ForMotiv detects fraud, bots, and risky applicant behavior—before it binds—giving you the ability to triage risky and fraudulent applications before they become a problem.

Fraud is evolving, and so should your defenses. ForMotiv’s advanced fraud detection solutions harness real-time behavioral analytics to identify and mitigate fraudulent activity before it impacts your bottom line. Whether it’s detecting bots and identity harvesters, unmasking ghost brokers, flagging suspicious VPN usage, or tracking repeat offenders, our solutions provide carriers with the tools to stay one step ahead. By uncovering hidden patterns and intent signals, we help insurers protect their customers, reduce exposure to fraudulent claims, and streamline the underwriting process with confidence.

ForMotiv uncovers the intent behind every interaction—so you can stop fraud before it enters your book. Trained on behavioral data from over 1 billion auto insurance applications, ForMotiv provides various solutions to your digital fraud problems.

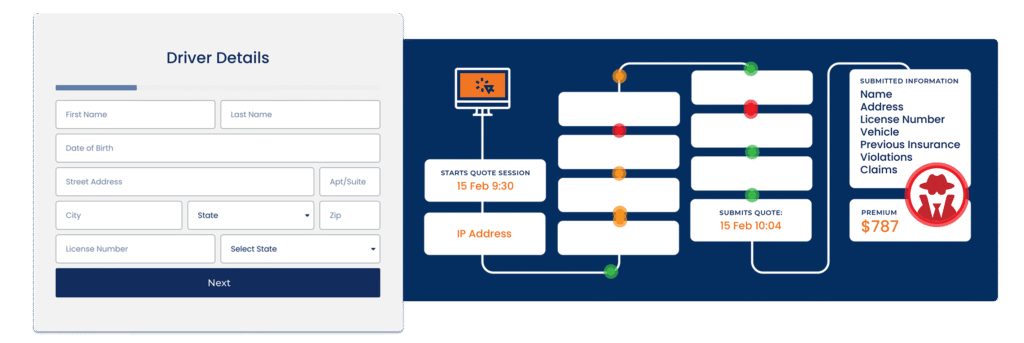

ForMotiv’s Fraud Solutions protect you through the entire digital application, from start to quote to purchase and beyond. Our technology empowers you to stop fraudulent applications anywhere in the process.

ForMotiv’s Fraud Solutions use advanced behavioral analytics to uncover hidden patterns in user behavior, revealing indicators of ghost broking, bot activity, pre-fill phishing, and other forms of fraud that you can explore offline.

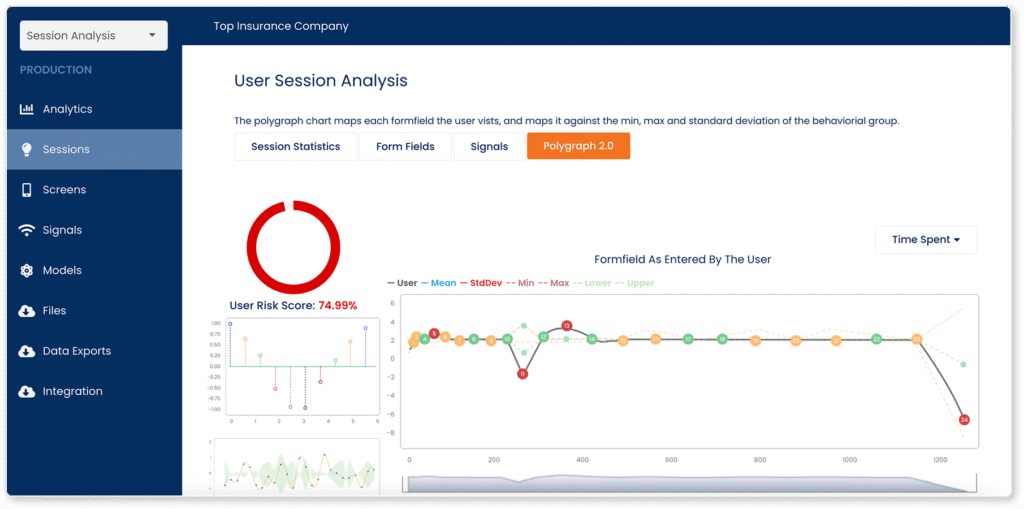

ForMotiv’s Underwriting Risk Solutions help carriers identify and act on underwriting risk in real-time.

ForMotiv’s Leakage Solutions identify instances of rate evasion, premium leakage, and eligibility leakage during the application process enabling you to act in real-time.

ForMotiv’s Marketing Solutions help carriers increase gross written premium while lowering your loss ratio.

Carriers leverage ForMotiv’s Monetization Solution to monetize risky, unwanted, or low-intent business.

Intelligently orchestrate 3rd party data checks based on the purchase intent and risk profile of your applicants.

Predict which users are likely to churn quickly after policy issue.

Easy, light-weight Javascript integration. Zero performance degradation.

ForMotiv Signals, Models, and Behavioral Features are accessible in real-time via API or batch file.

Proprietary, predictive dataset captured from solely your customers and agents.

Capture dozens of intuitive behaviors like Hesitation, Type Speed, Corrections, and more.

Zero PII Captured. GDPR, CCPA & PIPEDA Compliant.