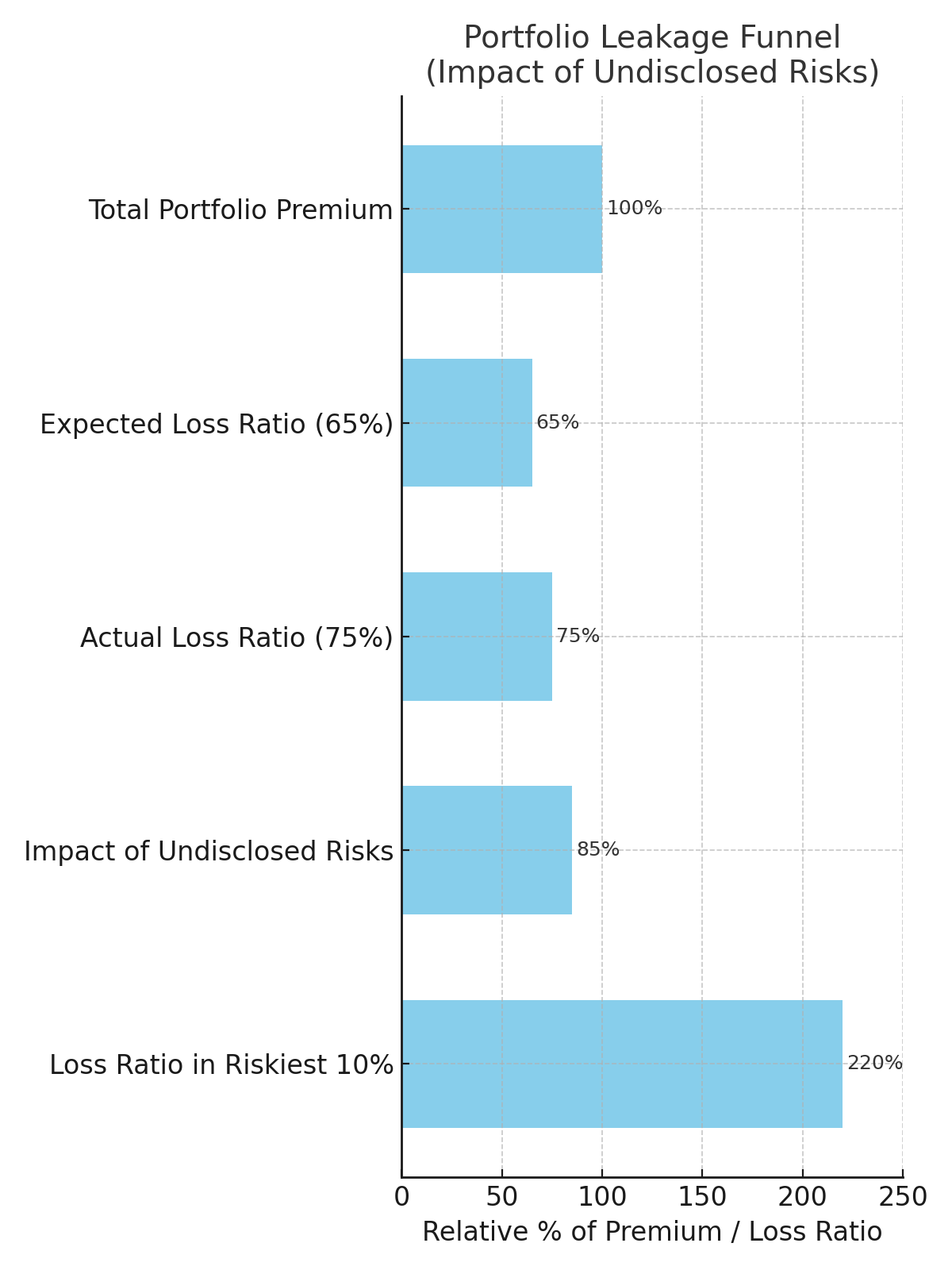

In personal auto insurance, it’s no secret that the riskiest 10% of policyholders can account for a disproportionate share of losses, often with loss ratios exceeding 200% or even 300%. While some of this is expected in a skewed risk distribution, a significant portion stems from undisclosed risk factors that aren’t properly priced into premiums, and this auto premium leakage is slowly draining profits.

