Uncovering Undisclosed Drivers in Online Auto Insurance

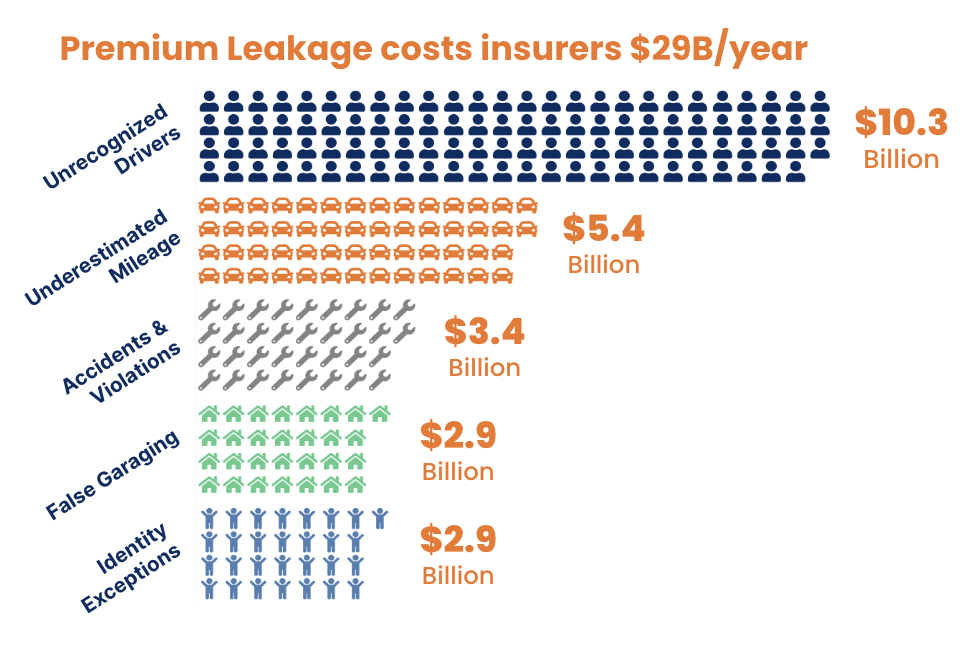

In an era where convenience reigns supreme, the evolution of online auto insurance applications has significantly streamlined obtaining coverage. While beneficial, this transformation has inadvertently paved the way for leakage to seep into the underwriting process. One of the biggest leakage culprits is the issue of undisclosed drivers on insurance policies, which is the biggest piece of the $35 billion dollar leakage pie facing the auto industry.

Undisclosed drivers are individuals who use a vehicle covered by an auto insurance policy but are not listed as drivers on the policy itself. Whether intentional or accidental, this oversight can lead to significant repercussions for policyholders and insurance companies. Unfortunately, the rise of online applications, with their emphasis on user-friendliness and efficiency, offers ample opportunities for policyholders to omit crucial information about additional drivers. To combat the increase in driver leakage, carriers are turning to digital behavioral data from companies like ForMotiv to help.

Understanding the Issue of Undisclosed Drivers

Undisclosed drivers pose a multifaceted challenge in the auto insurance industry. These drivers, who might include teenage children, other family members, or even friends, use the insured vehicle without the insurer’s knowledge. Verisk estimates that 12% of standard and 15% of nonstandard policies may have hidden drivers. Even more concerning is that roughly 75% of discovered drivers are high-risk. This isn’t surprising, as there is ample incentive to conceal a high-risk driver and lower the premium.

This scenario becomes problematic when these unlisted drivers are involved in accidents, leading to claims that insurers are unprepared for. The key tactics employed by individuals or groups to avoid listing additional drivers include:

- Omitting young or high-risk drivers to avoid higher premiums.

- Failing to update policies when new drivers should be added, such as when a teenager gets their driver’s license.

- Intentionally listing inaccurate information to minimize insurance costs.

Some examples of the consequences of such omissions are that policyholders may face denied claims, increased premiums, or even policy cancellations when undisclosed drivers are discovered, especially after an accident. Moreover, insurance companies encounter financial risks and administrative burdens in rectifying these oversights.

The Digital Dilemma: How Online Platforms Complicate Undisclosed Driver Detection

The digital nature of modern insurance applications exacerbates the challenge of identifying undisclosed drivers. The goal of digital distribution and direct-to-consumer policies is to remove friction. By doing so, however, carriers inadvertently increase risk. The inverse relationship between Risk and Customer Experience is one we write about often.

