ForMotiv detects and prevents instances of Premium Leakage, Rate Evasion, and Eligibility Misrepresentation during the application — enabling carriers to act in real-time and assess risk more accurately.

Auto insurers lose over $35 billion each year to premium and eligibility leakage. From undisclosed drivers to falsified mileage and garaging details, these behaviors skew your risk models, inflate loss ratios, and create systemic rate evasion issues across your book.

ForMotiv’s real-time behavioral analytics surface these high-risk behaviors as they happen — empowering you to intervene mid-flow, adjust quoting logic, or trigger manual reviews before policies bind.

ForMotiv sees the truth behind their answers—so you catch leakage and fraud before it becomes a loss. Trained on data from over 1 billion auto insurance applications, we know Leakage isn’t random, and we know what behaviors to look for.

In an era where convenience reigns supreme, the evolution of online auto insurance applications has significantly streamlined obtaining coverage…

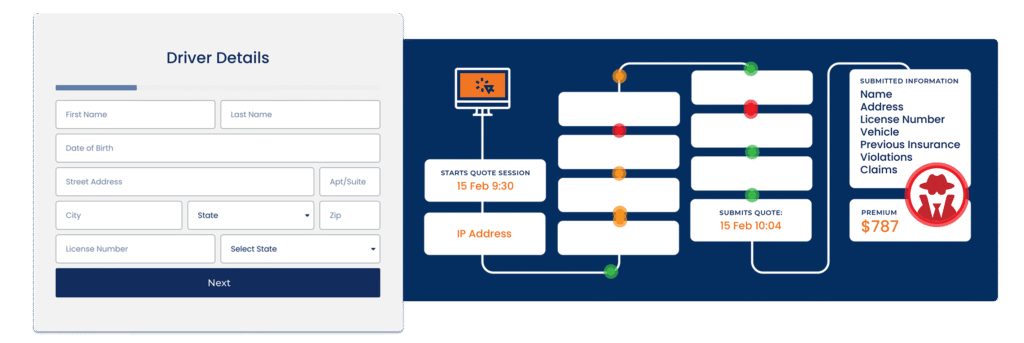

As users complete your digital application, ForMotiv collects behavioral micro-expressions—mouse movements, field edits, timing, flow patterns, and more—to identify subtle but critical indicators of premium leakage and other high-risk behaviors. By analyzing behavioral data patterns during the quoting process, we empower you to act on hidden risks to stop premium and eligibility leakage in real-time.

Here are some examples of dynamic interventions carriers leverage today:

Reflexive Questions to confirm suspicious answers

Adaptive 3rd-Party Data Calls only when risk justifies the cost

Manual Review Triggers for high-leakage applications

Field Locking or Flow Interruptions post-quote

All signals are deterministic and explainable — and can be used directly or fed into your ML pipelines.

By analyzing this data after the fact, insurers can:

Identify Patterns of Rate Manipulation

Discover which behaviors consistently precede misrepresentation — like removing drivers post-quote or changing vehicle usage mid-app.

Quantify Premium Leakage by Segment

Understand where and how often leakage occurs across channels, agents, geographies, and quote types.

Enhance Underwriting Guidelines and Risk Models

Feed behavioral features into predictive models or adjust underwriting logic based on statistically proven leakage patterns.

Optimize When and Where to Use 3rd-Party Data

Use offline insights to create rules for calling MVRs, CLUE, or other costly data sources only when historical behaviors suggest it’s necessary.

ForMotiv’s Underwriting Risk Solutions help carriers identify and act on underwriting risk in real-time.

ForMotiv’s Fraud Solutions helps carriers identify and act on malicious activity from both humans and non-humans in real-time.

ForMotiv’s Marketing Solutions help carriers increase gross written premium while lowering your loss ratio.

Carriers leverage ForMotiv’s Monetization Solution to monetize risky, unwanted, or low-intent business.

Intelligently orchestrate 3rd party data checks based on the purchase intent and risk profile of your applicants.

Predict which users are likely to churn quickly after policy issue.

Easy, light-weight Javascript integration. Zero performance degradation.

ForMotiv Signals, Models, and Behavioral Features are accessible in real-time via API or batch file.

Proprietary, predictive dataset captured from solely your customers and agents.

Capture dozens of intuitive behaviors like Hesitation, Type Speed, Corrections, and more.

Zero PII Captured. GDPR, CCPA & PIPEDA Compliant.