These hidden risks, whether intentional misrepresentations or simply omitted facts, quietly erode profitability and drive premium leakage.

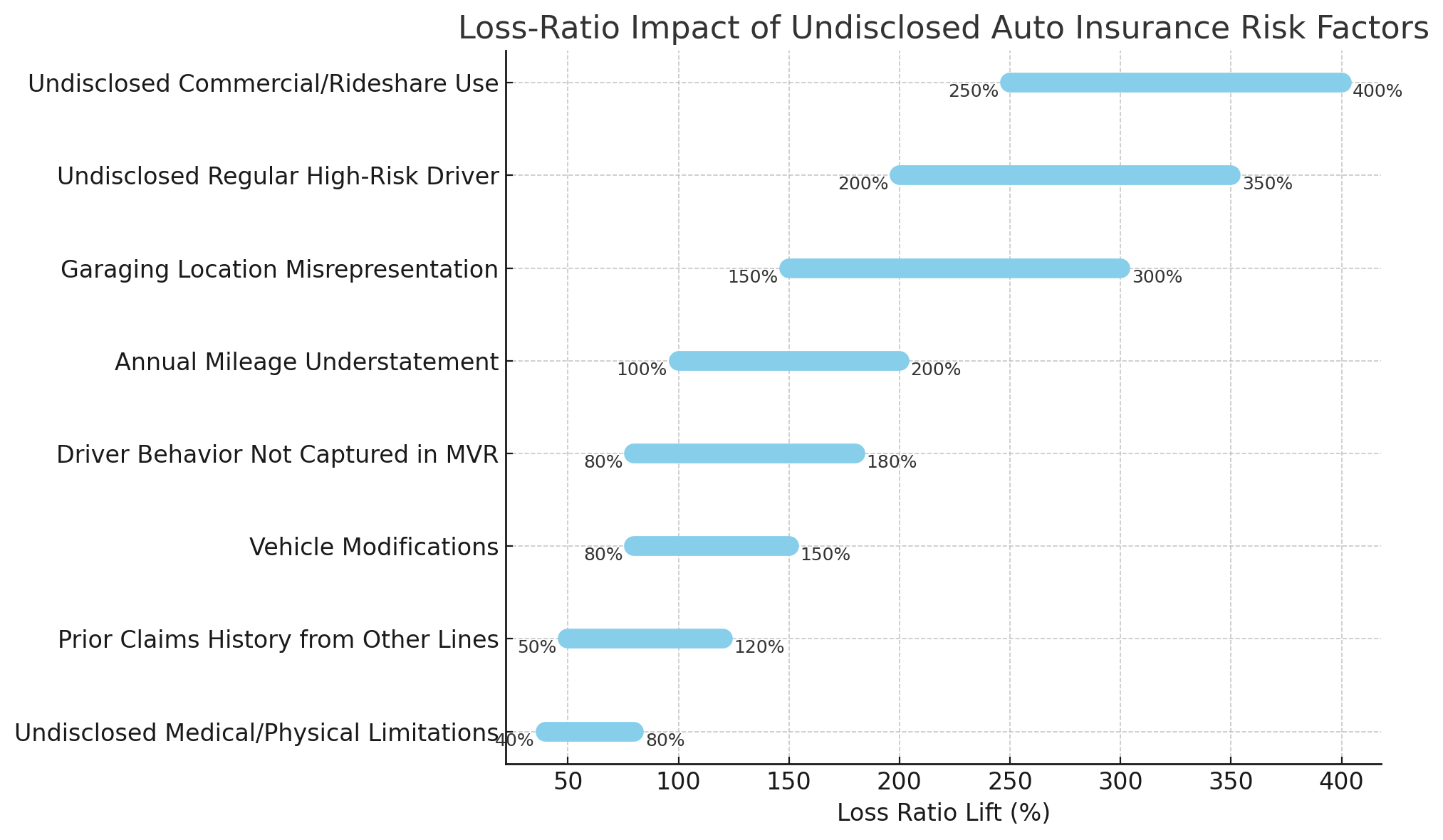

Ranking the Top Undisclosed Risk Factors by Loss-Ratio Impact

Loss-Ratio Impact Ranking (Highest → Lowest)

(Impact measured as how much the actual claims cost exceeds the priced premium when undisclosed.)

