ForMotiv Introduces “Enterprise Intent Solution”

One Behavioral Truth for the End-to-End Insurance Journey

With nearly ten years of experience working closely with leading insurance carriers, one theme has come up over and over: their user data is highly fragmented.

- Digital may use session replay to improve the user experience.

- Applicants may submit one version of an application, while agents may hear a different version.

- Underwriting reviews the final answers an applicant or agent submits.

- Endorsements and policy changes after a bind are siloed.

- Claims and SIU see the loss with little to no prior context.

No one sees the full behavioral story. And that gap is expensive.

- Misrepresentation slips through.

- Premium leakage goes undetected.

- Good customers abandon unnecessarily.

- Claims teams investigate without pre-bind context.

To date, carriers have relied on customer journey data available from web analytics tools, such as Google Analytics or Adobe Analytics, or different solutions for session recording and heatmaps. However, these tools show what happened, not why.

ForMotiv’s Enterprise Intent solution closes that gap.

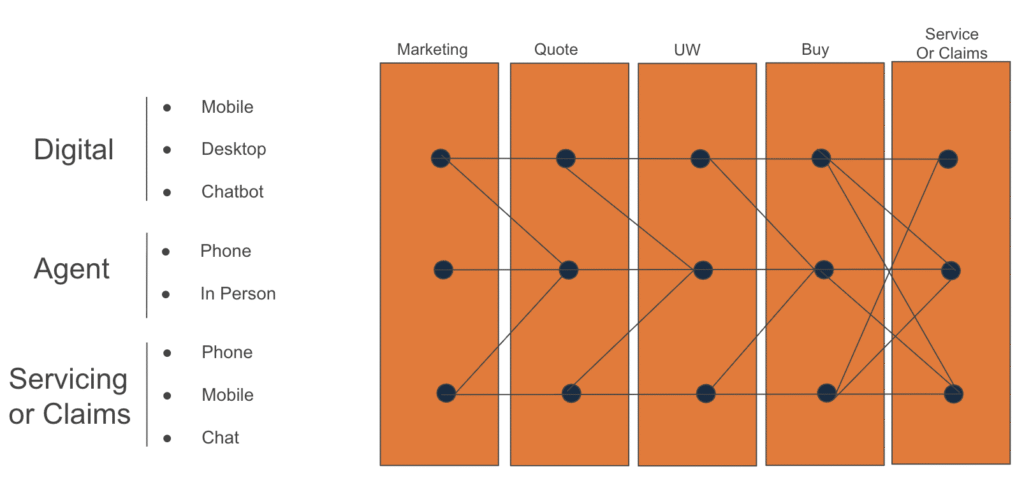

It connects behavioral intelligence across Direct, Agent, Call Center, Endorsements, Claims, and beyond — giving carriers one unified view of how a customer actually navigates the lifecycle of a policy.

The Core Problem: User Journeys Are Not Linear

Simply put, insurance customers do not move neatly from quote to bind to claim.

They:

- Start online

- Call with questions

- Speak to an agent

- Edit answers

- Modify policies post-bind

- File claims weeks later

Earlier this year, we discussed our Agent Intelligence Solution, which is only one chapter in the user story. The problem is that these journeys currently all live in silos, with each channel seeing only a slice of the story. Direct, agent, call center, claims, and endorsements each see part of the journey but don’t easily talk to each other, which makes it very challenging to assess underwriting risk, detect fraud, and improve experiences across the various distribution channels. To give the full picture of a user journey, carriers need the ability to understand all of the disparate interactions that occur.

Again, traditional analytics tools show what happened in a single session. They do not explain intent. They do not connect behavior across channels. They do not link pre-bind signals to post-bind outcomes.

As a result, carriers are forced to:

- Rely on static form answers submitted by customers

- Increase third-party data spend to compensate

- Conduct random audits instead of targeted reviews

- Investigate claims without understanding the original application behavior

Enterprise Intent changes that.

