Powered by insights from billions of digital insurance transactions, ForMotiv’s Insurance Solutions are trusted by leading carriers worldwide to increase conversions, prevent fraud, and reduce underwriting risk in real-time.

ForMotiv analyzes applicants and agents’ digital body language, such as typing speed, time spent, keystrokes, corrections, and hundreds of other digital behaviors, as they go through the online quoting and binding process.

We combine this proprietary, first-party behavioral dataset with real-time predictive analytics to identify which of your applicants are genuine, risky, or fraudulent during the underwriting flow.

ForMotiv’s Solutions are vertically agnostic and used by leading carriers across both Direct and Agent distribution channels.

ForMotiv provides enterprise-wide Behavioral Data Solutions to every channel and department within your organization.

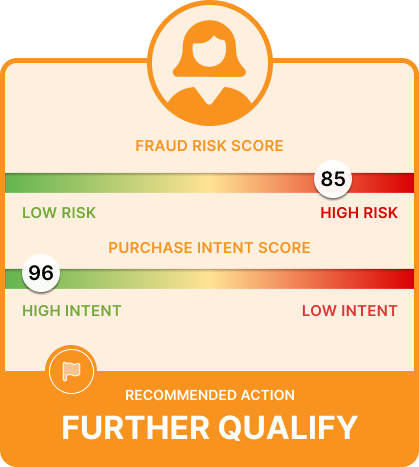

Is your applicant high-intent because they bought a car this morning or because they got in an accident this morning?

ForMotiv is the only solution on the market that provides a holistic view of an applicant’s intent, good or bad, and helps determine the right next step on an individual basis. Stop sacrificing a better user experience for more risk and fraud controls, and vice versa. Apply the right level of friction to the right applicants.

Easy, light-weight Javascript integration. Zero performance degradation.

ForMotiv Signals, Models, and Behavioral Features are accessible in real-time via API or batch file.

Proprietary, predictive dataset captured from solely your customers and agents.

Capture dozens of intuitive behaviors like Hesitation, Type Speed, Corrections, and more.

Zero PII Captured. GDPR, CCPA & PIPEDA Compliant.