| Rank | Factor | Estimated Loss-Ratio Lift When Undisclosed | Why It’s So Risky |

| 1 | Undisclosed Commercial/Rideshare Use | +250–400% | Vehicles in commercial/rideshare service have ~2–3× frequency and higher severity but are often rated as personal-use if undisclosed. |

| 2 | Undisclosed Regular High-Risk Driver (teen, inexperienced, suspended) | +200–350% | Adds another high-frequency driver without premium to cover them. Loss frequency spikes, especially for teens (3×–4× higher). |

| 3 | Garaging Location Misrepresentation | +150–300% | Inner-city garaging increases theft and collision risk sharply. Loss frequency can more than double compared to rural/suburban addresses. |

| 4 | Annual Mileage Understatement | +100–200% | Frequency risk rises sharply after 12–15k miles/year. Understating mileage is common and can push true exposure far above priced assumption. |

| 5 | Driver Behavior Not Captured in MVR (aggressive driving, phone use) | +80–180% | Telematics data shows aggressive drivers have ~60–70% higher frequency even with clean MVRs. Big hidden cost until crash occurs. |

| 6 | Vehicle Modifications (performance upgrades) | +80–150% | Performance enhancements increase both frequency (reckless driving) and severity (higher repair costs, greater injury risk). |

| 7 | Prior Claims History from Other Lines Not Considered | +50–120% | Loss-prone behavior in boats, motorcycles, or commercial vehicles often carries over but isn’t priced into personal auto. |

| 8 | Undisclosed Medical/Physical Limitations | +40–80% | Certain conditions increase crash risk but are hard to underwrite without medical disclosure; regulators limit pricing on health factors. |

Key Observations

- The top three (commercial use, undisclosed drivers, and garaging location) are massive hidden exposures and often drive disproportionate losses in the riskiest 10% of a book. We dive deeper into Undisclosed Drivers here.

- Mileage understatement is also highly underestimated; frequency risk is almost linear with miles driven up to ~20k/year, then jumps.

- Telematics adoption is slowly closing the gap on factors #4 and #5.

- Carriers often catch garaging fraud and undisclosed drivers only after a claim, which is why these stay hidden in premium calculations.

The Auto Premium Leakage Problem

Undisclosed or misrepresented risk factors don’t just create underwriting headaches—they quietly drain profitability. The impact is threefold:

- Missing premium, as policies are priced lower than they should be.

- Immediate loss ratio inflation occurs as policies are written at rates far below the actual risk.

- Ongoing portfolio drag as high-risk insureds renew year after year without proper repricing.

According to Verisk, this hidden exposure represents more than $35 billion in lost premiums annually in auto insurance alone.

What’s Driving the Auto Premium Leakage Problem?

Premium leakage thrives in the gaps between what’s reported and what’s real. Two systemic issues make it possible:

- Overreliance on self-reported data at the point of sale, where mileage, usage, driver details, and more can be understated or omitted. As one carrier put it, “In many ways, applicants are essentially underwriting themselves.”

- Limitations of traditional data sources like MVRs and CLUE reports, which offer only partial visibility, aren’t always current, and can be expensive, with quality varying by market.

These blind spots open the door for the riskiest policies to slip through rating models undetected, creating a measurable and recurring profitability leak.

How Carriers Are Fighting Back

Leading carriers are deploying Behavioral Intelligence to detect and address these risks before binding.

ForMotiv works with top insurers to:

- Detect misrepresentation in real time – identifying applicants who are likely removing or hiding household or youth drivers, understating mileage, hiding commercial use, omitting drivers, and other ways customers and agents game the application.

- Analyze digital behaviors that correlate with risky applicants – such as frequent corrections, post-quote manipulation, known fraud behaviors, or inconsistent inputs.

- Enable targeted verification – allowing underwriters to escalate only the riskiest applications for additional review, reducing costs and improving bind rates of your genuine applicants.

By surfacing the highest-leakage cases before policy issuance, carriers can price accurately, improve portfolio quality, and reduce avoidable loss ratio spikes in their riskiest decile.

Bottom line:

The riskiest 10% of policyholders will always carry outsized losses, but undisclosed risk factors make them far more expensive than they appear. With behavioral analytics, insurers can close the gap between priced and actual risk, turning hidden leakage into measurable savings.