What ForMotiv’s “Enterprise Intent Solution” Actually Delivers

Powered by ForMotiv’s proprietary Behavioral Intelligence dataset, Enterprise Intent stitches together user behavior across every touchpoint into a single, real-time behavioral timeline.

This is not session replay. It is not web analytics. It is cross-channel intent intelligence. And the value is measurable.

The Business Impact

1. Increase Conversion Without Increasing Risk

Predict purchase intent in real time across channels.

Identify:

- High-intent applicants at risk of abandoning

- Low-intent traffic where third-party spend can be reduced

- Channel preference signals to route customers to the highest-conversion path

Result:

Higher bind rates. Smarter spend allocation. No added risk exposure.

2. Reduce Premium Leakage and Misrepresentation

Detect cross-channel manipulation patterns before or after policies bind.

Surface:

- Answer changes across sessions

- Quote shopping behavior

- Risk edits between direct and agent channels

- Suspicious post-bind endorsements

Result:

Lower leakage. Tighter underwriting precision. Improved loss ratio.

3. Connect Pre-Bind Behavior to Claims Outcomes

Provide claims and SIU teams with full behavioral context from quote through bind.

Instead of reconstructing the story after a loss, investigators see:

- Original hesitation patterns

- Multiple quote attempts

- Answer changes

- Channel hopping

- Post-bind policy edits

Result:

Faster investigations. Higher hit rates. Fewer surprises at claim time.

4. Eliminate Channel Blind Spots

Understand how one customer interacts across direct, agent, and call center environments.

Prevent:

- Duplicate quotes

- Redundant outreach

- Channel conflicts

- Disconnected servicing

Result:

Improved operational efficiency and better customer experience.

5. Feed Behavioral Context Into Core Systems

Enterprise Intent integrates behavioral signals directly into underwriting, claims, CRM, and analytics systems, all without collecting or storing personally identifiable information.

Result:

Enterprise-level intelligence, not just dashboard insights.

What Happens Without Enterprise Intent?

- Underwriting sees only final form answers

- Digital cannot see agent context

- Claims lack pre-bind insights

- SIU reconstructs timelines manually

- Carriers overspend on third-party data

- Premium leakage and fraud hide across channels

Fragmentation creates margin erosion.

What Changes With Enterprise Intent?

Underwriting, distribution, servicing, and claims operate from the same behavioral truth.

Carriers can:

- Make smarter underwriting decisions

- Accelerate good risks

- Flag risky edits in real time

- Route customers to optimal channels

- Investigate with full lifecycle visibility

This is not about better dashboards. It is about protecting margin while enabling growth.

