And the Mortality Silver Medal Goes To…Body Mass Index

Mortality Risk of Body Mass Index (BMI) Misrepresentation

While tobacco nondisclosure consistently takes the Gold in the Mortality Impact Olympics, it’s important not to overlook the other top contenders. Body Mass Index (BMI) misrepresentation and alcohol nondisclosure are also significant factors in mortality risk, both comfortably standing on the podium. This article will focus on the often-underestimated Silver medalist: BMI.

BMI is a critical factor in life insurance underwriting, second only to smoking in terms of the impact on risk classification. Misrepresentation of BMI—where applicants underreport their true BMI—can lead to applicants being placed in more favorable underwriting classes than they would qualify for if their actual BMI were known. Research indicates that BMI misrepresentation occurs in approximately 20% of fully underwritten cases, and this rate is likely to be higher in accelerated underwriting, given the lack of medical verification and self-selection. The resulting increase in mortality risk must be balanced against the benefits of higher placement rates and reduced costs.

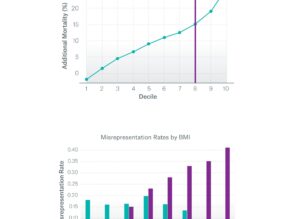

According to a study done by MunichRe, assuming all applicants are accepted through accelerated underwriting, there is a 2% mortality increase due to BMI misrepresentation, with a 7% increase in the highest decile, or the top 10% of applicants most likely to misrepresent. If a carrier can triage the top 20% of applicants most likely to misrepresent and reroute them to full underwriting, the mortality impact decreases from 2.2% to 1.4% while maintaining an 80% straight-through processing rate.

In their study, they found that a 6% difference between the self-reported and measured BMI is an appropriate misrepresentation flag as it is typically large enough to lead to an underwriting class change. In practical terms, this could be a 212lb male who claims they are 200lb.

In the context of accelerated underwriting, predictive models help identify applicants likely to misrepresent their BMI. These models can stratify applicants based on the likelihood and degree of BMI misrepresentation, allowing insurers to selectively reroute high-risk individuals to full underwriting processes, thereby mitigating potential mortality impacts.

That said, predictive models are only as good as the data they have to work with.

There are new, innovative solutions and datasets that are helping carriers identify application misrepresentations in real-time enabling them to triage risky applicants before they are underwritten.

Innovative Use of Real-Time Behavioral Data

While traditional predictive models rely on static data sources such as demographics, medical history, and geographic information, there is growing potential to enhance these models by incorporating real-time behavioral data. This is where platforms like ForMotiv come into play. ForMotiv’s real-time behavioral data can provide insurers with additional insights into the likelihood of BMI misrepresentation. By analyzing how applicants interact with online forms—such as hesitation, changes in answers, or inconsistencies in data entry—insurers can gain a more nuanced understanding of an applicant’s intent and honesty.

Integrating ForMotiv’s behavioral data with your existing underwriting triage process and predictive models can significantly enhance accuracy and the ability to identify high-risk applicants. ForMotiv also provides unique behavioral-based risk signals that can be leveraged in real-time to triage applicants showing signs of nondisclosure. For example, an applicant who repeatedly changes their self-reported weight or exhibits abnormal behavior when completing health-related questions might be triaged for further review or rerouted to a full underwriting process. This approach not only improves the accuracy of BMI misrepresentation predictions but also strengthens the overall risk management framework of accelerated underwriting programs by offering an explanation-based solution for underwriters.

Implementation and Monitoring of Body Mass Index Misrepresentation Solutions

For insurers, the integration of real-time behavioral data into BMI misrepresentation models represents an opportunity to further refine their underwriting processes and accelerate more users while maintaining stringent risk measures. Insurers should begin by testing the integration of behavioral data with their existing models, assessing the impact on prediction accuracy, and making adjustments as needed.

Monitoring is crucial to ensure that the models continue to perform effectively over time, especially as applicants and advisors become more aware of the criteria used in accelerated underwriting. Post-issue audits and random holdouts can help insurers track the effectiveness of their models and identify any shifts in misrepresentation patterns.

Conclusion

Accelerated underwriting offers significant benefits in terms of speed, customer experience, and cost savings, but it also introduces new risks, such as BMI misrepresentation. By leveraging advanced predictive models and integrating real-time behavioral data from platforms like ForMotiv, insurers can better identify high-risk applicants, mitigate additional mortality costs, and maintain the balance between efficiency and accurate risk assessment. This holistic approach represents the future of underwriting in the digital age, where data-driven insights enable smarter, more effective decision-making.