“Monetization”: The New Way P&C Carriers Are Driving Profits

For decades, insurance carriers have made money in two primary ways—growing premiums and investing their float. The first involves spending a fortune on customer acquisition, especially as customers shop more than ever. Super Bowl ads don’t come cheap, nor do brand mascots like talking lizards and friendly neighborhood agents.

But competition for customer attention isn’t just playing out on TV. Insurance-related searches are among the most lucrative for Google, where carriers bid aggressively to win new policyholders. There were 317 million auto insurance searches last year, and carriers paid roughly $50 per click. Lucrative indeed.

To add insult to injury, after spending gobs of money getting potential customers to your website, more often than not, you have to watch as they go to a competitor. If only there were a way to recoup some of that acquisition spend. After all, you did all the hard work, so why should Google get all the profit?

With that in mind, carriers have discovered a third and increasingly important revenue stream: monetization of their applicants.

How are carriers monetizing their traffic?

Even the best-run insurance companies see a significant portion of their website traffic leave without converting. Sometimes, applicants simply window shop or want to check a few quotes before purchasing. Other times, an applicant might fill out a form only to be told they are ineligible, or the carrier doesn’t provide coverage in their state. That’s time wasted for the applicant and money wasted for the carrier. But what if there was a way to capitalize on this coveted, high-intent traffic you worked so hard to get AND provide a solution to your applicant?

This is exactly what leading carriers are doing today. Instead of rationalizing abandonment as a sunk cost, carriers are taking a page from Google’s playbook and getting paid for clicks that drive leads to other carriers. Monetization through click listings is quickly becoming a powerful profit generator for carriers of all shapes and sizes. Unlike policy sales, which come with claims and loss adjustment expenses, monetization revenue is pure profit—carriers get paid upfront.

To monetize or not—that is the question.

Getting paid for traffic you can’t write business for is the obvious low-hanging fruit. We’ve heard of carriers selling ads for anywhere from $20 to $200, which can make a huge dent in recouping your acquisition cost.

But what about your eligible traffic? You shouldn’t show them ads because you don’t want to compete against yourself, right? Wrong. That’s where ForMotiv comes in.

The key to effective monetization is understanding who is actually going to bind and who isn’t. Unlike traditional analytics, which rely on historical conversion data, ForMotiv’s Monetization Solution captures and analyzes real-time digital body language—subtle behaviors like keystroke patterns and form interactions—and predicts an applicant’s buying intent during the application flow. This allows insurers to make instant, data-driven decisions about whether to optimize for conversion or drive toward monetization, ensuring they maximize the value of every customer interaction.

Your applicants are shopping around, regardless of whether you show them ads or not, so you may as well help them and make some money in the process. On average, customers get 3 to 4 quotes before making a purchase. What we see happen quite often is that an applicant will get a quote, click and ads to a competitor site, receive another quote, and then come back and purchase from the original carrier. In that, the initial carrier wins twice.

By intelligently monetizing your shoppers, you can turn application abandons into pure profit—without compromising your core business.

Why a Real-Time Conversion Model is Critical

Many carriers hesitate to display offers to eligible site visitors for fear of cannibalizing policy sales. However, with a real-time conversion model, carriers can ensure they are monetizing only those users who are unlikely to convert while keeping high-intent customers engaged.

ForMotiv runs a real-time predictive model to identify segments in your application population that are significantly more or less likely to purchase and enables you to change the user experience (in this case, show ads) to the lowest intent population. Already have a conversion score? Ensemble ForMotiv’s proprietary Behavioral Data and/or Conversion Score with your internal model for an accuracy boost.

This approach has several advantages:

- No Lengthy Test-and-Learn Period: Traditional predictive models often require months, sometimes years, worth of data and lengthy refinement periods. ForMotiv’s models can be production-ready in just a few weeks post-integration, enabling carriers to act quickly on their insights.

- Dynamic Decision-Making: Since ForMotiv’s models operate in real-time, they can continuously refine which users should receive a monetization experience versus a conversion-focused experience.

Intelligent Monetization Strategies

With ForMotiv, carriers can implement a gradient approach to user experience, ensuring that each visitor receives the most profitable engagement:

- High-Likelihood Binders: These users see a seamless, ad-free experience designed to drive conversion.

- Moderate-Likelihood Binders: These users may see a blended experience with soft monetization elements.

- Unlikely Binders: These users are presented with high-value monetization offers while still being given a path to convert if they choose.