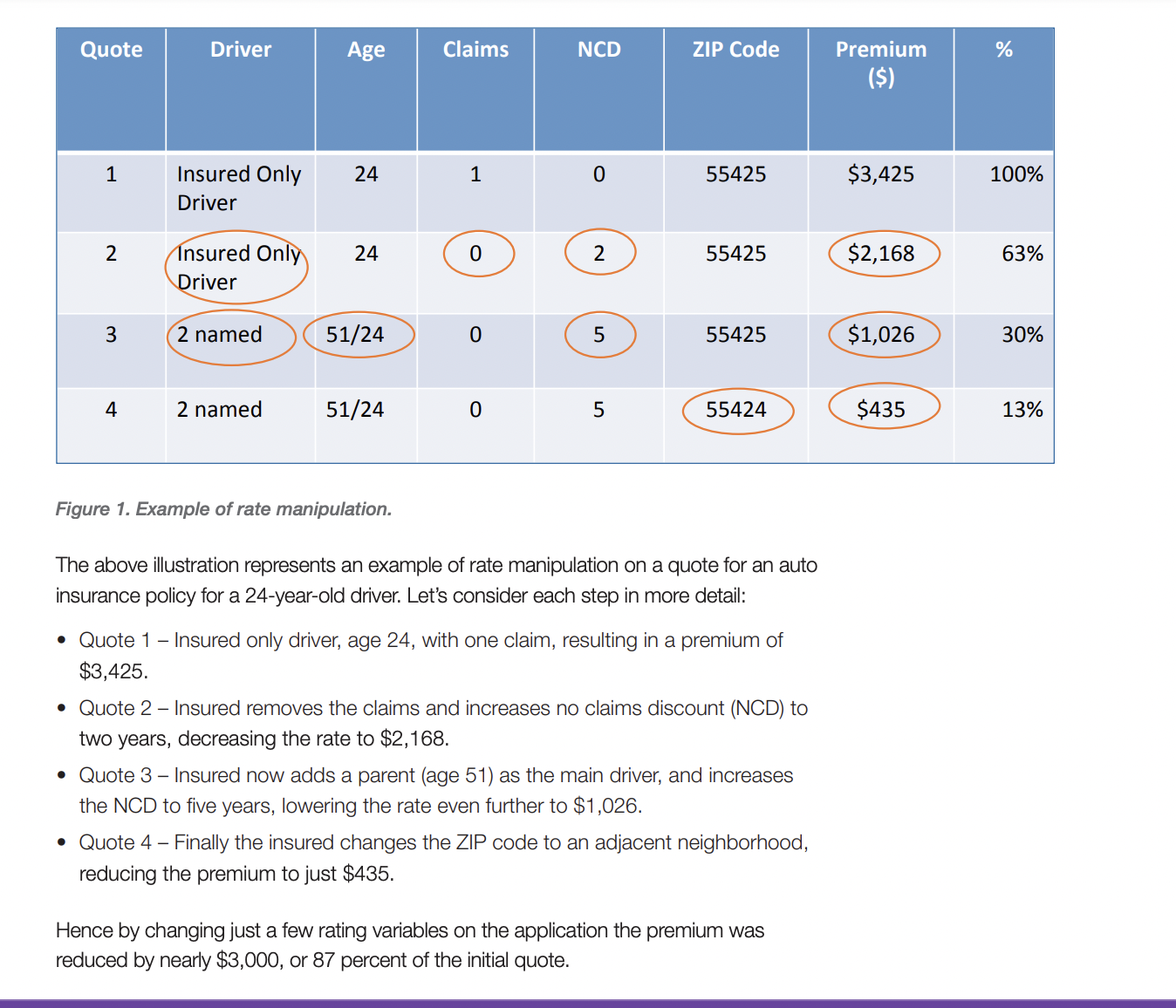

For starters, it wasn’t that long ago that a customer might sit down with an agent in person to apply for a policy. Online platforms often lack the personal interaction through which agents might notice inconsistencies or probe further about household members. The anonymity and convenience of online processes enable policyholders to bypass questions about additional drivers more easily than in face-to-face interactions. Oftentimes, applicants will repeatedly edit and manipulate the policy to receive the lowest rate.

Furthermore, the vast amount of data processed through these digital channels makes it difficult for insurers to manually monitor and verify every application’s accuracy. Policyholders can easily shop around and switch insurers, continually evading scrutiny, aggravating the situation.

Combating the Challenge of Undisclosed Drivers with Technology

The deployment of advanced analytics, machine learning algorithms, and AI-driven platforms has been instrumental in identifying patterns that suggest the presence of undisclosed drivers.

ForMotiv offers a solution purpose-built to identify Leakage such as UDO (undisclosed driver operators). It mimics the in-person agent/customer interaction digitally by analyzing an applicant’s digital body language and assessing real-time behaviors during the online insurance application process. How someone answers a question is just as important, and often more important, than the actual answer they submit. ForMotiv’s solution monitors behavioral actions that impact the ultimate premium displayed to the end customer and associated policy risk as well as the impact on premium.

In most cases, something as simple as removing a driver from a policy is a legitimate action. However, there are many times when it isn’t, and the consequences can be severe. With ForMotiv’s real-time behavioral analysis, carriers can zoom in on exactly how a customer is filling out an application and spot the applications that have a much higher chance of being manipulated. Behaviors like typing speed, mouse hovers, time spent, keystrokes, corrections, premium changes, and many more behaviors can be telltale signs of manipulation and malicious intent and ultimately be the difference between a risky claim and a property underwriting policy.

This real-time approach works by flagging applications that may contain discrepancies, misrepresentation, and leakage regarding the actual drivers, vehicles, and more, ensuring that insurers are alerted to potential omissions or inaccuracies and can triage the application instantly before it is fully underwritten.

A Collaborative Approach to Transparency

Insurers are tasked with improving their online platforms to simplify the process of including all drivers, thereby promoting the importance of transparency for policyholder protection. In tandem, ForMotiv’s behavioral analytics play a critical role by offering insurers a tool to better understand applicant behaviors that may indicate an intent to conceal driver information. This capability encourages a more transparent application process, wherein insurers can proactively engage with applicants to ensure accurate and complete disclosures.

Policyholders, on their part, must grasp the financial and legal ramifications of failing to disclose all drivers. Educating them about these consequences, coupled with the use of technologies like ForMotiv, can significantly enhance the honesty and accuracy of driver disclosures.

To learn more about our Leakage Solution and dive into the specifics of how we’re identifying and preventing undisclosed driver leakage and more, schedule some time with us.