Understanding your applicant’s purchase intent has never been more important than it is today

ForMotiv’s Growth Solution helps carriers predict, segment, and act on varying levels of applicant purchase interest to grow sales and create better digital experiences.

The Background:

Consumers are shopping more than ever in response to today’s rapidly rising auto insurance premiums. LexisNexis reports the quarterly year-over-year growth for new policies was “Sizzling,” up 8.7% for Q1 2024 (and up again from +7.0% last quarter.) We’ve called it “The Great Shop” for the past few years. While some P&C carriers have reduced advertising spend to offset underwriting losses, P&C carriers continue to spend north of $8 billion on advertising. Given the high lifetime value of auto insurance policies, Google ads can cost more than $50 per click. Yet, Accenture reports that over 75% of consumers attempting an online purchase reported a problem during this shopping. According to Salesforce, 78% of customers surveyed said they’re more likely to respond to personalized messages. This creates an opportunity for carriers to differentiate themselves from the crowd if they can predict and act in real-time on the purchase intent and buying preferences of the individual applicant and, ultimately, close more business.

The Opportunity:

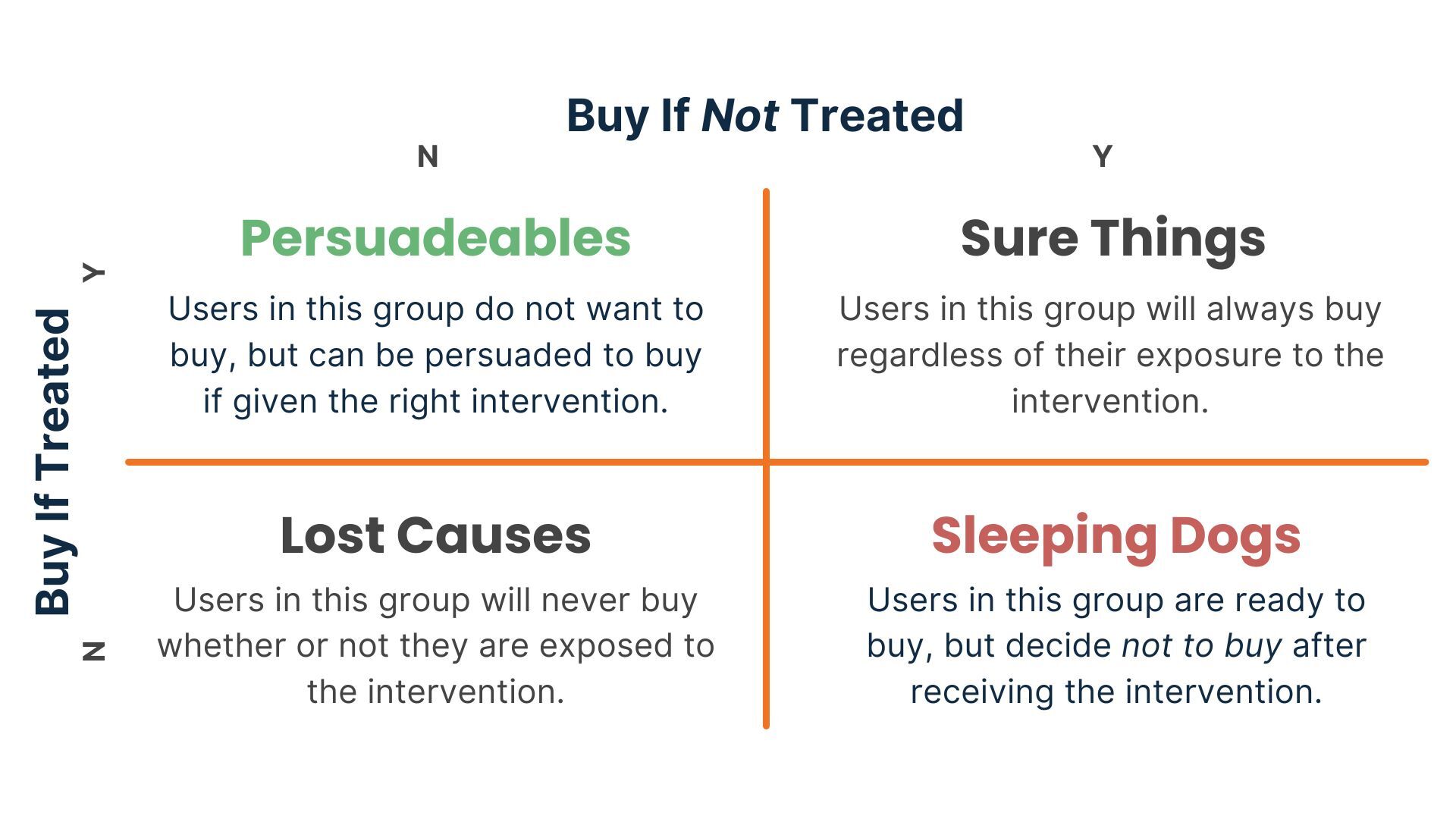

Every applicant is different. Some respond well to gentle and relevant buying pressure, while this turns others off. Some respond well to personalized outreach such as a phone call or text, while others don’t want this type of engagement. Some will convert without any sort of intervention, just as some will not convert no matter what you do. Herein lies the opportunity for carriers to begin segmenting their applicant populations and providing personalized treatments that have the highest chance of producing the desired result – a bound policy.

The Solution:

With ForMotiv’s real-time purchase intent solutions, which use our unique, proprietary behavioral dataset captured during the application process to predict the likelihood an applicant will purchase a policy as they fill out a digital quote, carriers are turning traditionally static digital user experiences into experiences that dynamically adapt to the end user. For instance, if a carrier knows a subset of applicants have a zero or near-zero chance of buying, they can take a few actions to save money. First, they can avoid calling 3rd party data reports to save the associated cost. Second, they can deprioritize these applicants for an agent or call center follow-up so those resources can spend time on higher probability applicants. Third, they can remove these applicants from ultimately wasted remarketing and retargeting spend. There is a cost associated with every ad served, phone call made, and text sent, and as carriers strive to maintain profitability, every dollar counts.