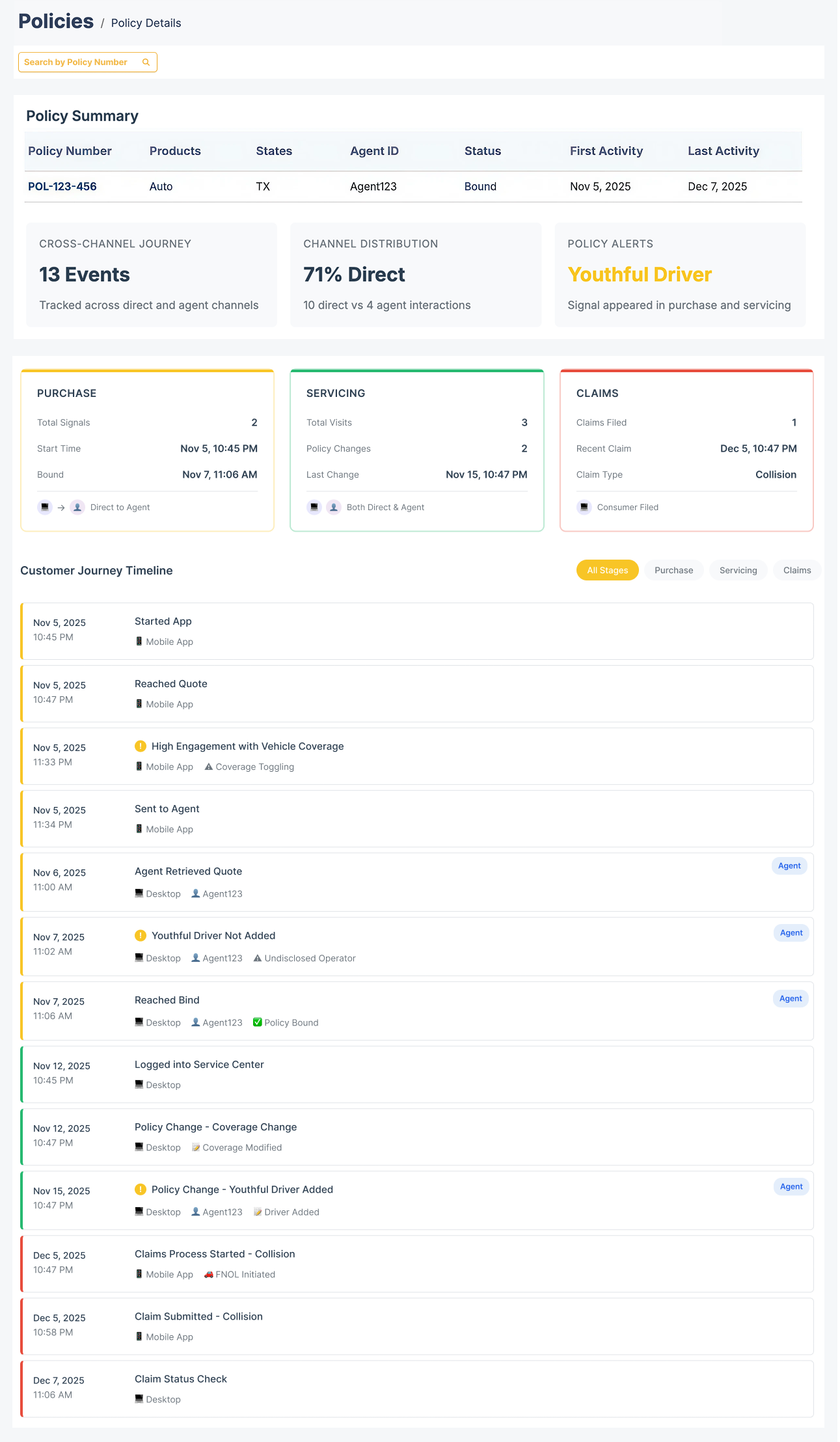

Real-World Journey Example

Scenario: Ad > Online > Agent > Call Center > Claim

- A customer sees a mobile ad and begins a quote online.

- They manipulate inputs to generate multiple quotes.

- An agent follows up and adjusts answers before binding.

- Two weeks later, the customer calls to add a driver.

- Days later, they file a claim.

Without Enterprise Intent:

- Each department sees only its fragment of the customer interaction.

- The behavioral pattern is invisible.

With Enterprise Intent:

- The full timeline is connected.

- Pre-bind manipulation is visible at every stage of the journey, including claim.

- Risk evolution is clear.

- Investigations become informed, not reactive.

That difference is financial.

Why Enterprise Intent Matters Now

As distribution expands and digital complexity increases, fragmentation increases risk.

Carriers cannot rely on isolated session data, static form responses, or disconnected channel analytics.

Enterprise Intent provides:

- One behavioral timeline

- One source of truth

- Real-time cross-channel insight

- Actionable intelligence at every stage

The result is:

- Tighter underwriting

- Lower premium leakage

- Faster decisions for good customers

- Reduced downstream volatility

Enterprise Intent turns fragmented journeys into a single source of behavioral truth. With ForMotiv, carriers see what applicants did, why they did it, and what they will likely do next. The result is tighter underwriting, less premium leakage, faster decisions for good customers, and fewer surprises at claim time. Connect your channels, elevate your signals, and turn intent into impact.

Ready to See It in Action?

Connect your channels. Unify your signals. Turn intent into impact.