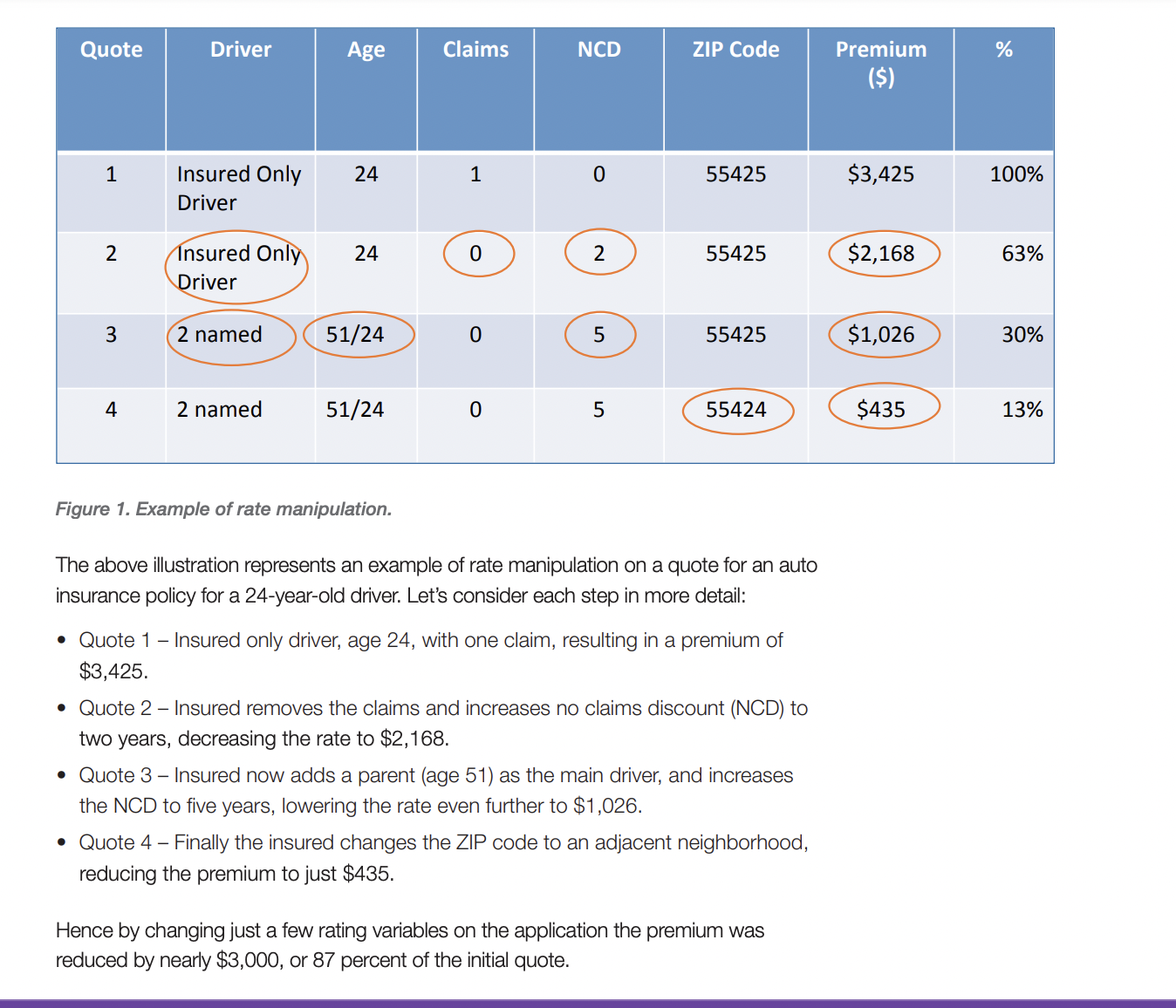

As we mentioned above, malicious behavior on important underwriting questions like driver or vehicle disclosure, mileage, garaging address, and prior accidents can have huge impacts on the quoted premium.

Take the following example from SAS:

Needless to say, there is a compelling financial incentive to be less than truthful during the application process.

The Challenge in Life Insurance

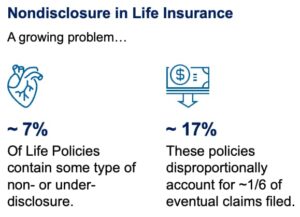

Life carriers are facing similar challenges. As they migrate towards accelerated underwriting, e-med interviews, fluidless and instant decision-making, they are confronted with the unfortunate reality that applicants are not always honest.

Given the magnitude of a Life claim payout, which can be millions of dollars, not to mention the mispriced premium losses, the cost of getting underwriting questions such as smoking, alcohol, and medical history wrong can be significantly higher than that of an auto policy.

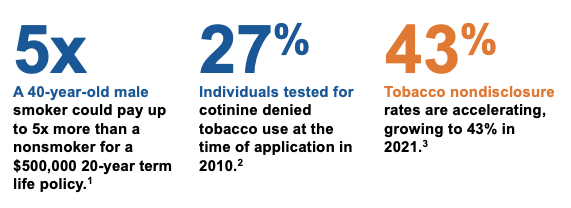

Tobacco nondisclosure alone is estimated to be a multi-billion-dollar problem and growing.

- A 40-year-old male smoker could pay up to 5x more than a non-smoker for a $500,000 20-year term life policy.

- In 2010, 27% of individuals testing positive for cotinine denied tobacco usage at the time of application. By 2021, that number had accelerated to over 43%!

So, again, the question carriers are asking themselves is, “How do we provide a seamless digital experience without increasing risk?”

The answer ultimately lies in understanding the intent of the individual applying for a policy.

Solving the Insurance Customer Experience x Risk Equation with Dynamic Intervention

For carriers to provide the real-time underwriting experience they desire, they need to be able to determine the intent of the person applying for the policy. The answer isn’t to add friction to everyone, i.e., forcing everyone to call an agent or call center once they receive an auto quote. Or require everyone to receive a fluid panel once they receive a life quote.

If you have a highly motivated, genuine, low-risk buyer applying for a policy, why provide them with the same experience as a low-intent shopper or a highly risky shopper?

Figuring out which applicants deserve more friction and which do not is the missing piece in the puzzle.

ForMotiv has developed a way for carriers to solve the risk x customer experience equation by creating dynamic digital experiences that adapt to the end-user and drive the appropriate next-best action on an individual basis.

As users engage with an application, ForMotiv passively collects and analyzes the user’s digital body language, which consists of hundreds of unique behavioral signals, to understand the intent of the applicant. We measure unique parameters like hesitation, typing speed, mouse movements, corrections, advanced keyboard shortcuts, and hundreds of other behaviors as an applicant navigates through a digital application to predict their purchase intent and risk level in real-time.

For instance, we have out-of-the-box solutions for Premium Leakage and Nondisclosure that alert carriers in real-time to which applicants require further investigation based on how they behave during the application process. This allows for proactive treatment of the application before it is fully underwritten. Carriers can apply different levels of friction to the applicant, such as automatically triggering additional data checks, asking additional clarifying questions, or even passing them over for manual review.

These are just a few of the many ways leading carriers are leveraging real-time intent scoring to drive personalized insurance customer experiences, increase sales, and lower their risk exposure with ForMotiv’s Solutions.