B2B Intent Data for Insurance

Why do insurers need B2B intent data? For starters, it’s a great time to be a data scientist and a not-so-great time to be a salesperson. According to Gartner, 83% of consumers make purchasing decisions based on their own research today.

They’re scrolling your website, reading blogs, opening emails, reading reviews and online forums, making search queries, and asking their network for recommendations. Guess the last place most turn to today? Your phone number.

The buyer’s journey is constantly evolving due to many factors. One major one to consider is that the journey is no longer as predictably linear as it used to be. Where you used to have a linear expectation — awareness, consideration, and decision stages — the modern consumer is more often engaging in a “looping” behavior, meaning they bounce between all stages simultaneously.

In the midst of bouncing back and forth looms the factor of their intent. Are they high-intent shoppers or window shoppers? Are they high-value or high-risk? The tricky part here is that intent is incredibly difficult to grasp for insurers. Throw in the industry-wide migration to the ‘faceless’ digital customer and carriers are essentially blindfolded to customer behavior and intent.

So how can data scientists accurately predict intent to minimize risk and increase value? We will discuss this in detail in this article.

Want to learn more about intent data? Check out this article: What is Intent Data?

What is B2B intent data in insurance?

Any marketer worth their weight in salt will tell you that intent data is the holy grail. If you can accurately predict user intent, the your life becomes a lot easier and your business a lot more successful. The challenge is how elusive it can be to find said data. Until now, marketers are usually stitching together datasets and solutions to try to fit a variety of intent puzzle pieces into one cohesive picture.

Here are some of the customer common touchpoints for intent data:

- Words used in searches – What’s their search history, and what are they currently interested in?

- Cookies – Where do they spend their time online? Where do they go?

- Job postings – What’s their current job status? Are they searching for something new?

- Use cases consumption – What are their priorities?

- Funding events – Do they care about something enough to back it with their dollar?

- News articles – What are they reading about? What algorithms are targeting them?

- Blogs – What do they want quick knowledge about?

- White paper downloads – Think eBook and other long-form content. Past skimming blog posts, what are they diving deep into?

- Social media activity – What do they care about? Who’s in their network? What does their network care about?

- Product reviews – What are they already buying?

- Product comparisons – What products are they considering? What supplemental products do they need?

- Message boards – What kind of questions are they asking? What topics are they interested in?

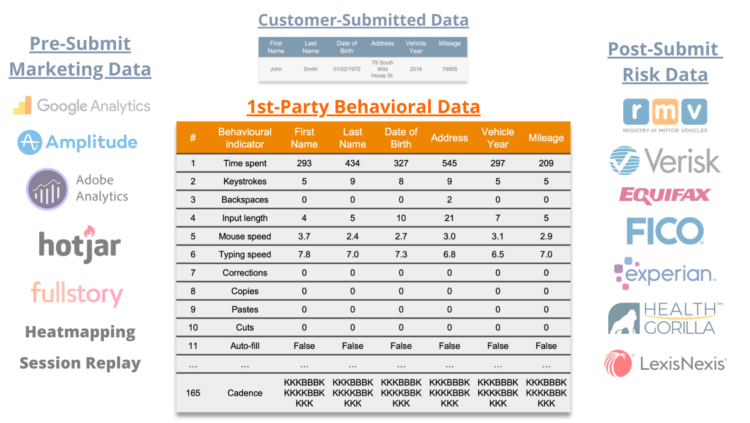

But what’s missing from this list? Your digital forms and applications! When you’re face to face with someone, you intuitively read and react to their body language, tone of voice, etc. Online, you don’t have that luxury. But what if you did? What if you could analyze digital body language the same way your brain does in person?

That’s where ForMotiv comes in.

If you had the ability to accurately predict your customer’s next moves, you’d preemptively react to meet their needs, right? Recent technological advances in behavioral data science & intent data give insurers this kind of power.

Traditionally, companies used intent data to help their marketing departments create a list of targeted leads. The next step forward in insurance analytics, however, is using real-time intent scoring to intuitively interact while a customer is engaging with their platforms.

And guess what, B2B intent data is no longer reserved for the marketers! Data scientists are using ForMotiv’s behavioral data science & intent platform across the enterprise…

- Detecting bot or fraudulent behavior such as excessive copy/pasting or deviant keystroke patterns

- Automatically adding friction and/or notifying the risk department in real-time to risky behavior

- Identifying high-value, high-intent customers based on their digital micro-expressions

- Increasing accelerated underwriting & straight-through processing

- Predicting medical/tobacco nondisclosure and underwriting class upgrades/downgrades

- Identifying agents gaming the system to get applicants to lower premiums

- Creating personalized experiences for users that need extra help completing the application, like cross-selling additional insurance packages they might be interested in, or auto-filling appropriate information.

Researching all your options? Bookmark this article to read our take on the Top 5 Data Intent Providers.

Filling the data gap

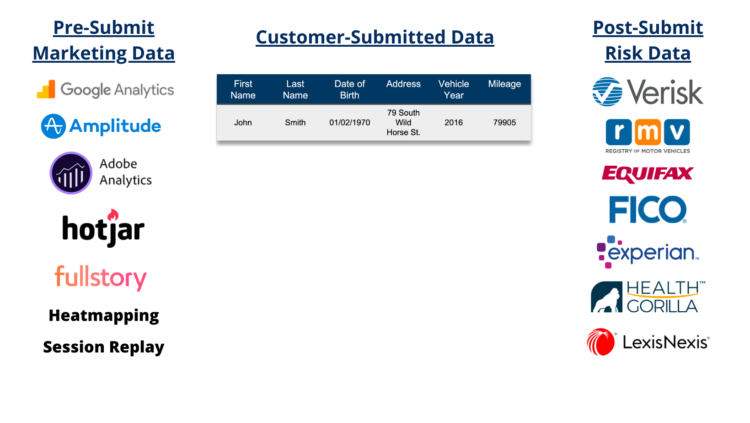

When thinking about the datasets and solutions available to carriers today – we group them into 3 categories. Pre-submit data, Customer-submit data, and Post-submit data.

Pre-submit solutions are usually marketing, sales, and customer experience-focused. The main objective is to help you determine how marketing campaigns are performing, where people dropped off, and where you could better test to optimize performance.

Post-submit solutions are third-party datasets such as health records, motor vehicle records, credit scores, etc., to help you validate customer-submitted answers and determine the risk profile of an applicant.

This leaves a critical gap during the application flow; what happens during the application itself?

Data scientists are recognizing that the digital behavioral breadcrumbs users leave behind are actually highly indicative of their intent — a lot more than pre- and post- submit options.

ForMotiv plugs this gap with a few lines of javascript, turning your application from a dry, static landing page to an oasis of behavioral intent data.

Using real-time intent scoring…

The main problem with pre and post-submit datasets is that they are built for retroactive analysis and consumption. “How did this campaign perform over the past few days, weeks, months and how can we use this information to A/B test?” They are not built for the real-time experiences of tomorrow.

But the world we live in today is all about instant gratification. Carriers need to make increasingly quicker decisions and in order to make real-time decisions, you need solutions built from the ground up to be used in real-time.

Curious to see how some of the world’s biggest insurers are utilizing real-time intent scoring to create Smart Applications that intuitively understand and react to user intent? Let’s chat.