Factoring in Risk: Not All High-Intent Leads Are Created Equal

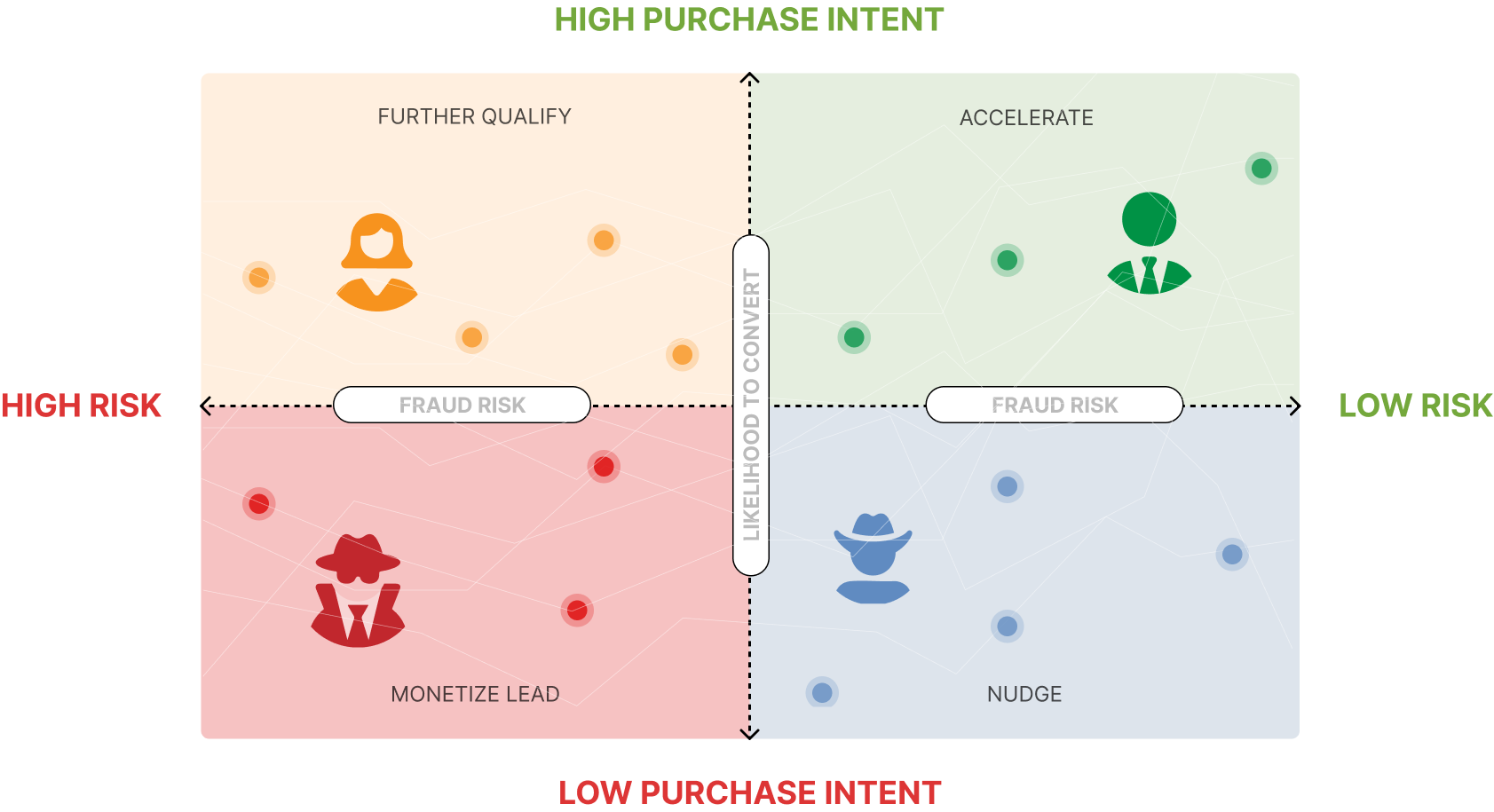

At ForMotiv, we believe that the holy grail of digital experiences is at the intersection of customer experience and risk.

It’s not just about predicting who will bind—it’s equally important to understand the applicant’s risk. If you only look at one variable, you’re missing half the story. Take a high-intent shopper, for example. Are they high-intent because they bought a car that day or because they got in an accident that morning and don’t have proper coverage?

Our solutions don’t just assess who is likely to buy but also who presents an unwanted risk to the business. Allowing carriers to intervene in these hyper-targeted application populations ensures that even high-intent but high-risk applicants are monetized effectively, creating a win-win scenario where carriers maximize revenue while mitigating exposure to poor-performing policies.

Conclusion

In today’s competitive insurance landscape, monetization is no longer an afterthought—it’s a core profit strategy. With ForMotiv’s real-time Monetization Solution, carriers can:

- Identify low-intent users and monetize them instantly

- Deploy production-ready models within weeks, not months

- Work with your internal models for increased predictive accuracy

- Optimize user experience dynamically to drive maximum revenue

- Factor in risk to ensure monetization strategies align with underwriting goals

By making every visitor interaction profitable, carriers can reduce marketing costs, increase profitability, and scale customer acquisition efficiently. The future of insurance profitability isn’t just about selling more policies—it’s about making every interaction count.

Interested in learning more or seeing how it works live? Schedule some time to speak with us.