There are multiple real-time approaches to leveraging ForMotiv’s behavioral data and real-time machine learning platform to increase conversion lift via data-driven interventions. The first approach is to use our real-time propensity to bind model and to optimize the messaging treatment, default selections, or user experience based on that propensity. For example, perhaps your treatment is a popup message to the “Persuadeables” before they hit the quote screen articulating your differentiation. This is attractive because it’s straightforward, easily configured, and can be focused only on applicants with a lower propensity to bind without spending additional dollars. Carriers have seen a significant lift in converting these low bind rate applicants using ForMotiv data.

The second approach carriers select allows them to consider optimizing the entire applicant population and thereby maximizing the conversion lift. This approach is called uplift modeling. Uplift modeling is a second prediction after the initial prediction that identifies the potential applicants likely to respond positively to marketing treatments. It takes into account that marketing efforts will not change the mind of every applicant and in fact, some treatments might reduce conversions. ForMotiv’s real-time modeling approach allows carriers to segment their applicant population into different groups, each deserving different treatments and experiences.

Lastly, carriers are ingesting ForMotiv’s behavioral data and real-time models into their own internal models to improve predictive accuracy. This approach allows carriers to combine the applicant’s personally identifiable information they capture during the application, which ForMotiv doesn’t capture, with other third-party data sources they use and ForMotiv’s behavioral data and models to create a powerful predictive model that can be leveraged in real time. Propensity to purchase models are very common these days but are one of many models carriers are adding ForMotiv data to.

Carriers are currently employing all of these approaches. These real-time machine learning techniques allow carriers to minimize unwanted friction, create a personalized purchase journey in real-time, and raise their conversion metrics.

Please reach out to us to learn more! Book A Demo